As the World Bank’s latest data shows, African migrants and expatriates still pay more than 3 percent when they send funds through the formal corridors. However, cryptocurrencies make it much cheaper than that target.

Global Average is Higher than SDG Target

The latest World Bank (WB), remittance data shows that Sub-Saharan Africa is once more the most costly region to send money to. The average cost for sending $200 to Sub-Saharan Africa was 7.8%. This region received $49 Billion in remittances between 2021 and 2020. It only beat the 2020 figure of 0.4%.

Nigeria, which accounts for the largest chunk of the region’s remittances, saw its inflows go up by 11.2 percent. According to the WB, the growth in the value of remittances sent to Nigeria via formal channels can be attributed to the country’s policies which encourage recipients to cash out at regulated platforms. The region also saw notable growth in the inflows of other countries, including Cabo Verde (23.3%), Gambia (31%), Kenya (20.1%)

Globally the average cost for sending money abroad was 6.6% in the same time frame. Both Sub-Saharan Africa, and global average transacting fees are higher than the Sustainable Development Goals (SDGs) 10.3 goal of below 3%.

However, even though efforts are being made to decrease this figure, transfer costs across countries remain high. This has been the case for several years. It is therefore unlikely that we will achieve the UN SDG 10.3 goal of decreasing transaction costs for migrant remittances by 3% by 2030. Similarly, the UN’s mission of eliminating remittance corridors with costs higher than 5 percent appears unattainable.

Cryptocurrency is a popular choice for migrants

However, due to the prohibitive cost of sending remittances through formal channels as well the rigorous KYC standards which are often applied frequently, migrants have to search for easier and more reliable channels. Some of the more informal methods that migrants can use to transfer funds to loved ones include couriers, bus drivers, and cross-border truck drivers. But, these informal means have their limitations. The main problem is the safety of the funds.

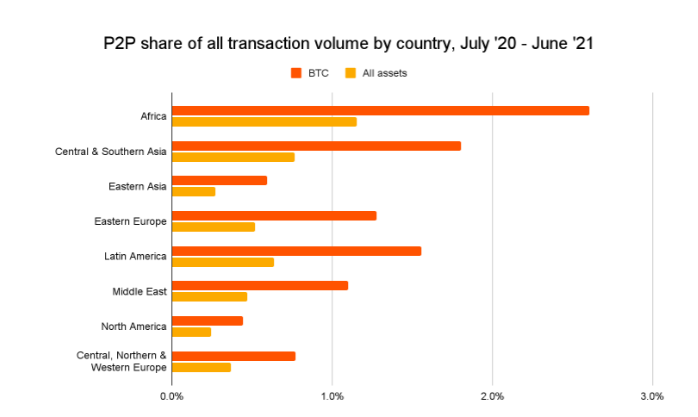

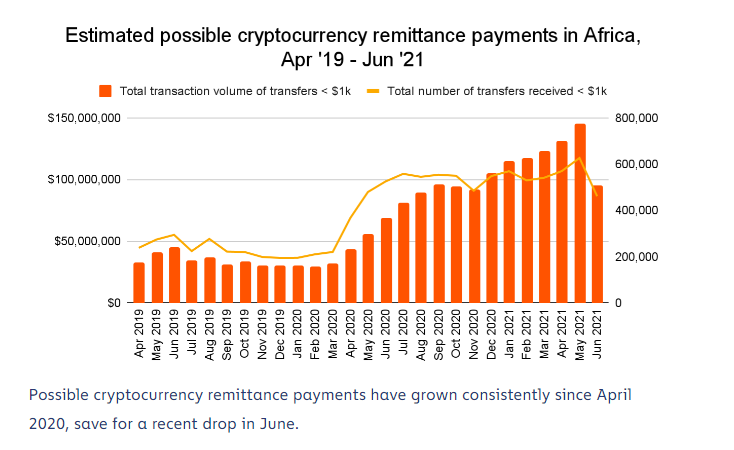

While cryptocurrencies are not intended to be the answer to this issue, they have been used by many migrants to send money home to relatives. Chainalysis has released the 2021 Geography of Cryptocurrency report. It shows that increasing numbers of African migrants are now using peer-to–peer exchange platforms for sending money back to home.

To illustrate, the intelligence firm’s data suggests that between July 2020 and June 2021, a total of $105.6 billion worth of cryptocurrency was sent to recipients on the African continent. Nearly 96% of these totals were cross-regional transfers.

Another metric in the report is the number of incoming transfer that exceed $1,000. This supports the claim that African migrants use digital currencies to send money. Chainalysis claims that such transfers reached a peak of over 200,000 in May 2020, and it has been increasing steadily since. In actuality, just 800,000 transfers were left below $1,000 in May 2021.

Not only are cryptocurrencies faster than traditional channels, but they can also be sent funds much more cheaply. It may be expensive to transfer $100 from South Africa into Zimbabwe using the regular corridors. However, sending $200 through BCH costs $0.01 or less than one percent. Even less than one penny is required to send the same amount via the Stellar network. There are many other examples that show cryptocurrency can offer a more cost-effective alternative to traditional remittances channels.

Functional Innovation must be allowed to continue without restriction by the regulators

Therefore, while critics — particularly those based in advanced economies — are eager to highlight the flaws in cryptocurrencies, migrants from not only from Africa but across the globe are proving that cryptos are better than traditional channels. The SDG 10.3 target of having remittance fees lower than 3 percent by 2030 could be achieved if cryptocurrencies suddenly became the most widely-used means to transfer funds between different jurisdictions.

Therefore, it stands to reason regulators need to be guided by facts rather than emotion when dealing with crypto currencies. In a policy brief, the United Nations Conference on Trade and Development recommended that regulation of cryptocurrency use should not focus on limiting their usage.

Regulators should encourage or promote the use of cryptocurrency where it is being used. Not ostracized, but protected innovation should be emancipating the poor and trying to even the playing field.

Register here for a weekly email update with African news.

Your thoughts? Comment below and let us know how you feel.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.