After bitcoin neared $25K roughly 44 days ago, the crypto asset’s price has lost more than 17.88% in value against the U.S. dollar. Onchain analysis from researchers at Glassnode details that the price drop has placed short-term holders into “severe unrealized loss.” Long-term holders, on the other hand, are holding strong and Glassnode researchers say numerous metrics are “displaying a full cycle detox.”

Bitcoin holders for long term hold tight

According to Glassnode’s recent newsletter, the crypto bear market is still a problem for short-term holders. Ukuria On-Chain. Bitcoin (BTC), which has experienced a 17.88% decline in value relative to the U.S. Dollar since August 14th, has seen 14-day stats show that BTC has fallen roughly 9.3% and has dropped 53.2% year-to date.

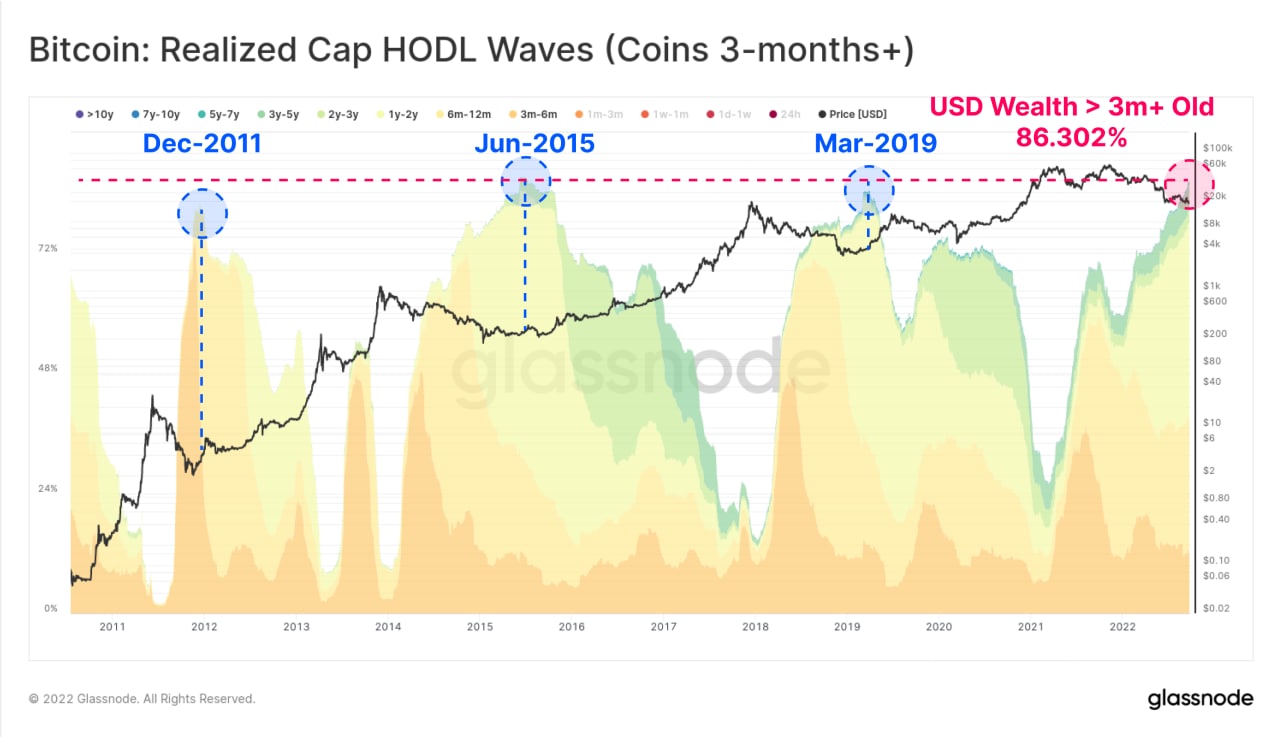

Furthermore, since the crypto asset’s lifetime price high, 11 months ago on November 10, 2021, BTC is down 71.3%. Glassnode’s newsletter published on September 26 highlights the Bitcoin Realized Cap HODL Waves chart which shows how BTC’s long-term holders remain steadfast.

According to the data from Glassnode’s Telegram channel prior to publishing the onchain newsletter, “coins aged 3-months+ now account for an all-time high (ATH) of 86.3% of all USD wealth held by the BTC supply.” Glassnode’s report details that the Realized Capitalization HODL Waves chart shows the U.S. dollar wealth held by individual age bands.

“With mature spending severely muted, the degree of HODLing behavior is historically high,” Glassnode details. “In a binary system of just Young and Mature coins, an increase in mature coin wealth held in BTC directly leads to an equivalent decrease in Young coin wealth.”

In terms of long-term holders, Glassnode’s report called “The Great Detox” states:

Current wealth is held by mature coinholders at an ATH. This can be attributed to the dominant investor behavior of refusing spend despite extremely uncertain global markets. The same young coin cohort is changing hands almost every day, and this makes market activity nearly impossible to control. If the market turns, the supply can become more limited as the numbers of coins that are being churned slowly decrease.

Bitcoin’s ‘Bottoming Process’ and the 4-Year Trend

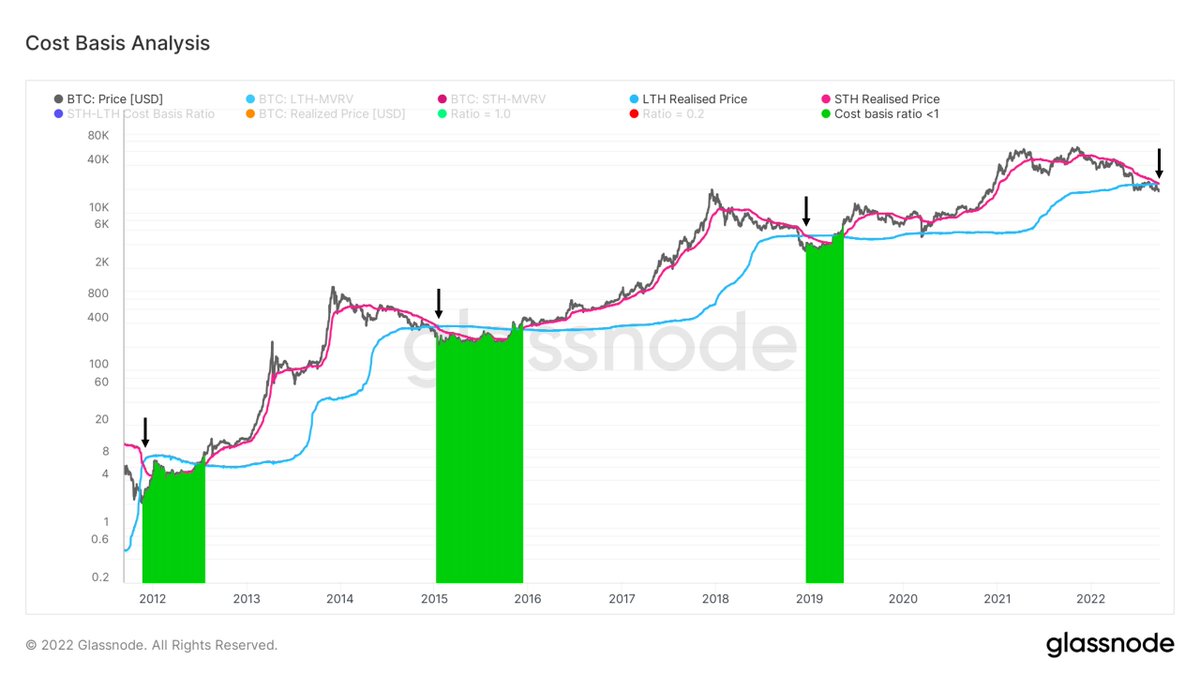

There are many believers in bitcoin’s long-term game. “After months of waiting, for just the fourth time ever bitcoin’s short-term holder cost basis has fallen below its long-term holder cost basis,” Will Clemente wroteOn September 24, “This indicates a bottoming process. The next cross to watch for is a bull cross of the short term back above the long term.”

On many occasions, Microstrategy’s Michael Saylor has talked about BTC’s four-year cycles. On September 26, when the U.S. dollar continued to depress a large basket of fiat currencies, Saylor spoke about bitcoin’s relationship with the greenback across four years.

“Over the past year currencies have collapsed against the dollar,” Saylor tweeted. “CAD -8%, CNY -9%, AUD -11%, ZAR -17%, KRW -18%, EUR -18%, PLN -21%, GBP -22%, JPY -23%, TRY -52%. Over the past four years, the dollar has collapsed -67% against bitcoin,” the Microstrategy executive added.

How do you feel about the fact long-term investors have held strong relative to short-term ones? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.