Bitcoin has retreated from a critical area of support, which served as the upper limit for the negative movement at 18,000 in June.

Bitcoin Breaks Crucial Level

Prices fell below the bear flag in the middle August and then continued to decline on a break at 20,000, before finally reaching support around 19,600. The top cryptocurrency has used this level as resistance ever since 2017, even though it just returned to activity.

BTC/USD drops below $20k Source: TradingView

As Bitcoin moves into September, this puts a significant downward pressure on the currency. According to a cryptocurrency expert, there is also a downward pressure on Bitcoin as it moves into September. Ali Martinez, Bitcoin’s market share has fallen below 39% for the first time since 2018.

This is bad news for Bitcoin maximalists as other cryptocurrencies keep overtaking the crypto monarch.

Popular cryptocurrency analysts have also drawn attention to a concerning trend in Bitcoin’s prior September performance.

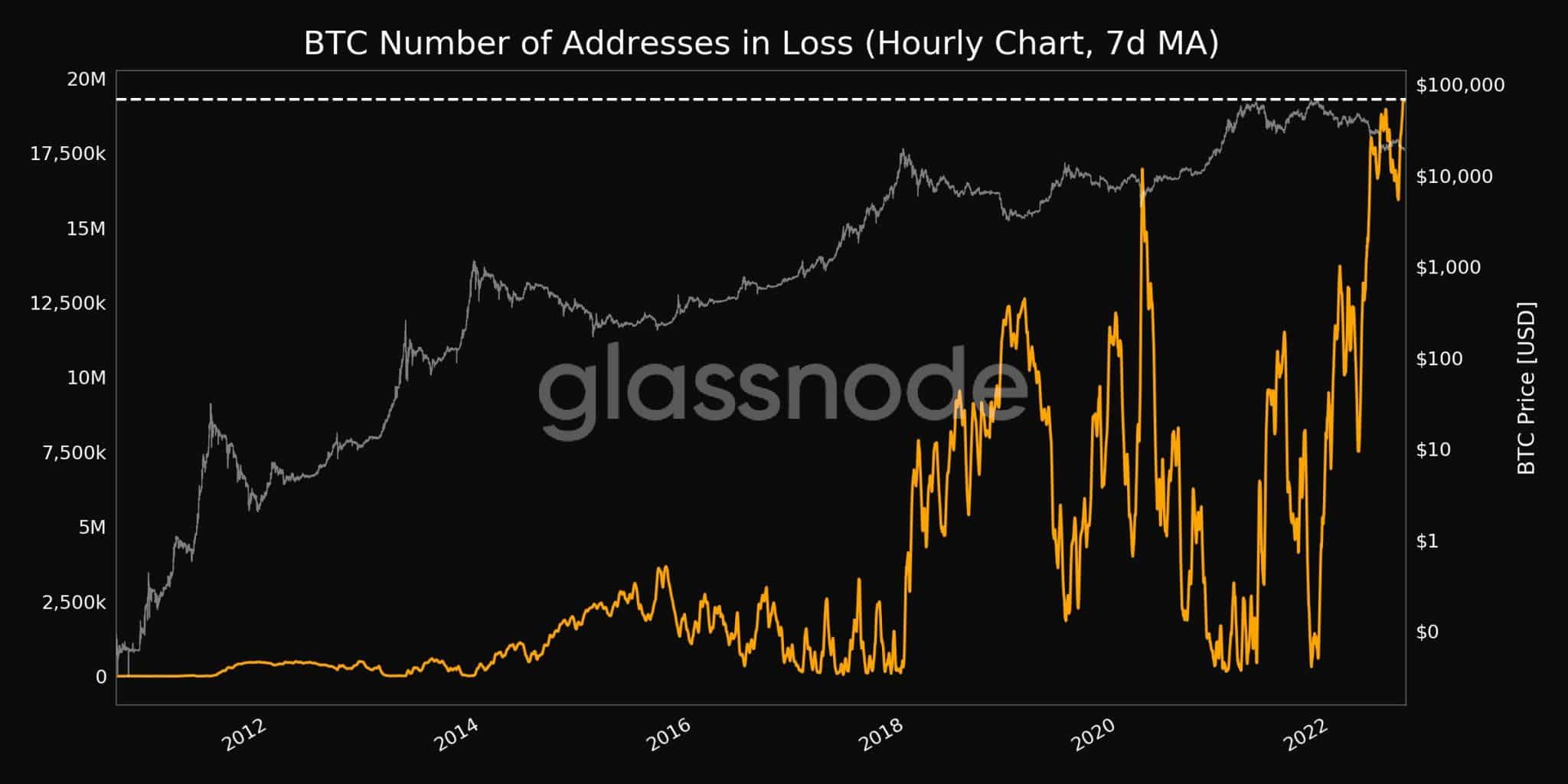

One expert claims that Bitcoin had a losing month for nine out of twelve Septembers in total. Glassnode was launched September 7. reportedThere were losses of 19.29 millions BTC addresses.

Glassnode

BTC/USD was at its peak when it hit $19,666 (an all-time high) on December 17, 2017. A breach of the zone in December 2020 led to a surge that helped major cryptocurrency rise before it reached a record of $69,000 last November.

Following a decline below support levels that were turned into resistance, prices have fallen below $18,595 under selling pressure.

Additional Price Crash

If prices fall further, breaking the $18,000 psychological level may lead to a test of the $17792 level. This represents the 78.6% return of the movement from 2020-2021 with the December 2020 low at $17 569 as the next level.

This chart for four hours shows that these historic levels have formed zones of confluence which continue to keep bulls and bears away as the short-term price fluctuates between $18,500- $19,000. If the price increases above $19,000 or $19500, retests at $19 666 and $20 418 will be possible.

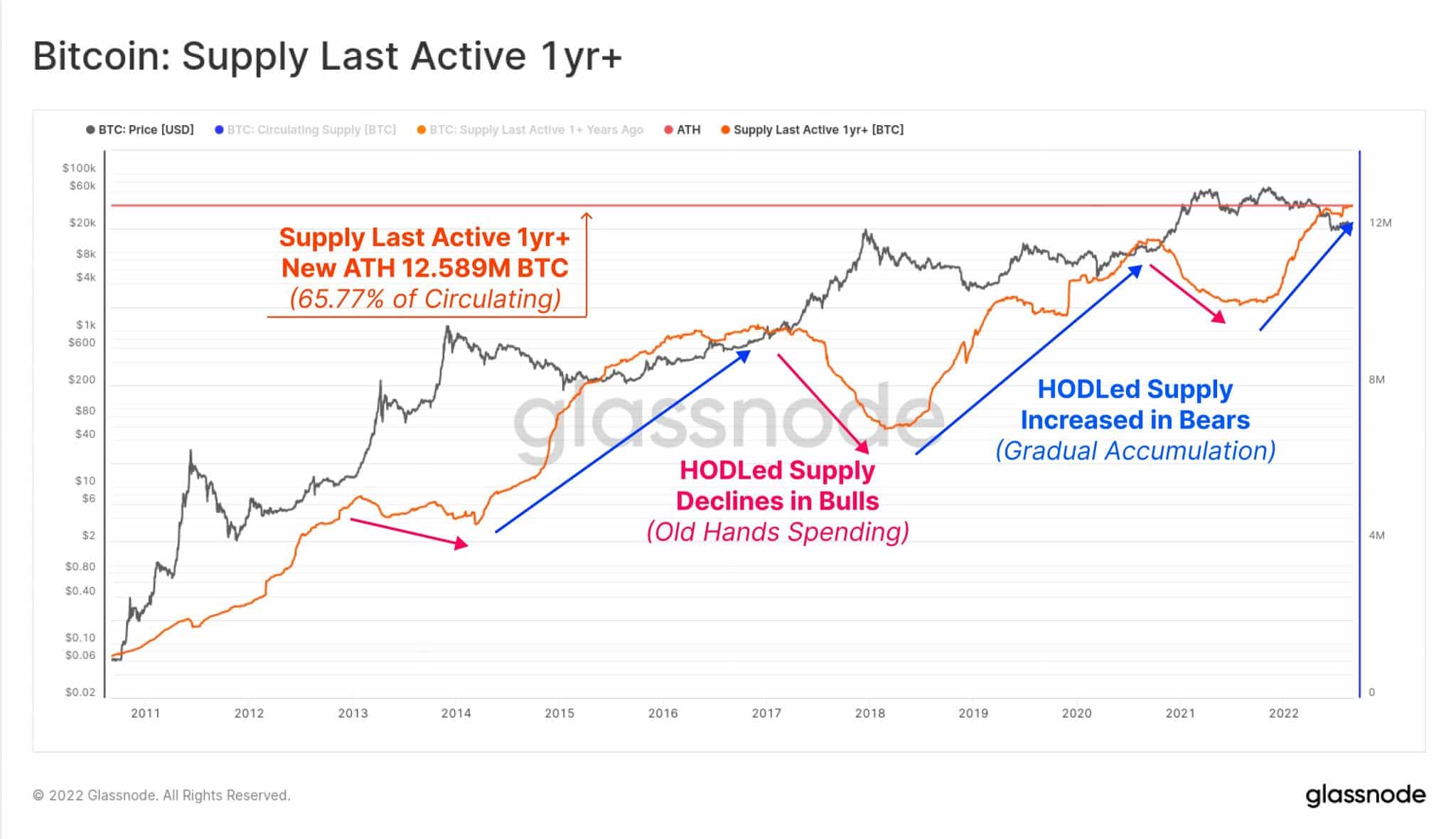

A recent report,Glassnode warned of a possible negative Bitcoin market move. According to the Glassnode, approximately 12.589 million BTC or 65.77% of total BTC have been inactive for at most one year.

Glassnode

In the past, “Bitcoin bear markets” have been characterized by an expanding inactive supply. This increases the pain experienced by maximumists, who patiently wait for a price break.

BaroVirtual (a CryptoQuant-based writer) predicted short-term volatility. Analyst BaroVirtual, a CryptoQuant-based author, studied the Net Unrealized Profits pattern. It exhibits volatility in short periods.

Featured image taken from Shutterstock. Also, Charts by Glassnode and TradingView.com.