During the last month, the stablecoin economy’s market valuation dropped from $155.23 billion to $153.34 billion on July 20, sliding roughly 1.21%. Over the past 30 days, market cap values for the top stablecoins, usd coin and tether, has fallen while those of BUSD and DAI saw increases.

Stablecoin Markets lose close to $2 billion, Stablecoin Token dominance equals to 14.16% in the entire crypto economy

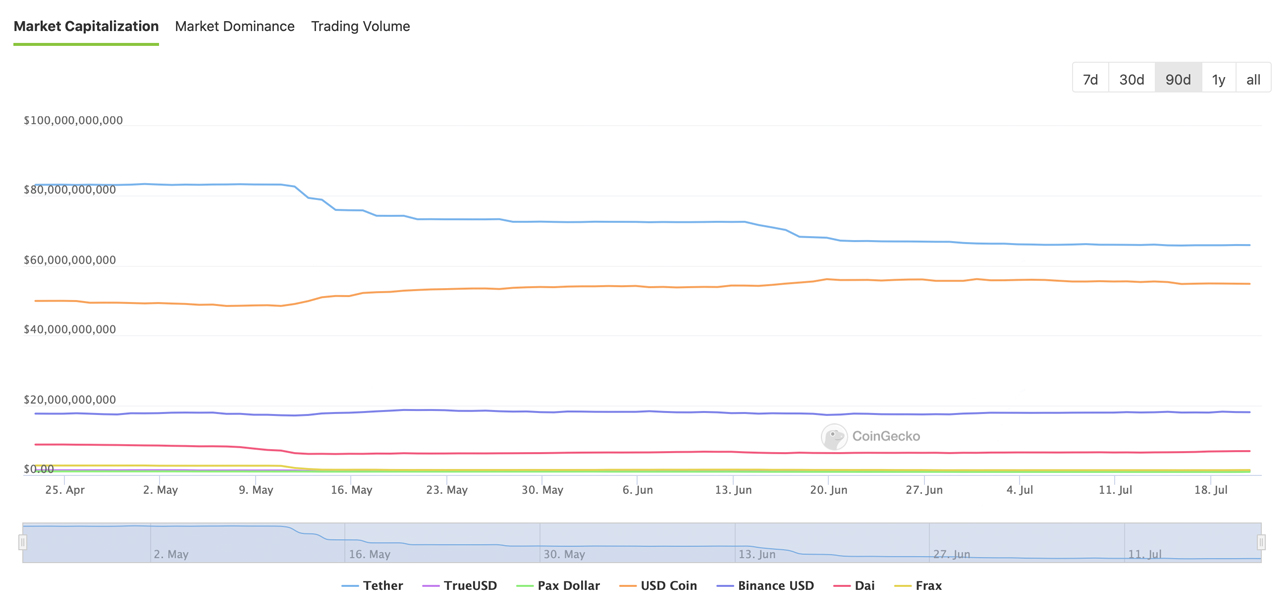

Statisticians show that the market capitalization in the whole stablecoin economy on June 23rd, 2022 was around $155.23 billion. The stablecoin market on Wednesday, July 20 is now approximately $153,349 982,002. Some of the 1.21% reduction stemmed from tether’s (USDT) and usd coin’s (USDC) 30-day reductions.

For instance, USDT’s market valuation dipped by 3.1% last month, and USDC’s slid by 2.4%. The Waves network-based neutrino usd’s (USDN) market cap decreased by 5.7% during the last 30 days. USDC has a smaller capitalization, although Tether (USDT), still holds the biggest stablecoin market value. USDC however is moving closer to that valuation. USDT’s market cap this week is $65.78 billion while USDC’s is 16.84% less at $54.70 billion.

On July 20, the entire stablecoin economy saw $84.99 billion in global trade volume while USDT’s captured $70.82 billion of that trade volume, and USDC saw $7.53 billion in global trade volume. With 92.18% global trade volume in the last 24 hours, both tokens have dominated stablecoin trade volumes.

The market capitalization of Binance’s stablecoin BUSD grew by 3.5%, to $17.95 Billion. BUSD saw more trade volume in 24 hours than USDC, with $8.65 trillion of BUSD volume. Makerdao’s DAI saw an 8.8% market cap increase during the past month. DAI currently has a market cap of $6.81 Billion and a global trade volume of $330 MILLION.

Inverse.finance stablecoin DOLA (DOLA), saw its value rise by 113.5% over the last month. Both the Synthetix.io stablecoins SUSD (SUSD), and SEUR (SEUR) saw double-digit gains over the last thirty days. SUSD’s valuation grew by 29.3% and the Synthetix.io euro token SEUR’s market capitalization jumped 23.5%.

Furthermore, Tron’s USDD has captured the ninth position in terms of stablecoins by market cap. Abracadabra’s stablecoin MIM was once a top ten contender but is now the 13th largest stablecoin by market valuation. Although the stability coin and the cryptocurrency economy have decreased in size, it is still very common in the market and the industry.

With USDT and USDC capturing 92.18% of the $84.99 billion in global trade volume, the aggregate global stablecoin trade volume represents 70.37% of the day’s $120.76 billion in trades. Additionally, USDT’s market dominance is 6.089% of the crypto economy’s net worth while USDC’s valuation equates to 5.09%. Stablecoins make up 14.16% the total value of $1,082,553,811,424 recorded July 20.

Let us know your thoughts about the recent stablecoin economic activity. Please share your views on this topic in the comment section.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.