Analysts believe the precious metal, gold, is currently in a bear-market and that prices will likely remain low for the next several weeks. The popular asset that is considered a safe haven has seen a 17.50% decline in its value relative to the U.S. Dollar over the past four months, despite the grim macroeconomic outlook.

TD Securities Market Analysts Say Fed Hikes Could Erode Gold’s Price

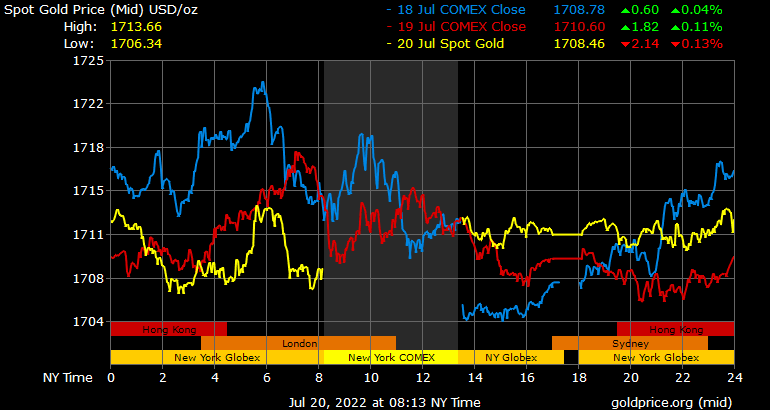

There’s no doubt that the cryptocurrency economy is experiencing a bearish downturn as some of the top digital currencies have lost anywhere between 65% to 90% in value. Since the gold, which is a safe investment and safe haven, reached its all-time peak (ATH), at $2,074.60 an ounce, on March 8, 2022, it has experienced a significant downturn. The asset is now trading at $1,711 an ounce. It has fallen 17.50% in the last 134 days.

According to Kitco’s Neils Christensen on July 18, analysts at TD Securities have said that gold has some pressure to deal with over the next few weeks. “Investors cut net length by a very large 6% of open interest (3 million oz) as it became very apparent that real rates on the short end of the curve will continue to increase and there was little chance of upside, as nominal policy rates jumped higher and inflation expectations eroded along with the pending economic slump,” the TD Securities market analysts wrote.

Canadian financial services and investment bank added

Expect gold to continue to shrink due to Fed hikes and lower economic activity. In the weeks ahead, prices will likely remain at or near their lowest levels.

Bear Market Called Immediately After Gold’s Top, Ukraine Sells Billions in Gold

Analysts at TD Securities are not the only ones who believe gold is in a bearish phase, as moneyweek.com’s main commentator on gold, commodities, currencies, and cryptocurrencies, Dominic Frisby, said gold was in a bear market on March 31, 2021. “It’s a bear market,” Frisby wrote at the time. “You get tradable rallies in a bear market, but a bear market is a bear market. You might not realize how long they can continue. They can ‘make no sense.’ But they don’t go on forever.”

On Monday, Kitco’s Christensen further explained that “for the first time since May 2019, gold’s speculative positioning has turned net short by 6,133 contracts.” Société Générale’s commodity analysts have also stated that the “gold market clearly turned bearish.” Additionally, reports note that Ukraine has sold billions in gold reserves since the start of the war with Russia. Kateryna Rozhkova, the National Bank of Ukraine’s (UNB) deputy governor, told the press that $12 billion in gold was sold to bolster the country’s supply of goods.

“We are selling (this gold) so that our importers are able to buy necessary goods for the country,” Rozhkova detailed in a statement on July 17.

TD Securities Market Strategists: ‘Gold Will Start to Feel the Pain Under a Hawkish Fed Regime’

Additionally, in an attempt strike Vladimir Putin, U.S. leaders and seven others sanctioned Russian gold imports towards the end of June. A hawkish Federal Reserve spells doom for gold’s value according to the investor’s note from analysts at TD Securities. ”With gold bugs falling like dominoes, prices have since slashed through various support levels on their way towards the $1600/oz-handle,” the analysts explained. “With prices now challenging pre-pandemic levels, the largest speculative cohort in gold will start to feel the pain under a hawkish Fed regime as their entry levels are tested.”

In terms of leveraged gold positions, TD Securities market strategists believe “these massive positions are most vulnerable, which suggests the yellow metal remains prone to further downside still.” Meanwhile, as gold has seen a significant downturn, the price of silver per ounce has followed the yellow metal’s fall. For the first time since August 2021, silver’s value fell to $20 per ounce. Coincidently, as August approaches, gold’s value is nearing the price low it tapped in August 2021 when it dropped under the $1,700 handle.

Do you agree with analysts claiming that gold is currently in a bear-market? What do you think about analysts predicting that gold will fall lower than its current value? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThe information contained in this article is intended to be informative. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or imply loss.