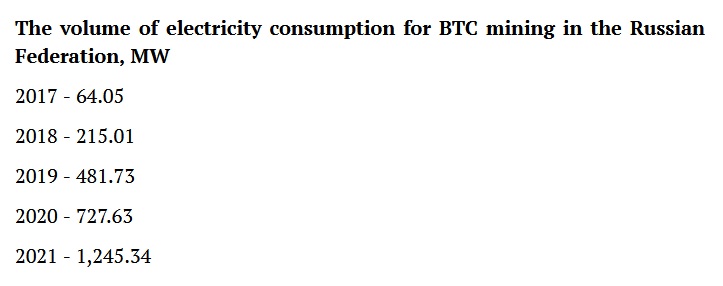

Since 2017, Russia’s cryptocurrency miners has seen a dramatic increase in power needs. The five-year span saw a 20fold increase in electricity consumption. To mint bitcoin, the most valuable coin in the world, it required 1.25 gigawatts of electricity. Experts believe that Russia is able to meet much higher demand.

Crypto miners spend as much power as Russian farmers

Electricity consumption in Russia’s crypto mining industry has been constantly rising since 2017, a new study has established. According to experts working at Intelion Data Systems, the positive trend has led to an increase in electricity consumption of around 150% annually.

Their calculations reveal that the extraction of bitcoin (BTC), required 1.25 gigawatts in energy alone by 2021. The volume of electricity used for the production of other major cryptocurrencies, such as ether (ETH) and litecoin (LTC), can be an additional 40-50% of BTC’s consumption, the researchers say.

Various government institutions estimate that cryptocurrency mining accounts for between 0.64% and 2% of the total electricity consumption in the Russian Federation, the business news portal RBC and other Russian media revealed, quoting Intelion’s report. That’s about as much as agriculture’s share of the total consumption.

Novie Izvestia wrote that the prospects of the Russian Federation developing a crypto market are very good and required the legalization for activities such as mining. With almost all types of electricity generation at its disposal — nuclear power plants, hydropower facilities, and a surplus of other capacities — Russia is in a position to achieve highly efficient cryptocurrency mining.

Industrial Crypto Mining Share Continues To Grow

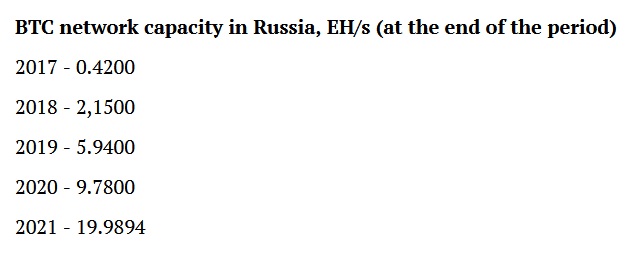

Russia’s largest industrial-scale mining operators consume 40-45% of the electricity used for mining in the country. This study found that the share of miners in the country’s total electricity consumption was increasing at an average rate of 5%-7% per year.

This significant rise, when the sector has been legalized and structured through transparency regulation, is expected to lead to positive changes at the macro level like an increase in high-skilled workers’ employment, new industries development, and further digitization of the economy.

“Growing interest in energy-intensive blockchain computing in the context of a significant surplus of energy resources in a number of Russian regions, undoubtedly, opens up new opportunities not only for participants in this market, but also for a significant number of industries and business areas related to this market,” Intelion Data Systems CEO Timofey Semyonov commented.

In July, Semyonov’s company published another report concluding that Russia could become a large player in the crypto mining space. That study listed the nation’s most attractive regions for coin minting operations, including the capital Moscow and the adjacent Moscow Oblast, Karelia, Buryatia, Khakassia, Krasnoyarsk, Sverdlovsk, Murmansk, and Irkutsk.

According to the Cambridge Institute for Alternative Finance, Bitcoin mining was one of many crypto-related business that are still waiting for comprehensive regulation in Russia. It controlled nearly 5% of global hashrate as of January 20, 2022. But, sanctions by the United States later placed on Russian miners in response to the conflict in Ukraine. Moscow officials agree crypto mining needs to be taxed and regulated like any other industrial activity.

What do you think Russia can achieve to surpass the challenges it faces and to be a global leader in crypto-mining? Comment below to share your opinions.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.