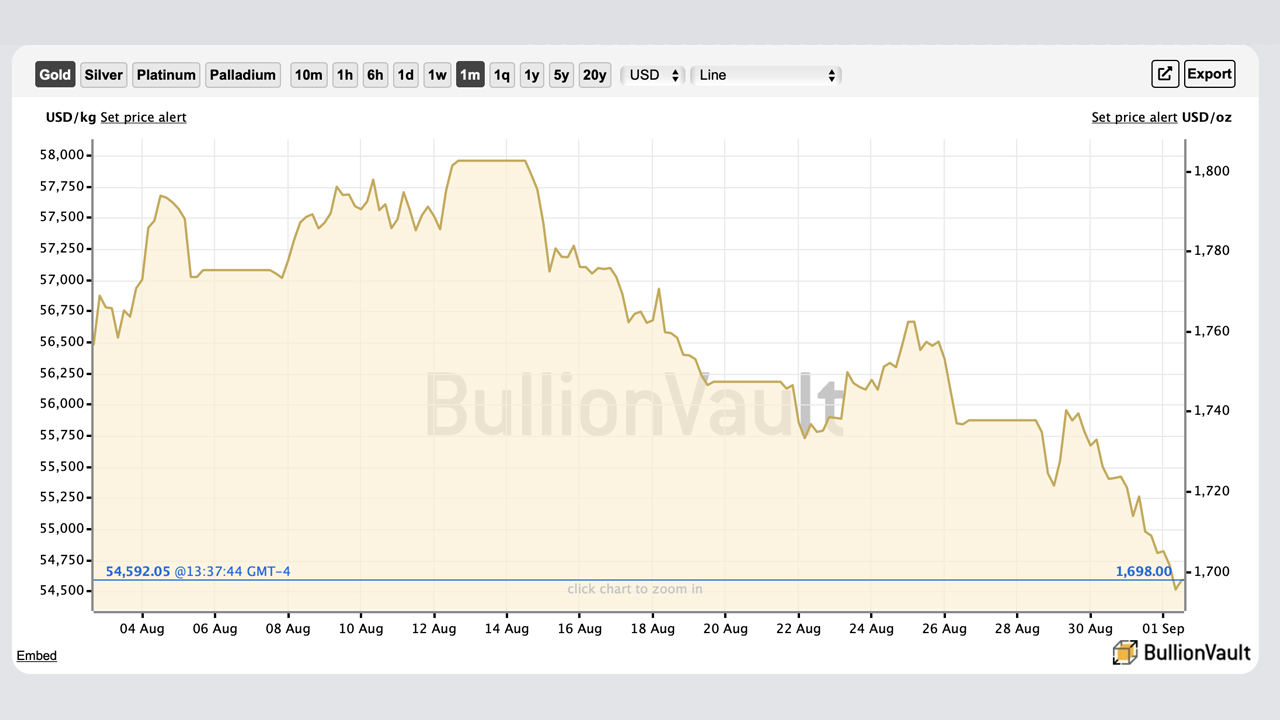

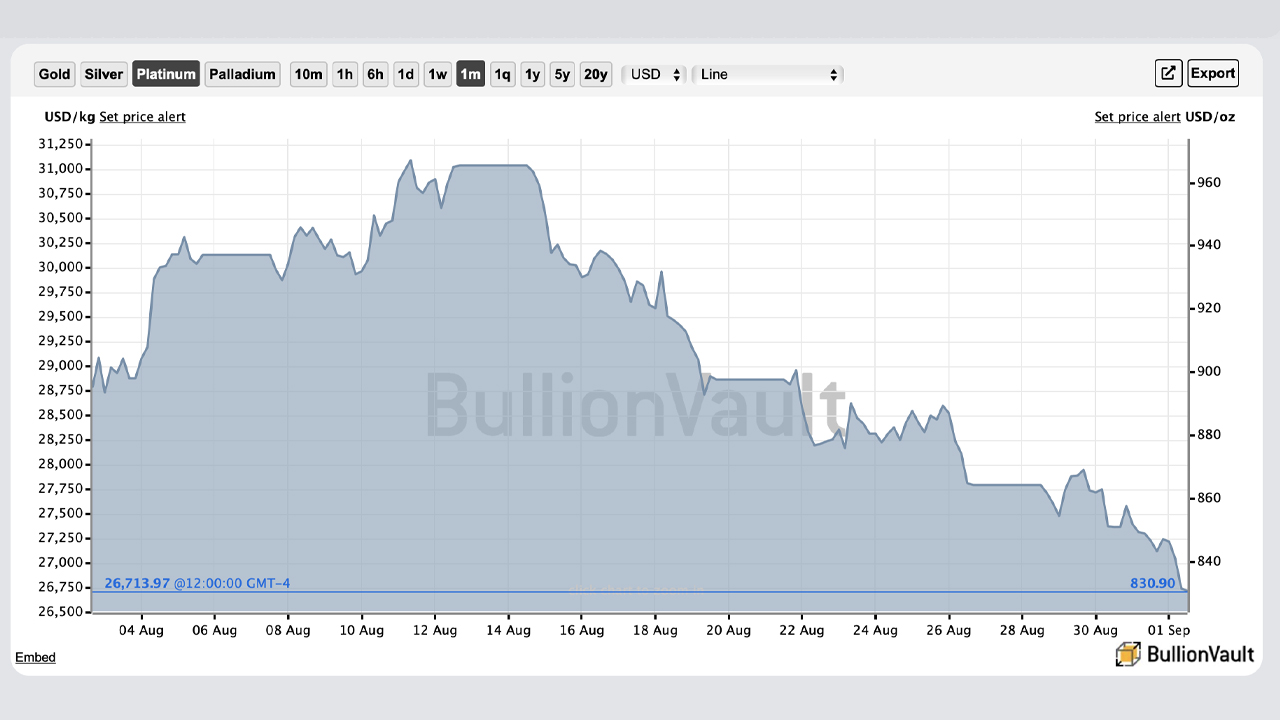

Precious metal markets have shuddered during the last few weeks, as gold’s price per ounce nears a six-week low hovering just under $1,700 per unit. Silver fell below $18 per ounce, falling to $17.80. In 24 hours silver and gold dropped between 0.85% and0.89% to the U.S. Dollar, while platinum fell 2.82% to the USD, and palladium lost 4.18%.

Despite Scorching Global Inflation, Gold Hasn’t Been a Safe Haven in 2022

While the entire world is suffering from red-hot inflation, many would assume that the world’s precious metals would be a safe haven against the surging prices. That hasn’t been the case in 2022, despite the U.S. and the Eurozone inflation rate rising above 9% this summer.

A fine ounce of gold achieved a lifetime record price at $2,000.70 an ounce in 2022. An ounce of sterling reached a record high price at $26.46 an ounce on March 8, 2022.

Silver is currently down 23.14 percent year-to-date. It was last trading at 23.16 U.S. dollar per troy ounce January 1, 2022. The nominal U.S. Dollars per troy ounce price of silver has dropped 32% from its March 8 peak. Gold’s nominal U.S. dollar value per troy ounce on January 1, 2022, was $1,827.49 per ounce and at today’s $1,695.45 per ounce value, gold is down 7.22%.

Investors who purchased gold at its lifetime high price on March 8 lost 18.09% USD since then. Gold and silver have suffered similar losses in their value as well as more volatility than platinum, palladium, or rhodium.

Since the beginning of time, precious metals (PMs), have played an important role in global economic development. Traditionally, silver and gold have been considered a hedge against rising inflation. This hasn’t been true in 2022. The blame lies with a strong greenback, as well as the Federal Reserve raising interest rates.

Analysts Say The Dollar Index Hits a 20-Year Record, Despite a Strong Dollar.

Przemyslaw Radomski, CEO of investment advisory firm Sunshine Profits told Forbes at the end of June that a “more hawkish Fed, implying higher real interest rates, and a stronger U.S. dollar, both point to lower gold prices.” The market strategist at dailyfx.com, Justin McQueen, says “a firmer USD and a renewed rally in global bond yields have dragged gold prices.”

Dhwani Mehta, an analyst at fxstreet.com explained that the gold price could fall further if bears continue to control the market. “The Technical Confluence Detector shows that the gold price is gathering strength for the next push lower, as bears aim for the pivot point one-day S2 at $1,700,” Mehta wrote on September 1. Mehta wrote that the fxstreet.com analyst also added:

Sellers who have a firm foothold under the former will see a steep sell-off toward the pivotal point S3 of $1,688.

David Meger, the director of metals trading at High Ridge Futures, blames gold’s poor performance on the statements Federal Reserve chair Jerome Powell made last week at the Jackson Hole Symposium.

“There is continued pressure on gold from Powell’s last week comments that raised [the] expectation of a more aggressive Fed,” Meger said. “Gold being a non-interest bearing asset will have more competition.”

Reuters reported that the U.S. Dollar Index reached a new 20-year high at 109.592 on Thursday. The reason for the strong greenback can be attributed to an aggressive Fed.

Let us know your thoughts on the recent action of precious metal markets. Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons. Bullionvault.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.