Ethereum followed the overall trend in crypto markets, returning its profits from the week before. The cryptocurrency was moving in tandem with Bitcoin and large cryptocurrencies, but now ETH’s price is reacting to new economic data published in the United States.

Ethereum is trading at $1,300 as of the writing. There has been a sideways move and a loss of 2% in Ethereum over the past week. Similar price movements are seen in other cryptocurrencies, with the exception being XRP. The token continues to show strength in the face of the trend, and has been generating profits for the past two years.

Ethereum inbound for another sideways week

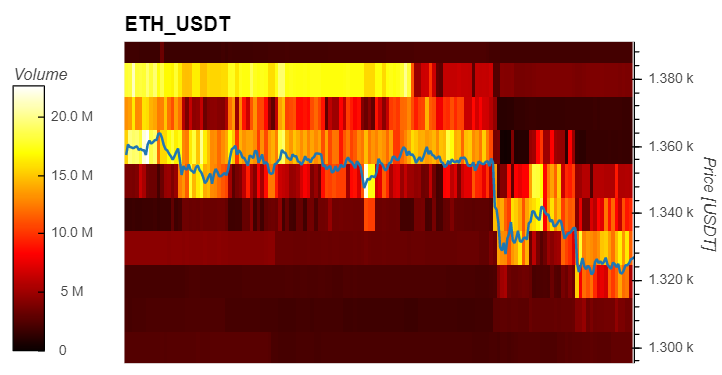

Material Indicators (MI), data showing that Ethereum is receiving some bids at the current level. This could be a sign of a rally towards previous resistance levels, $1,340. There is potential for $1.400.

As seen in the chart below, the Ethereum price has reacted relatively well to the recent price action with bid (buy) liquidity coming in at today’s low. This support has allowed ETH to rebound into the $1,340 area.

Today’s second cryptocurrency, by market capital, was witnessing a sudden spike in sales from all investors. However, the selling has been mitigated in recent hours with large players with bid orders of as much as $100,000 buying into Ethereum’s price action.

The players purchased ETH worth over $800,000,000 in short periods of time and may be able sustain ETH for a long period. Nevertheless, ETH’s price action might be in jeopardy as the market heads into the weekend.

The key levels for Ethereum and Bitcoin are $1,200 and $18,500 to avoid a new dip into the annual lows. A trader who is not identified as the trader said that as long as the levels are maintained, cryptocurrency should be able to hold its ground with less sideways movement. According to the trader said:

The moment $18.5K or $20.5K (for Bitcoin) gives in we’ll likely see it followed by a big move. Up to then, it’s chop chop and more chop. CPI on Wednesday may change it up a bit but as we speak we’re back to the middle of the range.

Bitcoin and Ethereum Are Preparing For An Incoming Volatility

On the latter, the upcoming Consumer Price Index (CPI) print for September and today’s data on the U.S. economy show that macroeconomic forces are still in control. The economic data so far has been encouraging and even exceeded expert expectations.

This negative news is bad for Bitcoin, Ethereum and other global markets as it suggests that the U.S. Federal Reserve could keep up with inflation and possibly even increase pressure to reduce it. In that sense, next week’s CPI print could be one of the key events for ETH, BTC, and the entire industry.

Keith Alan of Material Indicators discusses how the Fed could take a more aggressive stance and pivot its money policy. wrote:

A FED pivot isn’t likely without something of major significance happening. The #FED would like to see consecutive months in which the CPI is declining and unemployment increases.