Charles Schwab, a financial giant, published an analysis that shows cryptocurrency as a great way to save for retirement. “Gen Z and millennial workers are more likely to also invest in cryptocurrency, real estate, annuities, and small businesses, unlike older generations.”

Crypto Investments for 401(k), Accounts

Financial giant Charles Schwab published a report titled “401(k) Participant Study – Gen Z/Millennial Focus” Tuesday. This report contains the findings of an online survey that Logica Research conducted on behalf of Schwab Retirement Plan Services Inc.

The survey was completed by 1,000 participants in 401(k), aged 21 to 70 and employed at companies of 25 or more employees. This report contains:

While the 401(k) remains the top retirement savings vehicle for today’s workers overall, Gen Z and millennial workers are more likely to also invest in cryptocurrency, real estate, annuities, and small businesses, unlike older generations.

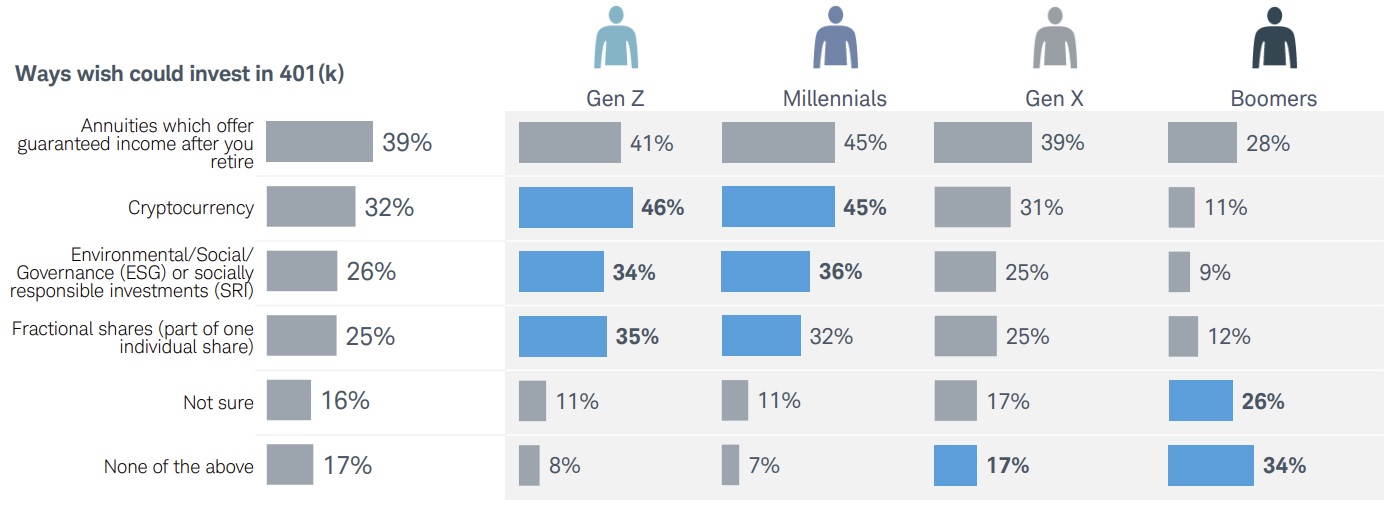

In addition, “More than 4 in 10 Gen Z and millennial workers wish they could invest in annuities and cryptocurrency in their 401(k),” the report adds.

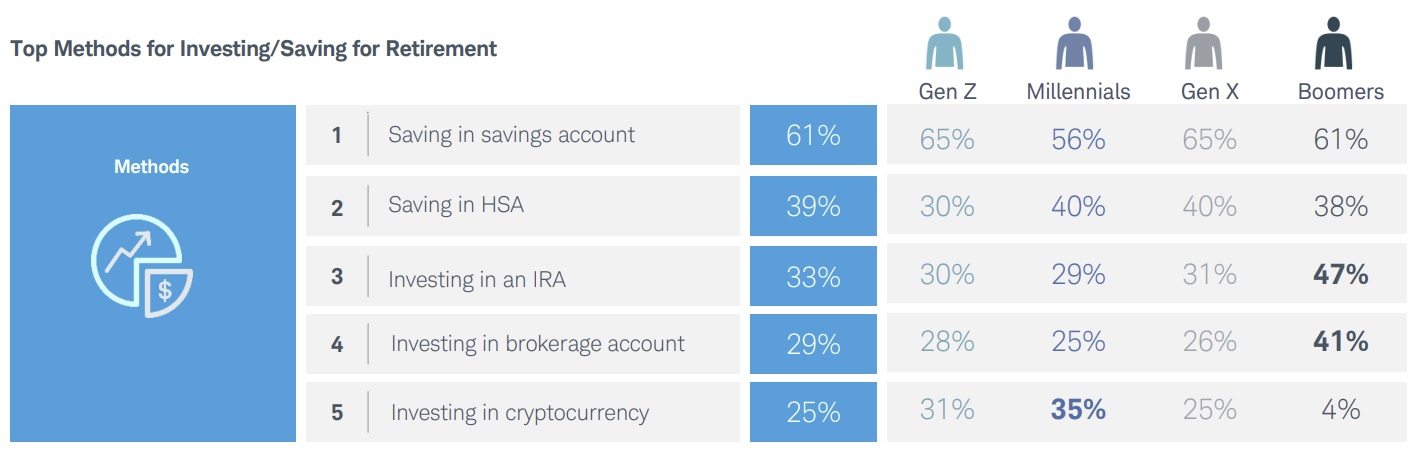

Regarding how workers save for retirement, the report states that “Outside of their 401(k), participants are still more likely to be saving for retirement in a savings account than investing, although a quarter are investing in cryptocurrencies.”

Respondents from Gen Z said that 43% invest in crypto. This compares to 33% of Gen X and 47% of millennials.

According to the report, cryptocurrency investment is one of five top options for saving money on retirement. This is the second-most popular way to save for retirement for Generation Z and third for millennials.

When asked how they would like to invest their 401(k), 39% chose annuities. 32% preferred cryptocurrency. Generation Z and millennials chose cryptocurrency as the top answer.

In June, the U.S. Labor Department raised concerns that Americans might invest in cryptocurrency and bitcoin in their 401k accounts. Treasury Secretary Janet Yellen also said in June that crypto is “very risky,” emphasizing that they are unsuitable for most retirement savers.

Despite the Labor Department’s warning, Fidelity Investments made bitcoin an option for 401(k) plans. Also, a bill has been introduced that allows crypto investments in 401 (k) plans.

Let us know your thoughts on the Charles Schwab retirement study. Comment below to let us know your thoughts about the Charles Schwab study on how people save for retirement.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.