BlockFi was established in 2017 as a New Jersey-based, privately owned lending platform. It seeks to “bridge the worlds of traditional finance and blockchain technology to bring financial empowerment to clients on a global scale.”

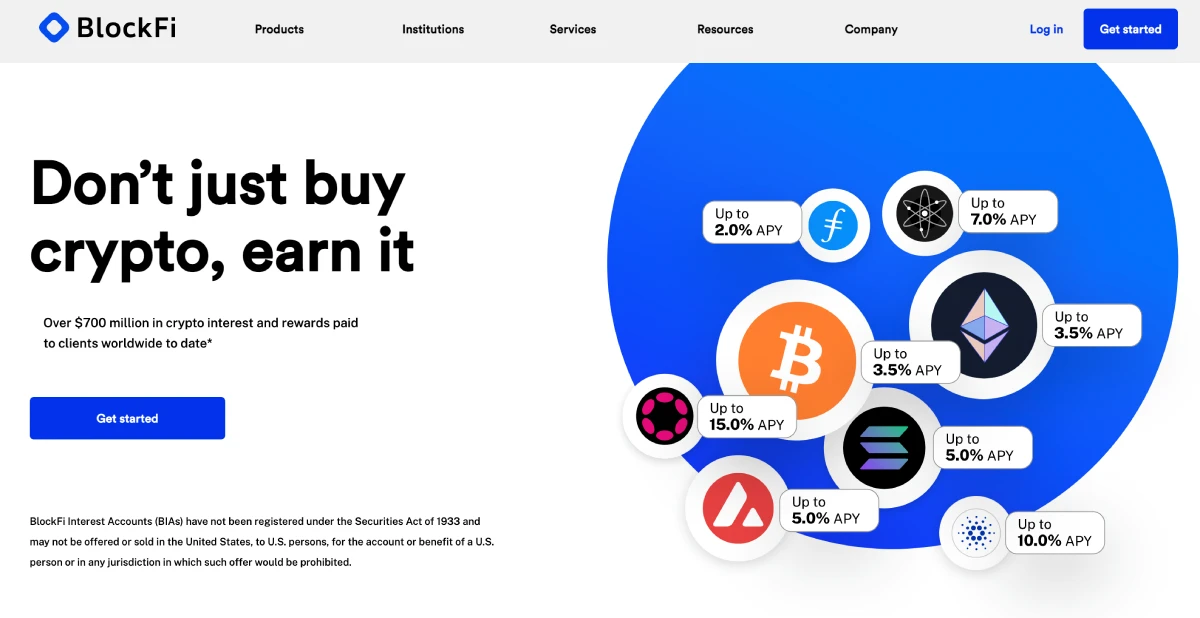

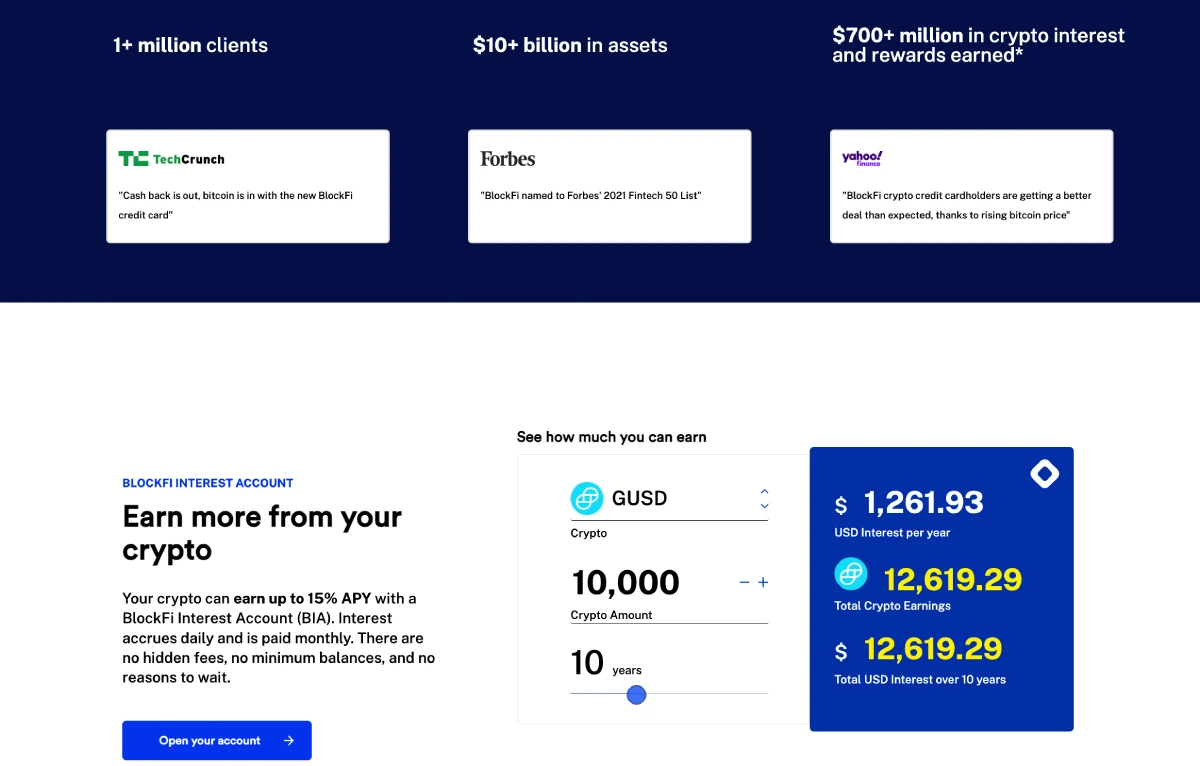

BlockFi is a global cryptocurrency exchange that offers interest-bearing account and low-interest loans at low rates. BlockFi has zero transaction fees, no hidden fees, and minimal balances. BlockFi Interest Accounts (BIA) are a top choice among cryptocurrency investors who want to make passive income. You can earn compound interest of between 3% to 8.6% on cryptocurrencies like BTC, ETH and LTC as well as USDC, USDT and GUSD.

After being charged, the company settled with SEC. BlockFi was fined $100 million and ordered to cease offering BlockFi Interest accounts to U.S. users.

Read our BlockFi review for an overview of the platform’s features and services.

Let’s get right to it!

What is BlockFi?

BlockFi is an NJ-based custodian for crypto assets, founded August 2017 by FloriMarquez and Zac Prin.

For investors who are looking to trade crypto, BlockFi is a great choice. There are no hidden fees and it requires a minimal deposit. The platform provides a rich suite of features and services such as a crypto rewards credit card, a BlockFi wallet, or cryptocurrency-backed loans with a 50% Ratio of LTV.

By depositing cryptocurrency assets to their BlockFi accounts and trading crypto currencies, traders can easily earn 8.6% interest. New clients residing outside the United States are not eligible for the BlockFi Interest Account (BIA), that allowed them to receive compound interest on their crypto holdings. Current clients who are US-residents will no longer be able transfer any assets to their BIAs.

Fundraising totalled $508.7M. $158.7 Million was in Series C.

What is BlockFi?

BlockFi allows traders to access cryptocurrency and stablecoins through a digital wallet.

Its previous Interest Account was a spread company that earned money borrowing capital at a particular rate (the interest it paid to its users) and lending it capital at an even higher rate (the interest it offered for BTC/ETH/GUSD loan loans).

BlockFi makes money from the exchange of assets on its platform and interest on loans.

BlockFi Team

BlockFi’s executive team has decades of experience in traditional financial services and banking. In order to be able to compete for the long-term, BlockFi commits itself as a prudent regulator.

Founder & CEO Zac Prince has held executive positions at several high-performing software firms. He was previously the Head of Business Development at Orchard Platform and Zibby before establishing BlockFi.

Flori Marquez, co-founder & VP of Operations, has prior expertise in managing alternative financing products. As the Head of Portfolio Management, Bond Street was purchased by Goldman Sachs. She assisted with the growth and scaling of a portfolio worth $125M. All operations were her responsibility, which included origination, default and litigation.

BlockFi Products and Services

It offers its users the following products and services from BlockFi:

BlockFi Interest Account

This account is only available to non-US persons and is offered through BlockFi’s subsidiary, BlockFi International (Bermuda). BlockFi’s most distinctive feature was this when it first was created. BlockFi’s interest accounts function in a similar way to savings plans or investment plans. Users can earn interest on savings and investments. BlockFi can either fund its interest account using crypto or fiat currency and earn interest on those deposits.

BlockFi currently offers an 6% annual percentage yield (APY), 8.6% on GUSD, USDT and 4.5% on Ethereum deposits, as of July 20,22.

The interest accrues on the account balance daily and is paid out each month. The account does not have minimum balance or hidden fees.

BlockFi has registered a BlockFi Yield product with the SEC, although the interest-bearing accounts are not available for US-based users. This new product may be made available to US-based clients if it is approved by the SEC.

BlockFi has reserves in New York with Gemini trust company Gemini for customer withdrawals.

Borrow against Crypto Collateral

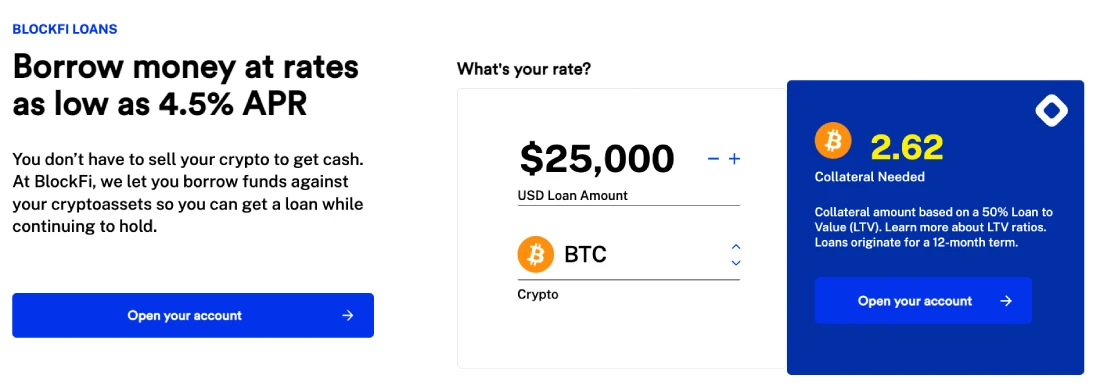

BlockFi offers its users the ability to borrow USD against crypto assets, with rates as low at 4.5%. Your crypto can be used as collateral to get a loan up to 50% off your BTC, ETH or LTC.

While borrowing USD from BlockFi, traders must maintain a 50 percent LTV ratio. To back BlockFi loans, the LTV ratio must not fall below 50%.

BlockFi can provide a loan to traders the very same day that they send their collateral. Traders can access their consumer loans as long as they have collateral. Additionally, it allows users to repay cryptocurrency loans any way that suits them, like paying off part of the full amount.

Cryptocurrency trading

BlockFi enables the efficient trading of stablecoins, such as USDC and USDT, GUSD and PAX, and digital assets, like BTC, LTC, ETH and PAXG. At competitive prices. When traders complete transactions (buy or sale), and they have crypto in their accounts, they will get interest. BlockFi emphasizes quick trade at low prices and rapid interest accrual.

BlockFi offers tax-loss harvesting as an investment method. This allows you to use losses in order to offset your taxable profits.

BlockFi Rewards Credit Cards

Rewards credit cards have become a key part of the lives of many consumers. BlockFi Rewards Visa Credit Card offers crypto traders up 3.5% in cryptocurrency for purchases above $100 within the first 90-days. The rate for crypto rewards increases to 2.5% if users spend more than $50K annually.

Users can apply for the ‘Bitcoin Rewards Credit Card account by signing up for a ‘BlockFi Interest Account,’ completing the registration process, funding their BlockFi accounts, and joining the BlockFi waitlist.

BlockFi Wallet

BlockFi Wallet, the standard solution for cryptocurrency storage on the platform is BlockFi Wallet. It’s a non-interest-bearing account, enabling you to buy, sell, store, and safeguard your crypto and stablecoin assets. BlockFi safeguards your assets, and does not lend them out.

Most cases allow external cryptocurrency to be moved into BlockFi Wallet. Additionally, assets within the wallet may be exported. For certain cryptos, however, the function may not work for US clients. Dogecoin, (DOGE)., Bitcoin Cash (BCH).And Algorand, ALGO. These cryptocurrencies can’t be withdrawn or paid from personal wallets.

BlockFi Personal Yield

BlockFi Personalized Yield Premium Services are available to any client or prospective client who has at least $3,000,000 in crypto assets U.S. equivalent. BlockFi’s Personalized Yield product is tailored to each client’s specific needs. High-level Onboarding is provided to prospective clients and an assigned client relationship manager.

BlockFi’s Personalized Yield customers enjoy discounts on trading, lower margin lending rates and the possibility to lend crypto to BlockFi for additional returns.

BlockFi Trusts

Investors who are accredited and institutions can make investments in any one of the BlockFi Trusts: Bitcoin Ethereum or Litecoin.

Trust holders have the opportunity to access crypto storage as well as passive management of their crypto assets. There is no minimum investment of $50,000. The annual management fee is 1.75%.

These trusts can have a different value than the actual value of digital assets. This makes them risky investments.

Loan through BlockFi

As with other margin loans and loan options, a BlockFi Loan uses your cryptocurrency assets as collateral. In return, you get US dollars directly into your account. It’s a convenient method to get cash without having to sell your cryptocurrencies, and it doesn’t require a credit check. Your loan will repay the collateral crypto.

BlockFi crypto-backed loans “need no credit information” and are accepted as long as you have enough collateral.

BlockFi can sell some of your staked cryptocurrency as collateral for your loan. If you don’t repay your loan altogether, you’ll be liable for capital gains taxes on the cryptocurrency sold by BlockFi.

BlockFi loan fees

Margin loan origination fees are 2%. Borrowers may borrow as much as half the account’s value. Margin rates are determined by the loan-to–value (LTV) ratio. Rates range from 4.5% up to 9.75%.

A 20% LTV Rate would result in 4.75% interest, while a 50% LTV Rate would yield 9.75%.

BlockFi Mobile App

BlockFi provides a high-quality mobile app, compatible with Android as well as iOS phones. BlockFi customers with mobile skills can manage their accounts from anywhere. Users can access their account balances to keep track of cryptocurrency management, make cryptocurrency trades and borrow money. They also have the ability to invest in cryptocurrency, earn passive income, or even create interest.

BlockFi Fees

BlockFi is the market maker and handles all transactions. This differs from other cryptocurrency exchanges. As a result, BlockFi doesn’t charge trading fees for buying or selling cryptocurrency on the platform.

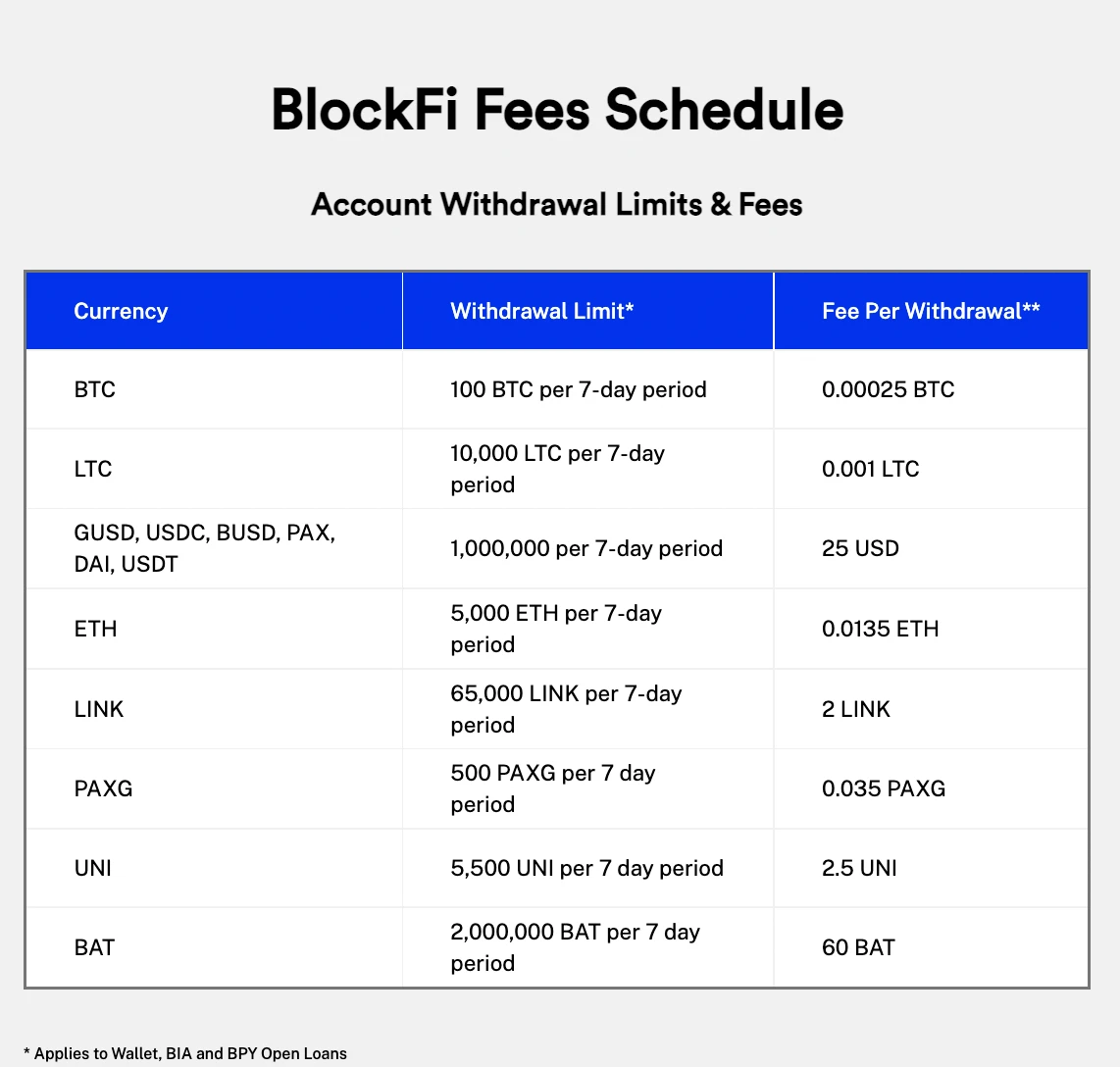

The platform charges withdrawal fees. Each month, users receive one withdrawal free of Bitcoin and Litecoin. These cryptocurrencies can be withdrawn again at a charge, as detailed below. Furthermore, certain supported currencies don’t qualify for free withdrawals.

It is possible to buy or sell on the exchange at different prices. The spread usually is 1%; however, it can vary depending on the coin’s liquidity.

Available Cryptocurrencies

BlockFi has a carefully curated collection of cryptocurrency that is different from many other competitors. This will appeal to most investors with the exception for the most passionate crypto traders. You can trade the following cryptocurrency on BlockFi

How to set up a BlockFi account

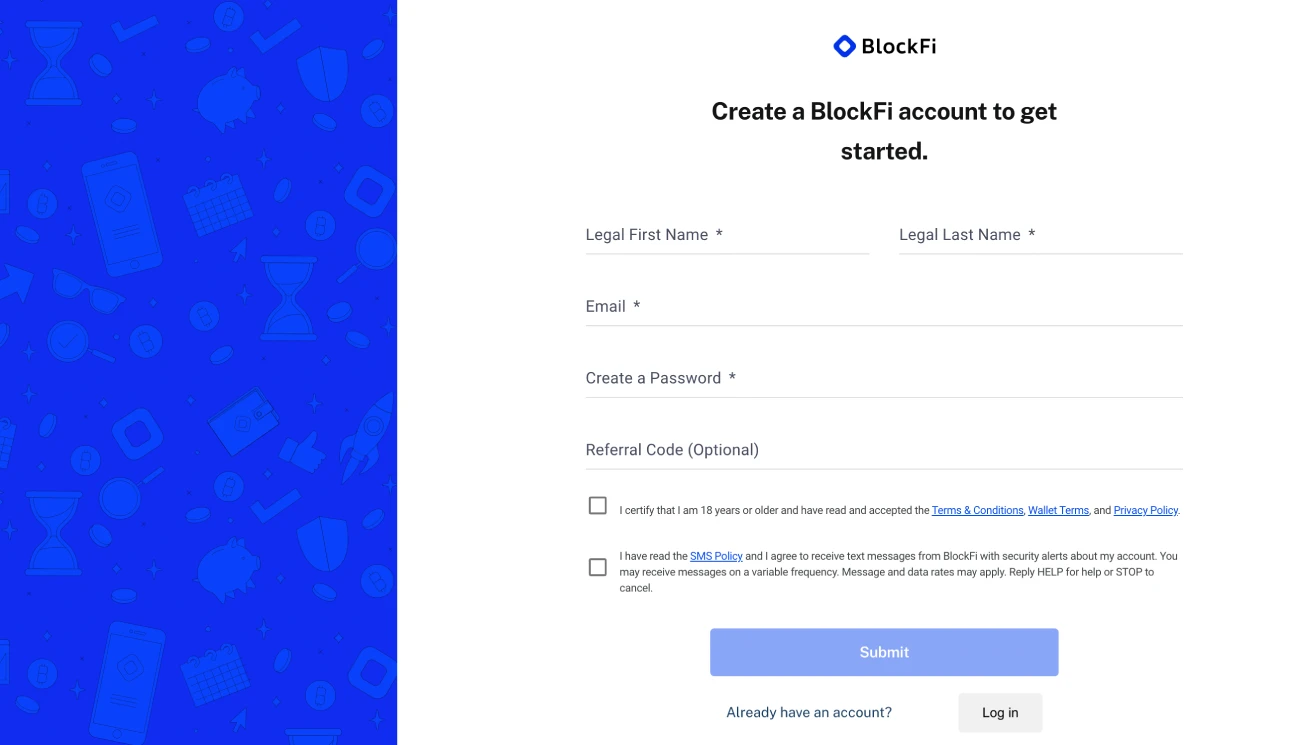

Signing up for an account at BlockFi is simple. To trade on BlockFi, users will first need to create a trading account and deposit a minimum amount.

Below is a step-by–step guide for traders to help them set up an account at the BlockFi exchange.

Step 1: Open an account

To open an account, users must visit the official website and click on the “Get Started” button in the upper right-hand corner of the screen. Click the button to open a registration form. Fill in your name and email address as well as a password.

After you submit and fill out the form, BlockFi will email you confirmation emails to the email address you have provided. Click on the confirmation email link to confirm your email address and to begin trading,

Step #2: Verification

You must submit your personal data to complete registration. Next, upload a valid government-issued identification such as a passport, driving permit, or another eligible ID.

Step #3: Start trading and deposit funds

After all the verification, traders will be able to open trading accounts in fiat currency. They can use their bank account for funds or a cryptocurrency wallet from their digital wallet. Individuals who have cryptocurrencies may earn interest on them or can use them to secure loans.

Security BlockFi

The following security precautions are taken by the BlockFi team to protect the platform from hackers:

- It stores its entire reserves with third party custodians like Coinbase, Gemini and BitGo to ensure maximum security.

- BlockFi’s investments are managed by the US government. BlockFi only purchases SEC-licensed futures and shares.

- To secure a loan, BlockFi asks borrowers for collateral equal to at least half of the amount.

- The self-service security option ‘Allowlisting’ allows clients to limit withdrawals or restrict them to specific addresses. This safeguard prohibits unwanted access to a user’s BlockFi account.

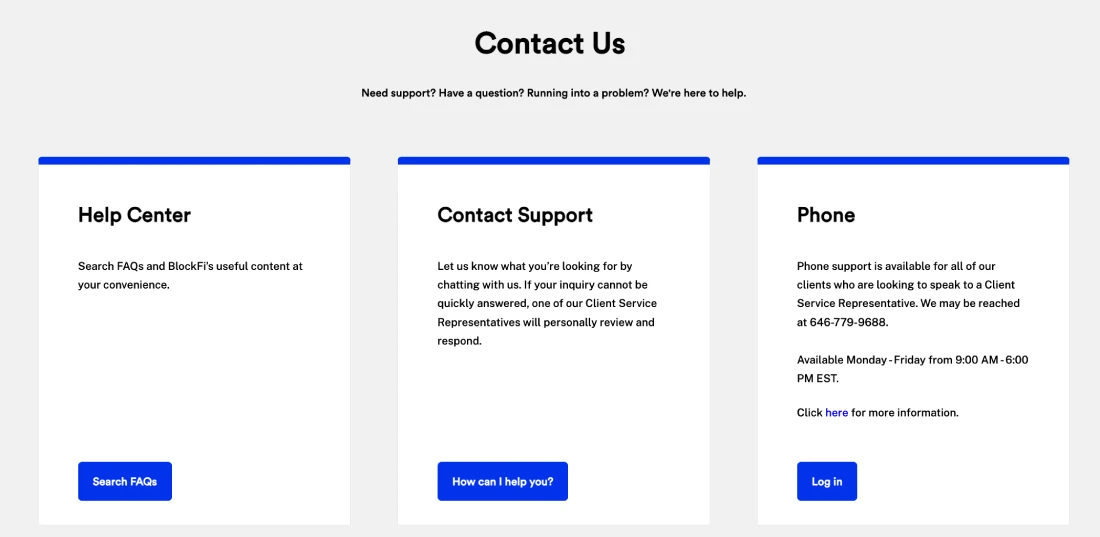

BlockFi review – Customer support

BlockFi’s customer service team is responsive and available 24 hours a day. You can reach them via phone or email anytime.

The platform’s official website provides a dedicated customer care line for any investment advice users may require (you can contact BlockFi anytime).

The BlockFi customer support team has organized help topics according to product categories, which makes it easy to find solutions. You can also search for specific searches.

Additionally, BlockFi Live, the company’s YouTube channel, offers a variety of topics, including general-interest crypto videos, interviews, and tutorials on how to use the platform.

SEC Fines and BlockFi: The Latest Update

The issues with BlockFi’s Interest Account were as follows:

- The corporation did not register BIAs to be securities.

- Lack of adequate risk disclosure in the marketing materials and on the website.

- BlockFi is a securities issuer and has more than 40% in investments instruments, such as crypto-backed loans for institutional borrowers.

BlockFi’s parent firm agreed to pay a $50 million penalty to the SEC, $50 million to 32 states, cease offering the unregistered BlockFi Interest Account, and try to bring its operations inside the Investment Company Act within 60 days.

BlockFi plans to register an offer and sale of new financing products under the Securities Act of 1933. However, the new product was not officially announced or registered. You can read the SEC’s full Here is the press release.

Is BlockFi safe

Although cryptocurrencies are inherently volatile, it’s safe to assume that BlockFi is one of the most secure organizations in the crypto industry.

BlockFi, which is located in America, uses Gemini Exchange to custodial crypto services. Gemini Exchange is widely recognized as the best-regulated and secure exchange in the world, having been created by twins Winklevoss.

BlockFi, one of few US cryptocurrency exchanges that adhere to state and federal standards makes the platform secure in all aspects.

However, the funds in a BlockFi account aren’t FDIC or SPIC insured.

BlockFi has a state-regulated custodian and is also supported by well-respected organizations, such as Valar Ventures or Coinbase Ventures. Morgan Creek Capital Management supports BlockFi.

FAQ

It does offer the BlockFi wallet. However, clients don’t receive interest on funds stored in their wallets. Crypto holdings that earn interest must be transferred to a Bitcoin Interest account.

It does charge a spread. This spread can vary and go up to 1%.

There are two kinds of accounts offered by BlockFi: BlockFi Trading account and BlockFi Intent Account.

A BlockFi Business account is temporarily unavailable. However, it’s anticipated that the platform will soon launch business accounts.

BlockFi’s maximum withdrawal time is 1-5 business days.

Our Verdict

BlockFi was a delight with its BlockFi Wallet, which is secure and available 24/7. We also appreciated the customer service provided by BlockFi. The company’s thorough answers to every complaint on a major review site make it a consumer-centric platform. BlockFi’s coin selection will satisfy the needs of most beginner-to-intermediate users, while the exchange’s financing, credit card, and BlockFi Trust offerings make it a solid alternative for US consumers. BlockFi’s trading and interest rates are very competitive.

All the indicators in this BlockFi review confirm our judgment that the platform is secure and legitimate; therefore, there is no justification for not giving BlockFi a “Thumbs Up.”

BlockFi can be used by traders to decide if it is suitable for their needs, depending on what their tolerances are and how they handle their crypto assets.

Our website is also available. CoinStats blogTo learn more about wallets portfolio trackersLearn more about tokens and cryptocurrencies, as well as our comprehensive reviews of different cryptocurrency exchanges. BKEX, Bybit, Crypto.com, BitMEX, FinexBox, Binance, WazirX, etc.

Do you want to know more? Explore our articles to learn more about the roots of blockchain technology and decentralized financing. DeFi: What’s it all about?, How to buy cryptocurrencyYou can find out more.

Information about InvestmentsThis website contains information that is intended to be informative. It does not recommend you to purchase, sell or hold any security, financial product or instrument.

Because cryptocurrency can fluctuate and be subject to secondary activities, it is important to do independent research, get advice and not invest more than you can afford. Trading stocks and CFDs can be risky. CFD trading can cause losses of between 74-89% in retail investor accounts. It is important to consider all aspects of your financial situation before you make any investments. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

BlockFi Pros

- Transparency in Price

- Excellent Customer Service

- BlockFi Credit Card

- Margin Lending Account

- The managed funds are available to Accredited Investors.

BlockFi Cons

- Only a small number of cryptocurrency are currently available. Most of these are stablecoins.

- Clients who are not current clients will be unable to open interest-bearing accounts

- No joint or custodial accounts

- Fluctuating APY & Loan rate