Tesla CEO Elon Tesla has warned against a Federal Reserve rate increase that could cause deflation. Musk’s warning followed an analysis by Ark Invest CEO Cathie Wood, who cautioned that “Leading inflation indicators like gold and copper are flagging the risk of deflation.”

Elon Musk: Fed Rate Hikes and Deflation

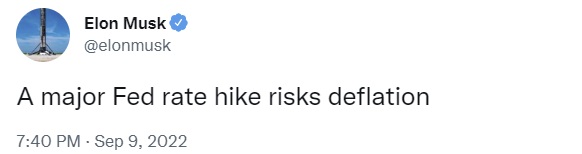

Tesla and Spacex CEO Elon Musk tweeted Friday evening that “A major Fed rate hike risks deflation.” His tweet has attracted much attention. It has been liked more than 80K times, and almost 7K people have retweeted it.

Many comments were received, with many agreeing with Tesla’s CEO and others insisting that he is wrong about America’s economy. Real Vision CEO and crypto investor Raoul Pal agreed with Musk, tweeting: “Yup. Pretty much baked in the cake.”

Northmantrader founder and lead market strategist Sven Henrich stressed that the danger is the Federal Reserve being “obtuse to consequences.” He elaborated that the central bank was “Too slow to react in the first place” and is “now slamming the foot on the brakes,” emphasizing that the Fed is “too reliant on backward-looking data risking breaking things quickly.”

Peter Schiff (bi-currency skeptic, gold bug) offered another view and replied to Musk.

Hyperinflation is possible. It risks hyperinflation. Massive QE will be used by the Fed to eviscerate the dollar and send consumer prices skyrocketing.

The conversation was also attended by politicians. Congresswoman Nancy Mace (R-SC) opined: “If [U.S. President Joe]Biden [House Speaker Nancy] Pelosi hadn’t spent trillions of dollars we don’t have, we wouldn’t be having this conversation…”

Federal Reserve Chairman Jerome Powell recently emphasized the central bank’s hawkish stance in his speech at Jackson Hole, Wyoming. He noted that the Fed’s fight against inflation will “bring some pain.” Many people are concerned about the Federal Reserve raising interest rates, including Senator Elizabeth Warren (D-MA), who stated that she is “very worried” that the central bank’s action will tip the U.S. economy into recession.

Musk’s tweet followed an analysisCathie Wood (Ark Invest CEO) warned Wednesday about the dangers of deflation. “The Fed is basing monetary policy decisions on lagging indicators: employment and core inflation,” she detailed, elaborating:

The risk of deflation is being flagged by leading inflation indicators, such as copper and gold. The oil price is down more than 35% since its peak. This year’s gains have been erased.

“One of the best inflation gauges, the gold price peaked more than two years ago in August 2020 at $2,075 and has dropped about 15%. Lumber prices have dropped more than 60%, copper -30%, iron ore -60%, DRAM -46%, and crude oil -35%,” Wood explained.

“Further downstream, retailers seem to be swimming in inventories which they could be forced to discount aggressively to clear the shelves for holiday merchandise. The surprise could be deflation in the CPI and PCE deflator by year-end,” the executive added. “In the pipeline, inflation is turning into deflation.”

Musk said in August that inflation has peaked and “is going to drop rapidly.” He also predicted that we will likely have a recession lasting about 18 months.

Is Elon Musk right that an increase in the Fed’s rate could cause deflation? Leave your comments below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is intended for general purposes. It does not constitute an offer, solicitation, or recommendation of products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.