A first-of-its-kind study published by the Basel Committee on Banking Supervision details that the world’s largest financial institutions are exposed to roughly €9.4 billion (US$9 billion) in crypto assets. The research paper authored by the Basel Committee’s secretariat Renzo Corrias further explains that out of all the banks’ total risk exposure, cryptocurrency exposure is estimated to be around 0.01% of total exposures.

Cryptocurrency exposure of banks is $9 Billion. This amounts to roughly 0.1% of total risk exposure.

A recent study published by the Basel Committee on Banking Supervision (BCBS) explains that the world’s top banks are exposed to around $9 billion worth of cryptocurrencies. The BCBS is a global organization made up of members tied to the world’s central banks and financial institutions from a myriad of jurisdictions.

The study, called “Banks’ exposures to cryptoassets – a novel dataset,” was written by secretariat Renzo Corrias. The research aims to create a primary global standard on the “prudential treatment of banks’ [crypto asset] exposures.”

“Total [crypto asset] exposures reported by banks amount to approximately €9.4 billion. Relatively, they account for just 0.4% of total exposures. This is based on the weighted-average basis of all reporting banks. [crypto asset] exposures,” the report written by Corrias details. “When considering the whole sample of banks included in the Basel III monitoring exercise (ie also those that do not report [crypto asset] exposures), the amount shrinks to 0.01% of total exposures.”

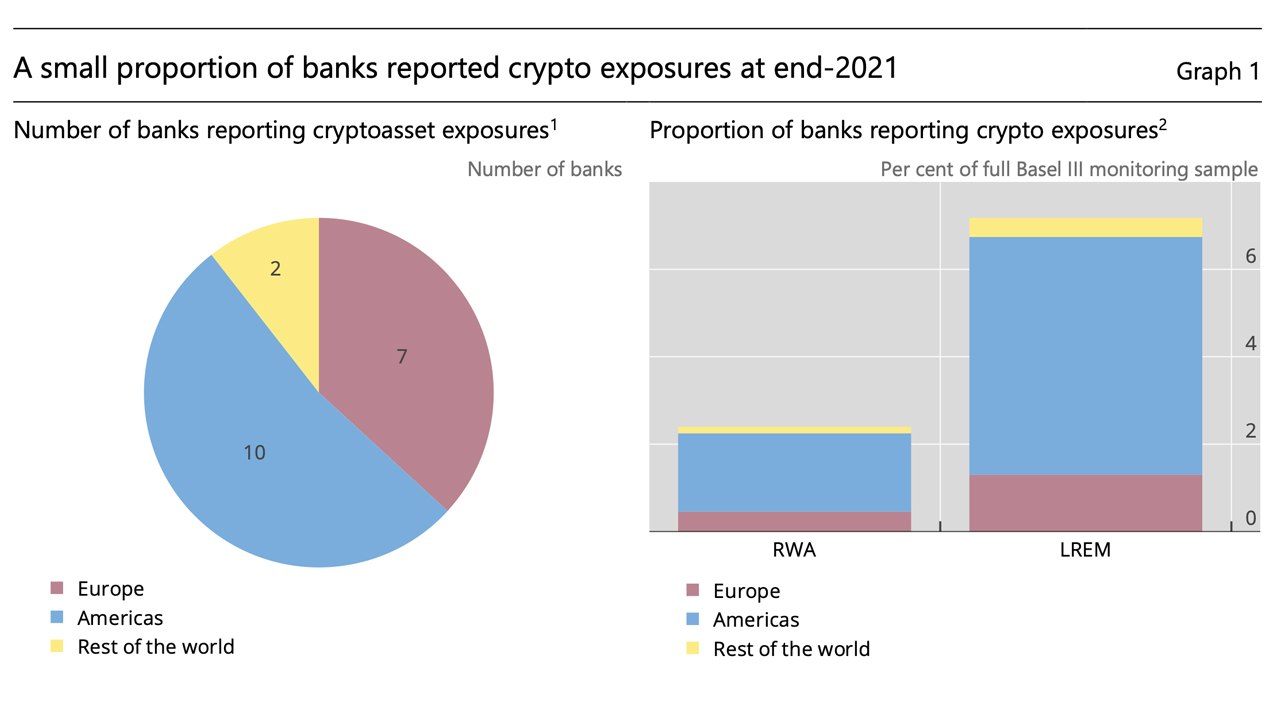

According to the BCBS, 19 international banks submitted data. Nearly ten of these financial institutions are from the Americas. 7 banks came from Europe and 2 from elsewhere. Corrias points out that these banks are a select group of financial institutions from the total 182 BCBS banks it considered in its Basel III surveillance exercise.

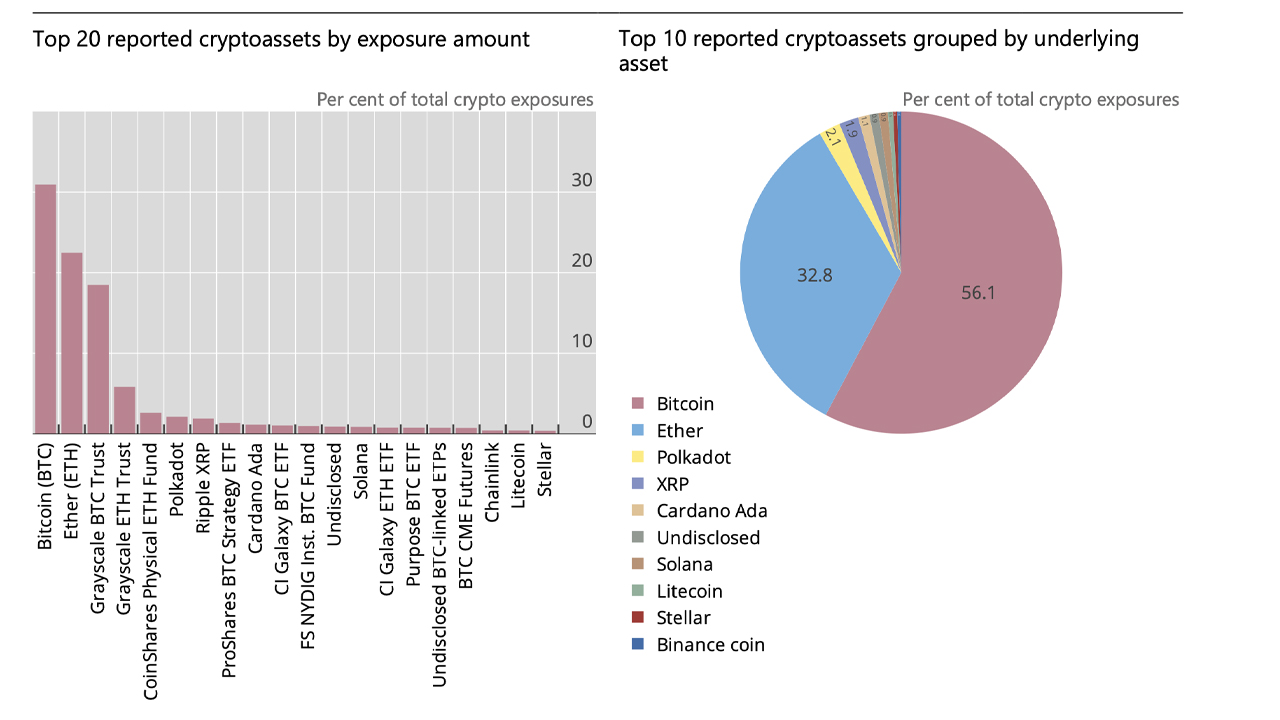

Most of the crypto assets reported by banks were bitcoin (BTC), which represented 31% of exposures and ethereum (22%). Banks are not only exposed to USD-backed stablecoins but also crypto assets such as xrp, cardano (ADA), SOLANA (SOL), Stellar (XLM), litecoins (LTC) and solana (SOL).

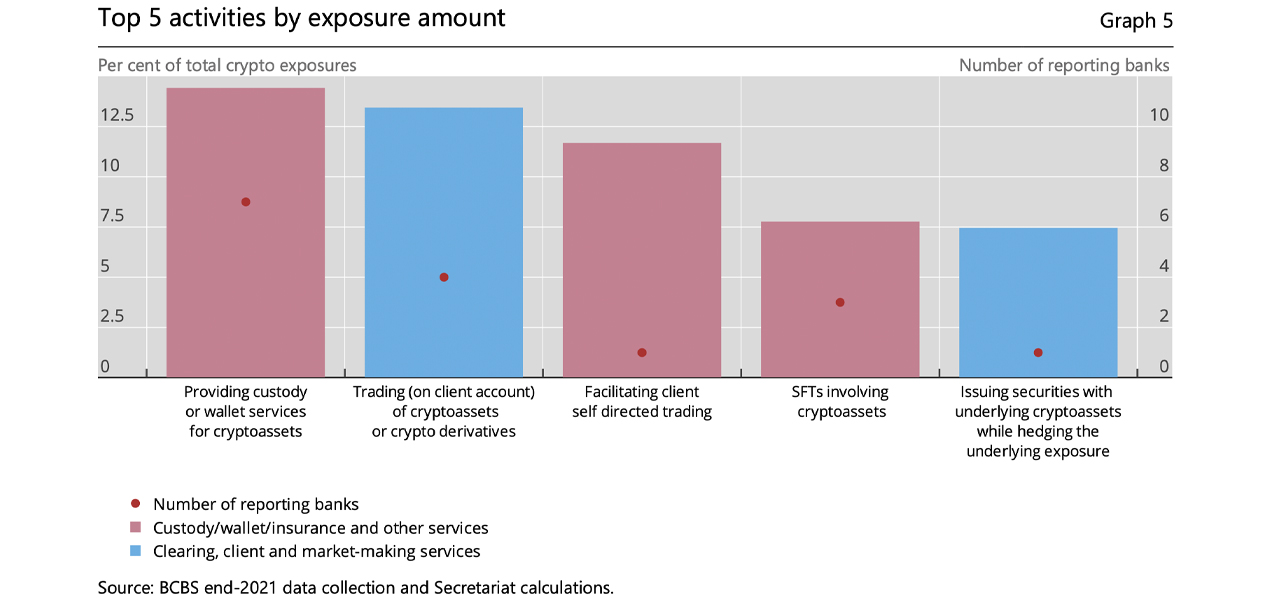

Corrias explains that the banks’ exposure to crypto is comprised of three different categories which include crypto holdings and lending, clearing and market-making services, and custody/wallet/insurance services. Out of the top five activities that add to the banks’ crypto exposure, the top service is “providing custody or wallet services for [crypto assets].”

What do you think about the recent BCBS report concerning banks’ exposures to crypto assets? Comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.