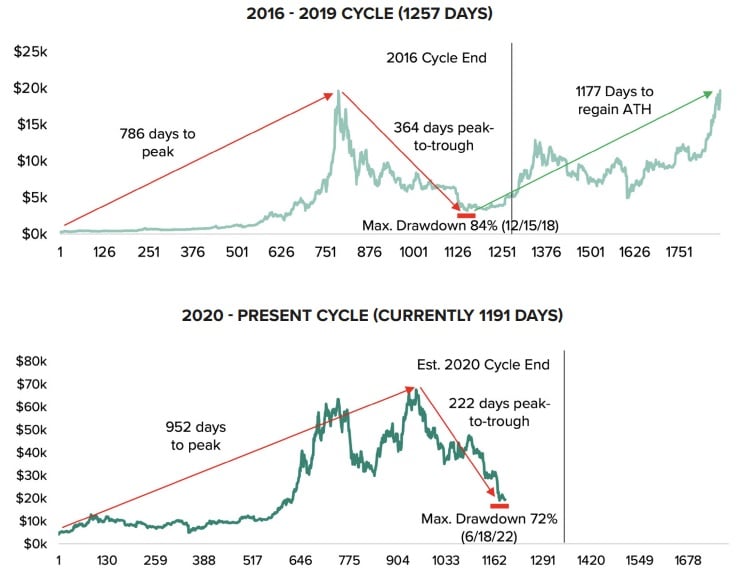

Grayscale Investments explained that it is possible for the crypto market to remain bearish for another 250 days. They cited patterns seen in past cycles. In addition, “Bitcoin is 222 days off the all-time high, which means we may see another 5-6 months of downward or sideways price movement,” the world’s largest digital asset manager detailed.

Grayscale’s Crypto Market Outlook

Grayscale Investments, the world’s largest digital asset manager, published a report titled “Bear Markets in Perspective” this week.

The firm explained: “The length, time to peak and trough, and recovery time to previous all-time highs in each market cycle may suggest that the current market may resemble previous cycles, which have resulted in the crypto industry continuing to innovate and push new highs.”

This report contains:

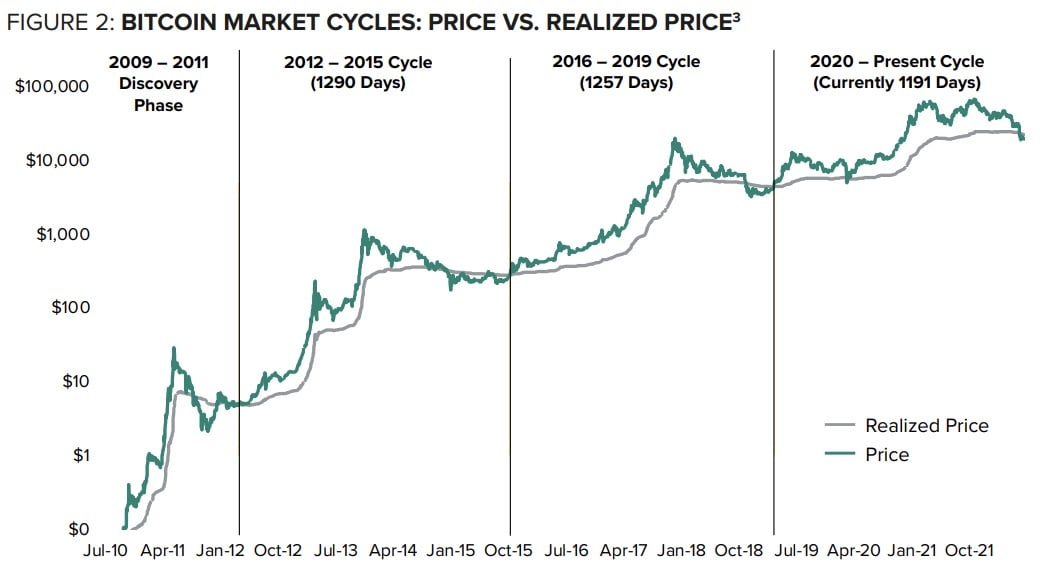

On average, crypto market cycles last approximately 4 years, or 1,275 days.

While most bitcoiners are familiar with market cycles based on bitcoin’s halving cycle, Grayscale has defined an overall crypto market cycle that also roughly works out to a four-year period.

The digital asset manager explained: “While methods vary for identifying crypto market cycles, we can quantitatively define a cycle by when the realized price moves below the market price (the current trading price of an asset), using bitcoin prices as a proxy.”

“As of June 13, 2022, the realized price of bitcoin crossed below the market price signaling that we may officially have entered a bear market,” Grayscale described.

The report proceeds to explain that in the 2012 cycle, there were 303 days in the zone where the realized price was less than bitcoin’s market price. The zone remained open for 268 days during the 2016 cycle.

The digital asset manager pointed out that we have only 21 days left in 2020’s cycle.

There may be another 250-day period of buying opportunities with high value, as compared to the previous cycles.

Additionally, it is noted that each peak in the crypto market cycle takes about 180 days.

“From peak-to-trough, the 2012 and 2016 cycles lasted approximately 4 years, or 1,290 and 1,257 days respectively, and took 391 days to fall 73% in 2012, and 364 days to fall 84% in 2016,” Grayscale said.

“In the current 2020 cycle, we are 1,198 days in as of July 12, 2022, which could represent another approximate four months left in this cycle until the realized price crosses back above the market price,” the firm continued, elaborating:

The Bitcoin all-time record high is still 222 days away. We may also see a 5-6 month period of price declines or sideways.

What do you think about Grayscale’s explanation of where the crypto market is headed? Please comment below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.