Bitcoin is unable to surpass key resistance levels of $23,000. Bitcoin has been trading sideways for the past 2 days and maintaining its gains of the previous week.

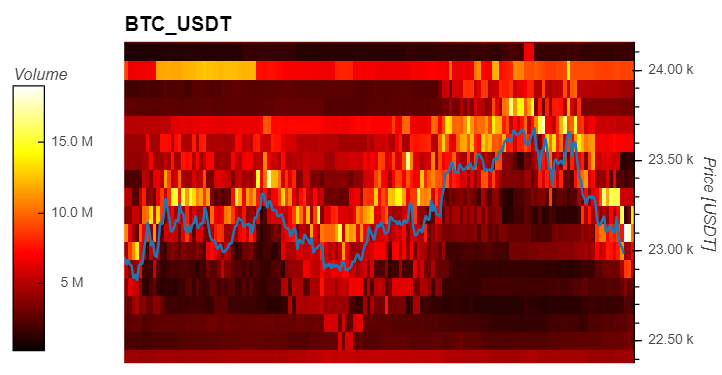

The slowdown in bullish momentum coincides with an increase in asks (sell orders) liquidity for BTC’s price above its current levels and a spike in BTC’s supply inflows on crypto exchange platforms. Short-term, Bitcoin has more than $70 million worth of sell orders between $23,000 and $24,000.

| Crypto market on the mend: ApeCoin and Curve DAO show gains

While Bitcoin’s price continues its upward trend, these levels appear to be a resistance. BTC’s price has been tapping into the immediate zone at $23,100, but data from Material Indicators records $18 million in selling orders at this level alone.

As seen below, BTC’s price is seeing less liquidity below its current levels with big liquidity gaps at key levels. This could hint at high volatility to the downside if BTC continues to lose momentum and can’t break above $24,000 in the short term.

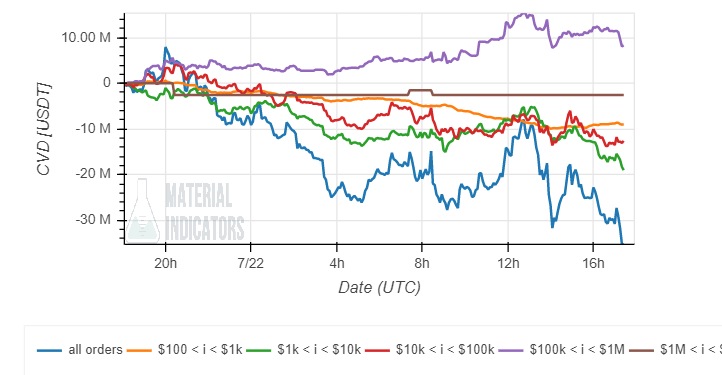

Material Indicators has also recorded an increase in selling pressure coming from investors placing sell orders over $100,000. The price movement was influenced by these investors, who had been accumulating BTC in recent weeks.

The chart below illustrates that these investors (in purple) are selling into current price movements. In this timeframes, it seems too early to conclude if this trend will continue and if it will have a negative impact on BTC’s price.

Analyst Ali Martinez concurredWith the above data. Martinez provided data on the surge in BTC selling pressure by BTC whales, miners. Martinez also showed data from Twitter. There was a drop in addresses with more than 1,000 BTC as well as a 1% decrease in Bitcoin held at addresses that are associated with miners.

Bitcoin Supply Rises on Exchanges. This Hints at Further Weakness.

Ali Martinez also provided additional data that shows an increase in Bitcoins held by cryptocurrency exchange platforms. As these BTCs can often be unloaded onto the market, this metric is considered to be bearish.

Ethereum Shows Signs Of Exhaustion, But Could It Still Touch $1,700?| Ethereum Shows Signs Of Exhaustion, But Could It Still Touch $1,700?

The analyst stated that there was a spike in 27,000 BTC, or $621 Million sent to these locations since July 12. Martinez provided the following comments on these metrics

An increase in open interest, combined with declining network growth and increasing selling pressure from miners and whales suggests that Bitcoin’s recent price action was driven by leverage. This network dynamic increases the likelihood of a sharp correction.