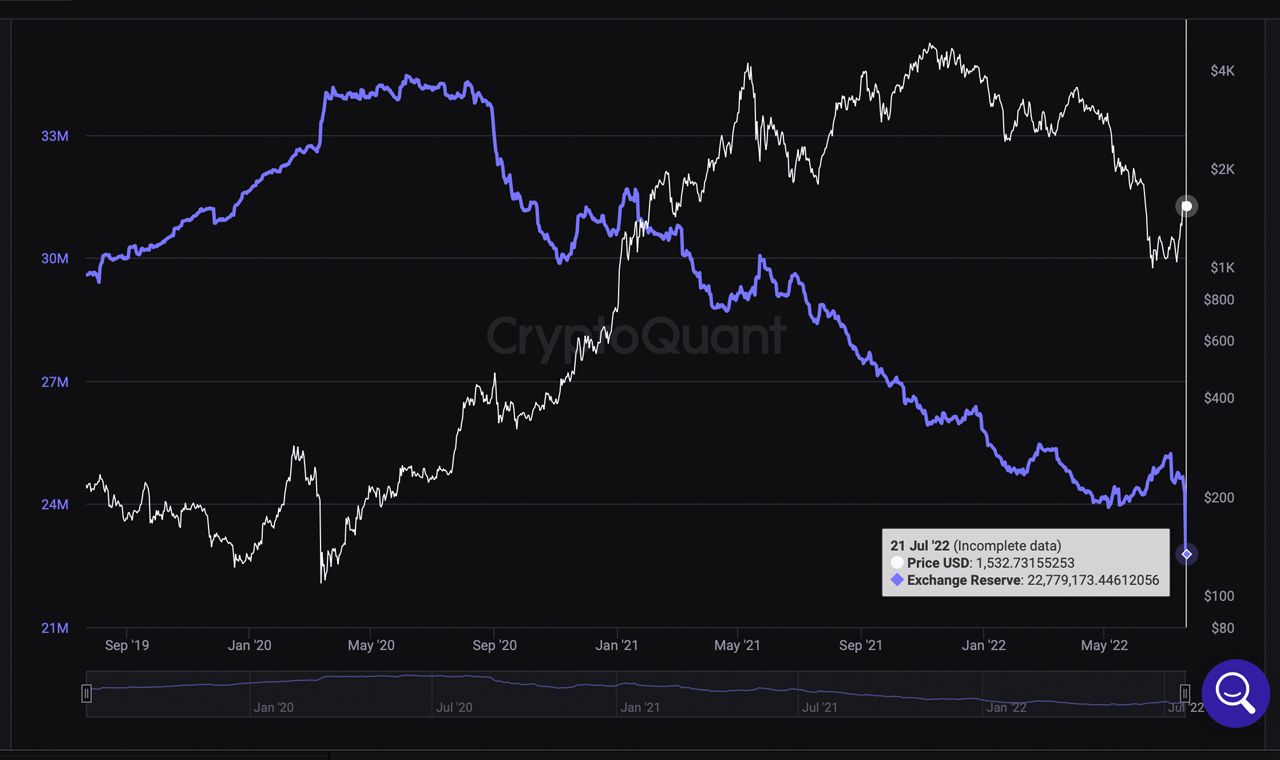

The Ethereum developer Superphiz revealed the preliminary date for The Merge. It is currently less than 2 months away. The announcement appears to have caused several developments. First off, the network’s native token ether saw a significant spike in value and secondly, Ethereum’s hashrate has dropped 18.21% since June 30. Data also shows that the number of ethereum stored on exchanges has seen a massive drop, as roughly 25.13 million ether was once held on exchanges on July 5, and today there’s only 22.77 million worth close to $35 billion.

Evidence shows that significant amounts of Ethereum have been withdrawn from centralized exchanges

Bitcoin.com News, July 9, 2022 reported about the delayed difficulty explosion and The Merge being moved back to at least September. The Merge basically marks the final upgrade of the Ethereum (ETH), which transforms it from proof-ofwork (PoW), to proof-ofstake (PoS)

Now there are two chains: one which still leverages PoW and another that is specifically designed for PoS. The ETH 2.0 contract was credited with 13,012,469 ETH being deposited that day. Since then, 13,416 ether have been transferred into the contract, and there are now 410.903 validators.

Superphiz, a software developer and director of Ethereum Beacon chains community, announced the potential date and timeline for The Merge on July 14. It could be during week 19 September. Superphiz, a software developer and Ethereum Beacon chain community director, revealed the possible date for The Merge. He also noted that it could take place during the week of September 19.

Since then, ETH has managed to gain 36.8% against the U.S. dollar in 30 days, as The Merge bolstered the smart contract platform token’s price. Amid the price jump, Ethereum’s hashrate dropped as well, sliding below the 1 petahash per second (PH/s) or 1,000 terahash per second (TH/s) region. The computational processing power has improved since then, as the Ethereum network’s hashrate is coasting along at 1,000 TH/s.

Cryptoquant.com data also shows that since July 5, 2.36million ether have been removed from cryptocurrency trading platforms. The trend in Ethereum is similar to that of bitcoin (BTC), with both crypto assets being pulled from centralized exchanges in large numbers.

Bitcoin.com News reported that on July 10, the total number of BTC traded on exchanges was 9.109% less than May 22’s statistics. New data indicates that holders and buyers of ether are also pulling large amounts from exchanges. Data from Chainalysis indicates that the “change in [ethereum]The last trading day of the exchanges was 1.82M [ethereum], the highest level in over 365 days.”

Are you afraid of insolvency?

Although The Merge is responsible for the latest withdrawals, investors in crypto have been taking large amounts from exchanges as a result of financial difficulties at crypto companies. Three large crypto companies filed for bankruptcy in recent weeks. Around five other crypto asset platforms also stopped withdrawing funds.

#CelsiusNot your keys and not your coins😂 pic.twitter.com/BFRiYF0oOf

— TF (@TF_826) July 15, 2022

People who owned crypto assets through platforms such as Voyager Digital or Celsius were able to see their accounts being frozen. A wave of withdrawals has been unprecedented due to the fear that funds could be lost to insolvent platforms. During the first week of July, Blockfi’s CEO Zac Prince told the public that while the company had no exposure to Celsius, when Celsius froze operations it caused a significant “uptick in client withdrawals” on the Blockfi platform.

Although the digital currency industry has suffered significant losses, the crypto community is still thriving. scolded newcomersThey did not hold their assets in non-custodial custody. Insolvencies and bankruptcies are also causing an increase in people. telling others the “not your keys, not your coins” adage.

Do you agree with the massive amount of ethereum being taken from centralized exchanges and why? Do you think that the withdrawals stem from people anticipating The Merge or do you think it’s caused by people being afraid to leave funds on centralized exchanges? We’d love to hear your views on the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.