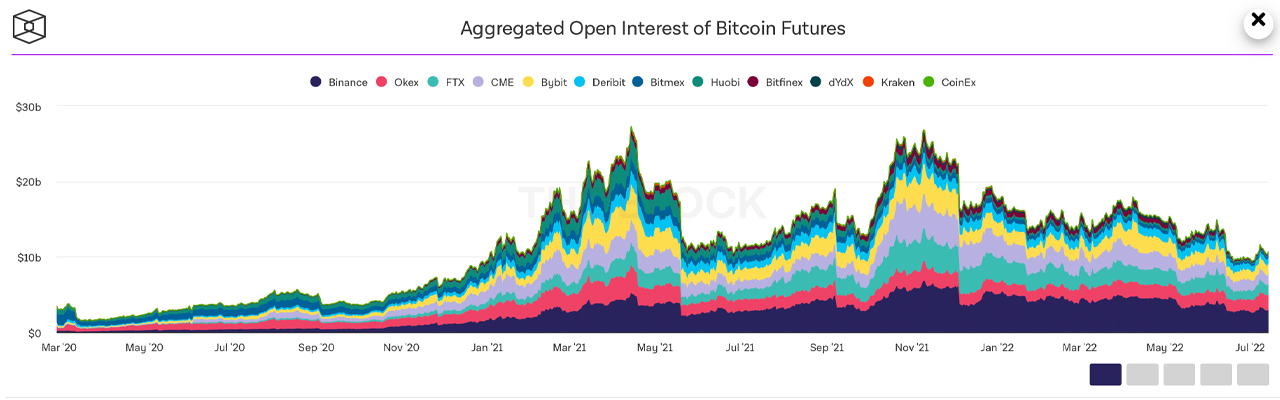

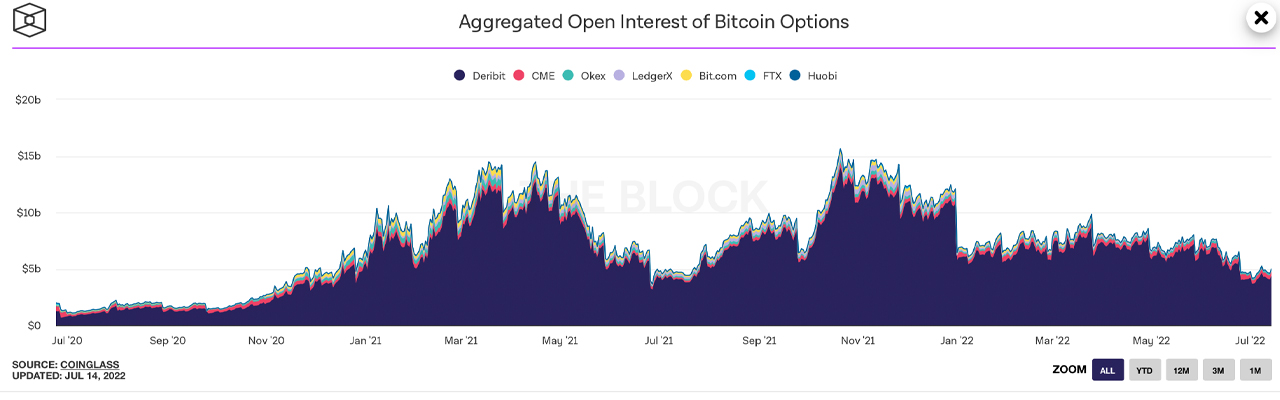

Just 247 days back, total bitcoin futures open interests across 12 different crypto derivatives trading platforms were $26.73 Billion. In the eight month period, open interest in bitcoin futures has decreased 60% to $10.69 Billion. Further, the bitcoin exchange-traded funds BITO and BTF have followed bitcoin’s spot market losses, as the bitcoin ETFs have shed between 70% and more than 73% in value since last year’s price highs.

Bitcoin Exchange Traded Funds Drop 70% Against The US Dollar

On November 10, 2021, the crypto economy’s 24-hour spot market trade volume worldwide was approximately $181.54 billion and more than 10,000 crypto assets had a valuation of around $3.13 trillion. Today, crypto spot market trade volume is 37% lower, as the global 24-hour trade volume on July 15 saw $114 billion in trades, and the crypto economy’s 13,400 crypto assets had a recorded overall value of around $980 billion.

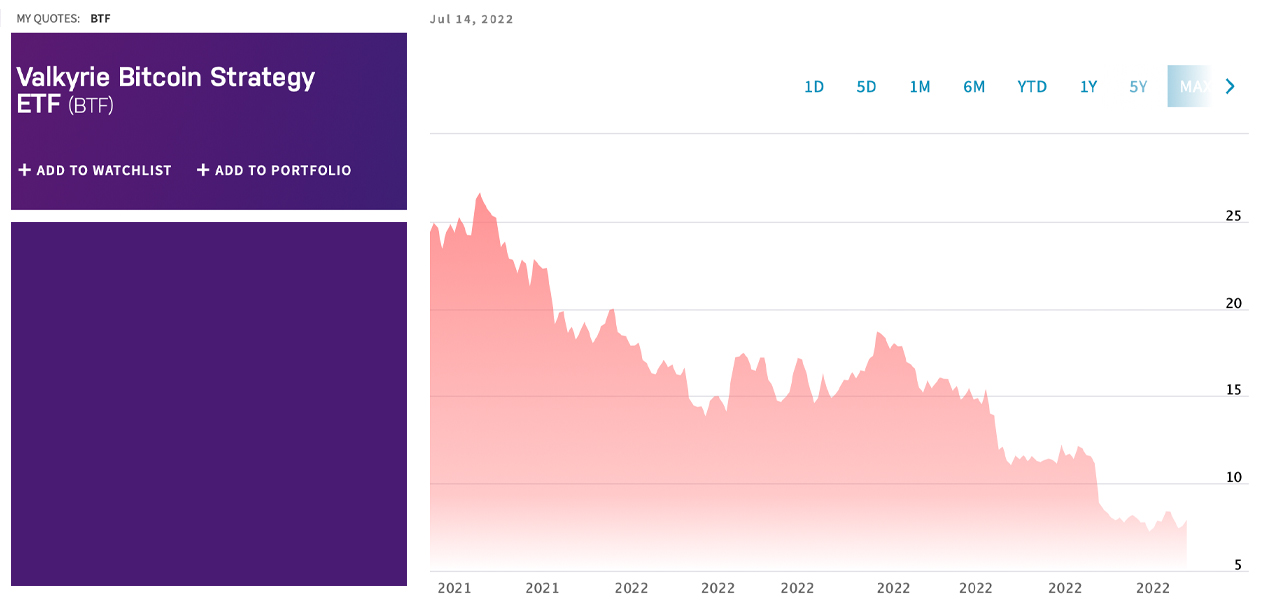

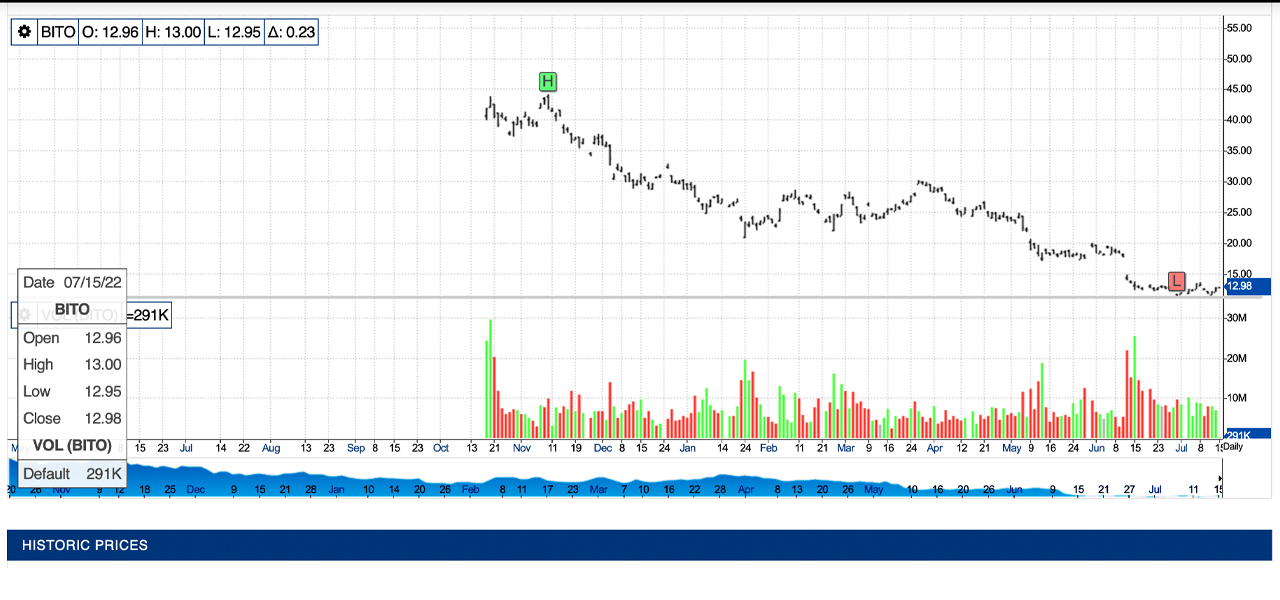

During the past eight months, data shows bitcoin futures markets and BTC-centric exchange-traded funds (ETFs) have taken deep losses during this year’s crypto bear market. Last year, when U.S.-based bitcoin ETFs were approved, the funds traded for much higher prices and have followed BTC’s spot market downturn.

Valkyrie’s bitcoin futures ETF, a fund that uses the ticker BTF on Nasdaq, traded for $26.67 on November 9, 2021, and on July 14, BTF’s price closed 70.19% lower at $7.95. Similar losses have been experienced by the Proshares Bitcoin ETF BITO, which has dropped 73.87% between $48.80 and $12.75 over the past eight months.

The Bitcoin Futures Volatility Spike, Slides and Options on Futures Interests.

Similar to the Proshares and Valkyrie ETFs for bitcoin, total bitcoin futures open interests have been in a downtrend. Recorded data shows that bitcoin futures open interests last November were very close to their record high of $27.29 trillion printed on April 14, 20,21.

In November 2021, bitcoin (BTC), which was traded at $68,766 an hour that day, had $26.73 billion aggregate open interest. As of Thursday, July 14, 20,22 statistics show, open interest in bitcoin futures has dropped to 60%.

Although bitcoin futures volumes declined in April, data shows that BTC futures volume rose significantly in May and reached $1.32 Trillion in June. In terms of monthly trade volume in bitcoin futures, the market leader is Binance and Okex.

BTC options open interest followed the exact same pattern, however bitcoin options volumes increased in May and Juni. Just like bitcoin derivatives and exchange-traded funds, stocks with exposure to crypto assets like BTC such as Coinbase Global, Microstrategy, Marathon, Silvergate, Riot, and more have also followed bitcoin’s spot market action over the last eight months.

Do you agree with the pattern of the derivative products and the bitcoin ETF being based on the same patterns as the Bitcoin spot markets over the past eight months? Please share your views on this topic in the comment section.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.