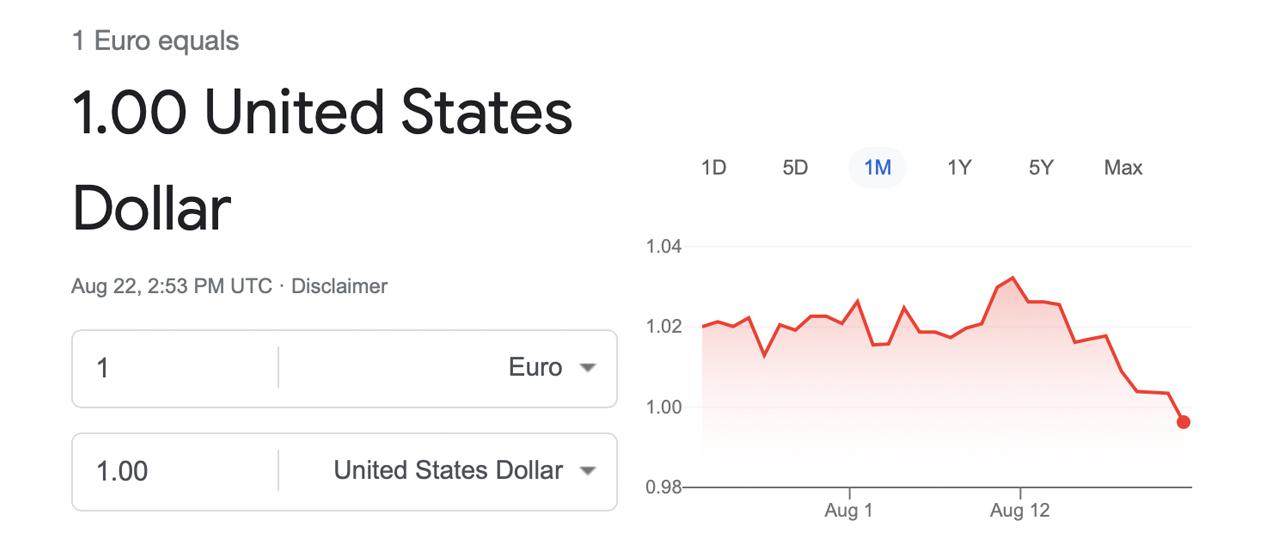

The U.S. currency has performed well in contrast to fiat currencies all over the globe. In fact, this week saw the dollar fall below the USD for only the second time since mid-July when it reached parity with the dollar. The dollar’s recent brawniness has resulted in the largest weekly rise since March 2020, according to Commodity Futures Trading Commission (CFTC) data.

US Dollar Rises, Euro Falters —Stocks, precious metals and cryptos drop lower

The Dow Jones Industrial Average fell 400 points Monday as Wall Street continues to be plagued by inflation worries. The four major stock indexes — NYSE, Nasdaq, Dow, and S&P 500 — all started off the morning (EST) in red compared to the gains recorded last week. As both silver and gold prices are falling on Monday, the markets for these precious metals have been under pressure. Global cryptocurrency market capitalization fell 1.4% this morning, hovering at just over $1 trillion.

For the second consecutive week, the euro has fallen below the U.S. Dollar for the start of this week. Both fiat currencies trade for exactly the same amount, however the euro dropped to $0.99 Monday morning (EST) at this writing. Also, the USD rose 1.0098 on July 12th 2022 to meet parity with the euro. This was the same day that the euro fell below the USD. The dollar index (DXY), which is based at 108.711 continued to gain strength on Monday, August 22.

Reuters reports that the euro’s drop on August 22 is due to an energy and petroleum crisis Europe has been dealing with since the start of the Ukraine-Russia war. Meanwhile, Reuters also crunched data stemming from the CFTC and the numbers show the “U.S. dollar net longs hit highest since early March 2020.” Many believe as long as the war persists and the Federal Reserve continues interest rate hikes and monetary tightening, the greenback will remain robust.

China’s Real Estate Mayhem Causes Central Bank to Slash Rates Amid US Federal Funds Rate Hike Fears

In addition to the robust dollar and the war in Europe, China’s economy has been dealing with a major real estate crisis. One of the most prominent Chinese theater chains, China Cineworld (a mega chain that operates over 900 theatres), has revealed signs of financial trouble and was thought to be on the brink. On Monday, China’s central bank cut the benchmark lending rate and the mortgage reference rate to ease the economy’s pressures.

With the strong dollar, Wall Street’s main indexes in the red, gold and silver down, and the crypto economy floundering, reports indicate that the fear stems from the Federal Reserve’s next rate hike. However, estimates by Reuters suggest that the Fed might be softer than usual this month after the U.S. central banks raised its federal funds rate by 75 base points (bps).

“The U.S. Federal Reserve will raise rates by 50 basis points in September amid expectations inflation has peaked and growing recession worries, according to economists in a Reuters poll,” the report detailed.

What do you think about the U.S. dollar’s strength and the euro dropping below the USD’s value? What do you think about the macroeconomic issues plaguing today’s financial markets? Please comment below to let us know your thoughts on this topic.

Credits for the imageShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.