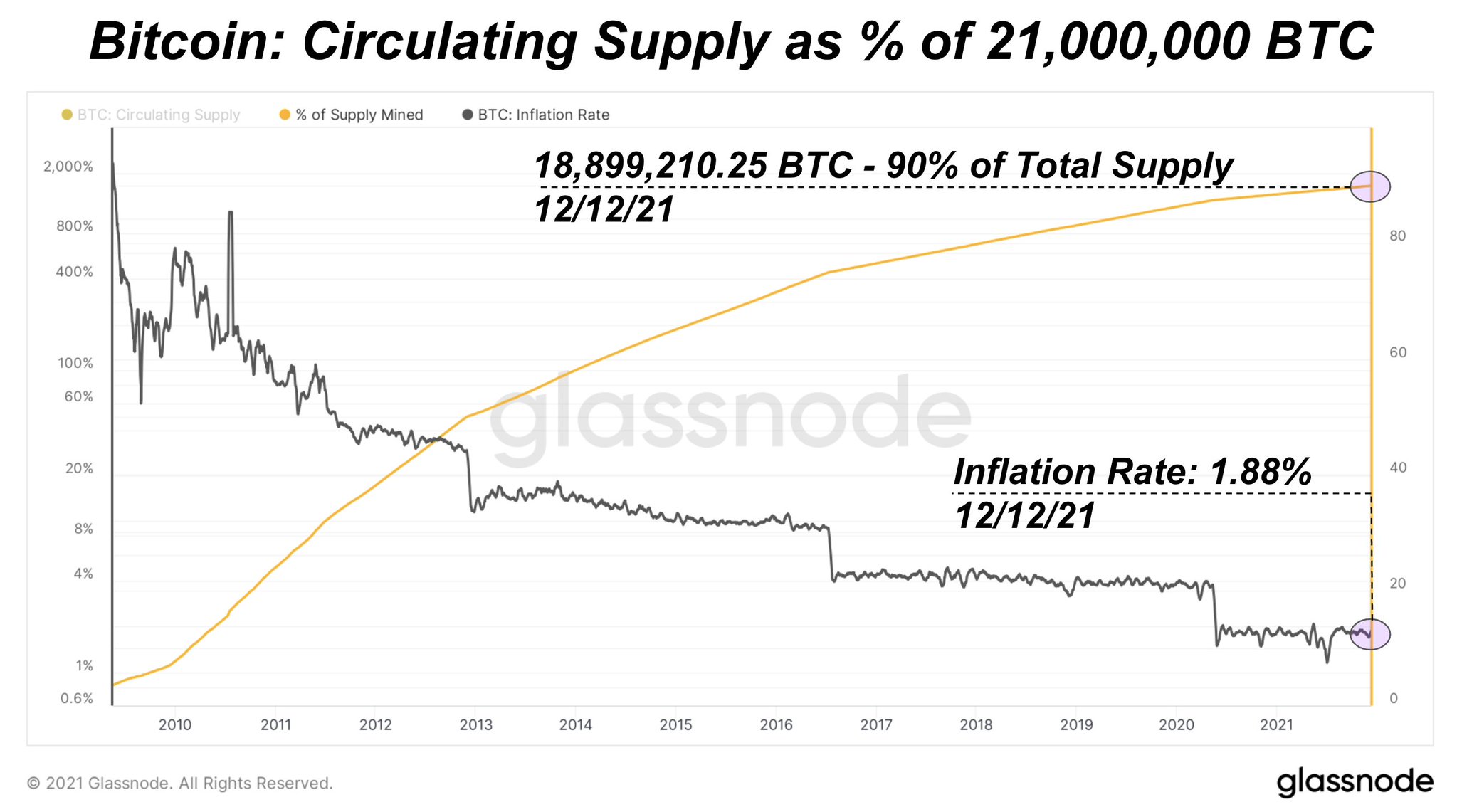

The fact that 92% of the 21,000,000 bitcoins ever created have already been put to use was celebrated by crypto enthusiasts on December 12. Currently, Bitcoin’s inflation rate per annum is around 1.88%, which is lower than the central banks’ traditional 2% target reference. Furthermore, in 875 days, the network’s inflation rate is expected to drop to 1.1% after 19.98 million bitcoins have been mined.

Programmatic Scarcity

The Bitcoin network has a number of advantages. It is predictable and mathematical, unlike monetary systems that are issued worldwide by central banks. These systems are subject to the decisions and actions of policymakers, and can be unpredictable. The total number of 18,899 800 BTC in circulation at the time this article was written is approximately 90% of the 21,000,000 BTC which will be ever produced. Digital currency fans acknowledged this milestone on Sunday, December 12, the same day as the 11th anniversary of Satoshi Nakamoto’s official departure.

The 90% statistic can be seen on data sites like coinmarketcap.com, and Glassnode’s percentage of the bitcoin supply currently mined. Reddit discussion about the 90% bitcoins that were mined led people to ask how many are still missing or stuck in non-recoverable wallets. Bitcoin.com News published a Coin Metrics 2019 report about the state of bitcoins lost. This reported that 1.5 million BTC had been lost. But some Redditors think it could be higher.

“Estimates of 3-5 million [bitcoin] are out there,” one Redditor explained on Sunday. “You can see onchain metrics showing how much bitcoin hasn’t moved [in the] last decade but that would be the highest possible and there are some that just haven’t moved even though they possess the keys. I believe it’s around 3 [million]It is not certain, however it will likely be higher than we know. There is also a delay factor because some people may not have lost their data for 10 years. It’s just assumed [for the]First couple of years [the] biggest losses occurred so we key in on that data.”

According to estimates, the Bitcoin inflation rate per year will be 0.4% in 2030

While we don’t have a hard number of how many bitcoins are officially unrecoverable or lost, it’s far different than the predictability of BTC issuance. Satoshi believed and many crypto advocates believe that lost coins simply add to the crypto asset’s scarcity. “Lost coins only make everyone else’s coins worth slightly more,” Bitcoin’s inventor said. “Think of it as a donation to everyone.” With 90% of the coins in existence circulating, and the current rate of 900 BTC per day, and 210,000 blocks every halving, the next reward halving is expected to happen on May 6, 2024.

The block reward currently stands at 6.25 Bitcoins per Block. After halving, rewards will drop to 3.125 Bitcoins per Block. With the current Bitcoin inflation rate fluctuating between 1.75% to 1.88%, we can estimate that after the halving Bitcoin’s inflation rate will be around 1.1%. Each 210,000 block, the Bitcoin protocol divides continuously until it reaches zero. This is expected to happen around 2140. The year 2140 is when it’s expected miners will stop securing the network, and instead process transactions on the basis of network transfer fees.

There’s a total of two more significantly sized bitcoin block reward halvings expected up until around 2130, and the halvings that follow after that year will be fractions of BTC. By 2028, Bitcoin’s inflation rate per annum is expected to be around 0.5% and by 2030 it will be around 0.4% with 20,585,442 million bitcoins in circulation. According to estimates, 98.02% will have been mined by 2030.

With Bitcoin’s hashrate climbing to all-time highs, the time frames of exactly when these changes will occur are fairly good approximations, but not set in stone. Network participants, or miners, have increased the interval between halves, and daily issuance rates are faster than expected.

You are likely to be shocked at the 90% of 21 million Bitcoins in circulation. What do you think about Bitcoin’s programmatic scarcity and predictable issuance rate? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki commons. Reddit.

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of selling or buying products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.