Decentralized finance, or DeFi, has revolutionized business and unlocked new value across every industry sector. However, significant problems have emerged with blockchain technology, hindering the unlocking of the full potential of Web 3. Vitalik Buterin, the Ethereum blockchain co-founder, has postulated a so-called “blockchain trilemma,” meaning a blockchain is unable to deliver decentralization, scalability, and security at the same time, so developers have to make trade-offs between them.

The DeFi boom is exposing Ethereum’s scalability issues and ability to cope with increased usage leading to network congestion and higher gas fees for processing transactions on the Network. Ethereum’s response to these issues is the long-awaited Ethereum 2.0 (since 2014), which would make Ethereum simultaneously more scalable, secure, and sustainable while still remaining decentralized.

Meanwhile, Solana is another highly functional open-source web-scale blockchain with a permissionless nature offering an ambitious design that aims to solve the blockchain trilemma. Matt Hougan, chief investment officer at Bitwise Asset Management, calls Solana a “leading Ethereum competitor.”

So how do Solana and Ethereum differ? This review will present a Solana and Ethereum detailed comparison and dive deep into the key features, ecosystems, advantages, and drawbacks of the Ethereum Network and Solana.

Let’s get started!

Ethereum Pros

- The world’s most prominent DApp and DeFi ecosystem

- It allows the creation and deployment smart contracts

- Zero downtime

- Security, efficient, and decentralized

Ethereum Cons

- High processing power is required

- Transaction speeds slow

- High gas fees.

Solana Pros

- Transaction fees are low

- Processing 50,000 transactions per minute (TPS), no congestion

- Scalable protocol.

Solana Cons

- Mangel of decentralization

- There are occasional halts in protocol.

Solana or Ethereum: The Initial Facts

Both Solana and Ethereum both offer smart contracts which are essential in operating DApps or NFTs, but at different speeds. It’s essential to understand what unites Ethereum and Solana, as well as the unique features of each blockchain, before investing.

Ethereum Network

An eclectic group of developers including Vitalik Buterin (Polkadot founder), Gavin Wood (Case Head of Cardano) created Ethereum Network as the first rival to Bitcoin in 2013.

Ethereum was the first smart contract-programmable blockchain and it changed the course of the entire blockchain industry.

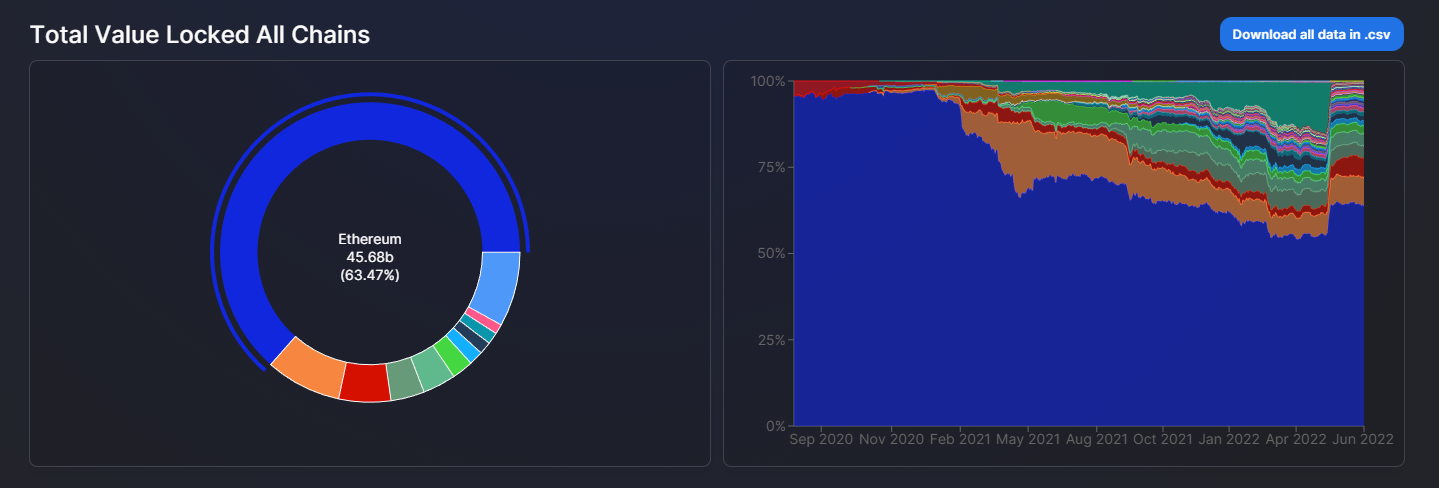

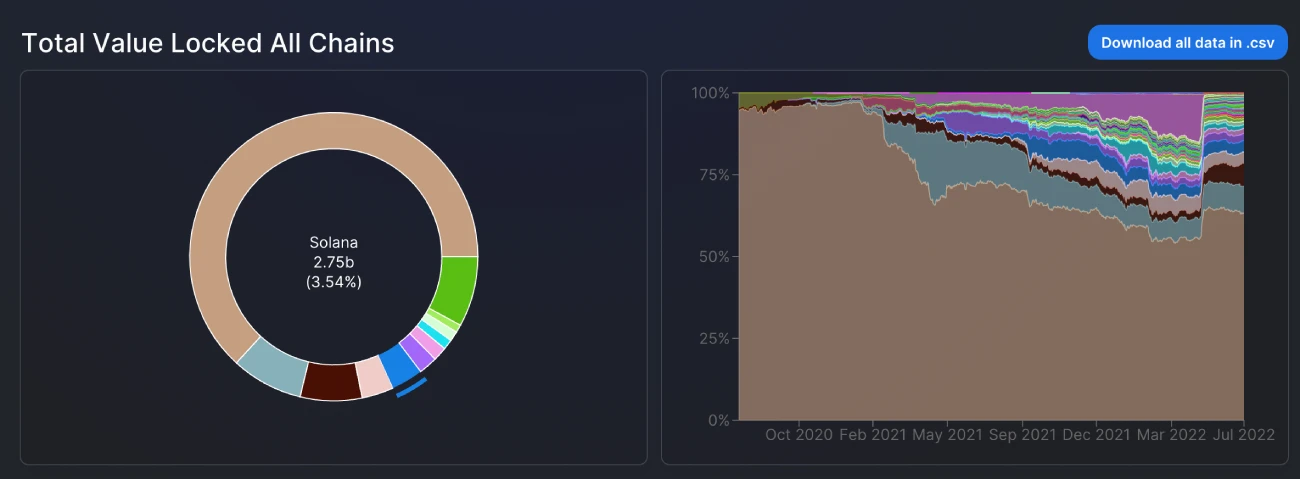

Ethereum’s token Ether (ETH) is currently the second-largest crypto in the market according to DeFi Llama. The market leader in DeFi is Ethereum (a blockchain offering a transparent, advanced DApps ecosystem) with $49.1 billion. Solana ranks fifth at $2.75 billion.

As decentralized apps (DApps), non-fungible tokens and NFTs become more popular, layer one protocols are facing fierce competition.

Ethereum is the blockchain that first offers smart contracts functionality. Additionally, it’s the largest blockchain used for Layer 2 project development. But its Proof of Work mining system and high gas prices have hindered transaction speed and scaleability in its DeFi ecosystem.

In 2021, several smart contract-enabled Layer 1 blockchains were created to address these issues by promising higher transaction speeds at lower costs — something Ethereum lacks and aims to achieve using its Ethereum 2.0 upgrade. Solana, an open-source project with high functionality, implements a layer-1, permissionless blockchain designed to achieve high throughput while maintaining low costs.

Solana Network

Solana was founded by Anatoly Yakovlenko in 2017. Solana’s hybrid consensus model is an attempt at solving the blockchain dilemma. The unique Proof-of-History(PoH) algorithm is combined with an extremely fast synchronization engine and version of Proof-of-Stake to process 710,000 transactions every second (TPS).

Solana facilitates DApp creation and smart contracts. It also supports many DeFi platforms.

Solana’s native toke SOL provides a means of transferring value and blockchain security through staking. SOL, which was first launched in March 2020, is now one of 10 top cryptocurrencies by market capitalization in crypto.

Let’s address the core differences between Solana and Ethereum below.

What is the main difference between Solana and Ethereum? It lies in consensus mechanism. All blockchain nodes must use this procedure to come up with agreements about the Network’s current status.

Ethereum’s Proof-of-Work Consensus Mechanism

Ethereum uses PoW as its consensus mechanism. It draws power from multiple participants worldwide who actively participate in the consensus. PoW consensus is a high-powered computing requirement, which restricts the participation of users. Although it is a security measure and allows for complete decentralization, the performance of PoW consensus can be impacted.

By the end of September 2022, the entire Network will transit to an alternative consensus mechanism – Proof-of-Stake (PoS). Ethereum will replace PoW (the environmentally inconvenient consensus mechanism) with the more sustainable PoS. PoS significantly reduces the energy consumed by eliminating mining. PoS uses a network or validators to validate each transaction.

Solana’s Proof-of-History Consensus Mechanism

Solana Network employs a hybrid consensus system that combines the best of Proof of-Stake with Proof-of History. Hybrid consensus allows for greater flexibility in arranging transactions, enabling approximately 50,000 transactions per minute.

PoH allows transaction verification using time stamps. PoH compute sequence makes a history record, proving an event took place at a given moment. This system uses a method for timestamping transactions in order to assess and ultimately produce an unique output that is publicly verifyable. As a result, validators all have a “uniform view of the order” in which new transactions appear on the blockchain. Network participants analyze the validity of transactions and must agree on a single history of events – this is why the system is called the Proof-of-History (PoH) consensus.

Solana is a groundbreaking project in blockchain technology because of its innovative blend of PoS/PoH.

The blockchain architecture is another important criterion in the Solana vs. Ethereum compartion.

The Ethereum Network is a true model of stateful architecture, as it records all transactions in its current state. Each time a transaction occurs, all the transactions must be updated by the Network. The constant updating takes energy and time, which is partly why Ethereum has been experiencing congestion.

Solana’s stateless architecture means that transactions are not required to be updated with the state of Solana. Solana’s architecture relies heavily on the Solana cluster, a collection of validators working together to address client transactions alongside ledger maintenance. Each cluster is led by a leader. The role of the leader continues to rotate among the validators. Cluster leaders are responsible for timestamping and bundling incoming transactions with PoH consensus. The stateless architecture allows for fast, low-cost transactions.

Solana also employs the Tower Byzantine fault tolerance (BFT), algorithmAn improvised form of pBFT, which eliminates the need to have nodes communicate in real-time. It improves efficiency overall.

The entire DeFi market was started by smart contracts. Smart contracts, also known as transaction protocols or computer programs that execute or document legal events (such as money transactions) in accordance with the contract’s terms, are shorthand for smart computers.

Ethereum Network, which introduced smart contracts functionality to the blockchain technology first, was followed by the other Layer 1 platforms including Solana.

The Solana network, however, offers a smart contract functionality that differs from other projects, in which smart contracts may interfere with one another since they can’t operate in parallel.

Sealevel is a platform that allows smart contract to be run side-by-side without any interruptions. Solana enjoys a huge advantage in terms performance within the Network.

Scalability

Solana’s core distinction from Ethereum is its scalability. Scalability refers to the ability of a system’s capacity to manage a growing volume of work through efficiency adjustments or additions.

Scalability is the main concern for Ethereum. Despite paying high gas fees, DApps are multiplying on the Blockchain, which requires more validation as well as a faster transaction speed.

Ethereum transactions are slow at 15 transactions per seconds. Therefore, the scaling problem cannot be fixed without Layer 2 scaling solutions. Layer 2, which include support for multichain networks and state channels as well as sidechains such Validium (Optimistic) and Rollups. Ethereum can also support multi-chain networks like Polygon that enhance its security and scalability.

Solana, on the other hand, addresses scaling issues with a high performance protocol. It offers innovative time architectures, faster transaction processing speeds and a efficient consensus model. This means that Solana doesn’t require Layer 2 solutions to enhance scalability. Solana’s Turbine block propagation protocol allows for easy data transfer across the Network.

Ecosystem

In terms of size, the Solana and Ethereum ecosystems are unrivalled.

Ethereum offers a variety of decentralized apps, including NFT marketplaces and stablecoins.

Tether stablecoin is one of the most well-known protocols on Ethereum. SushiSwap decentralized trading platform, Opensea NFT market, and SushiSwap are other examples. Ethereum also supports many tokens.

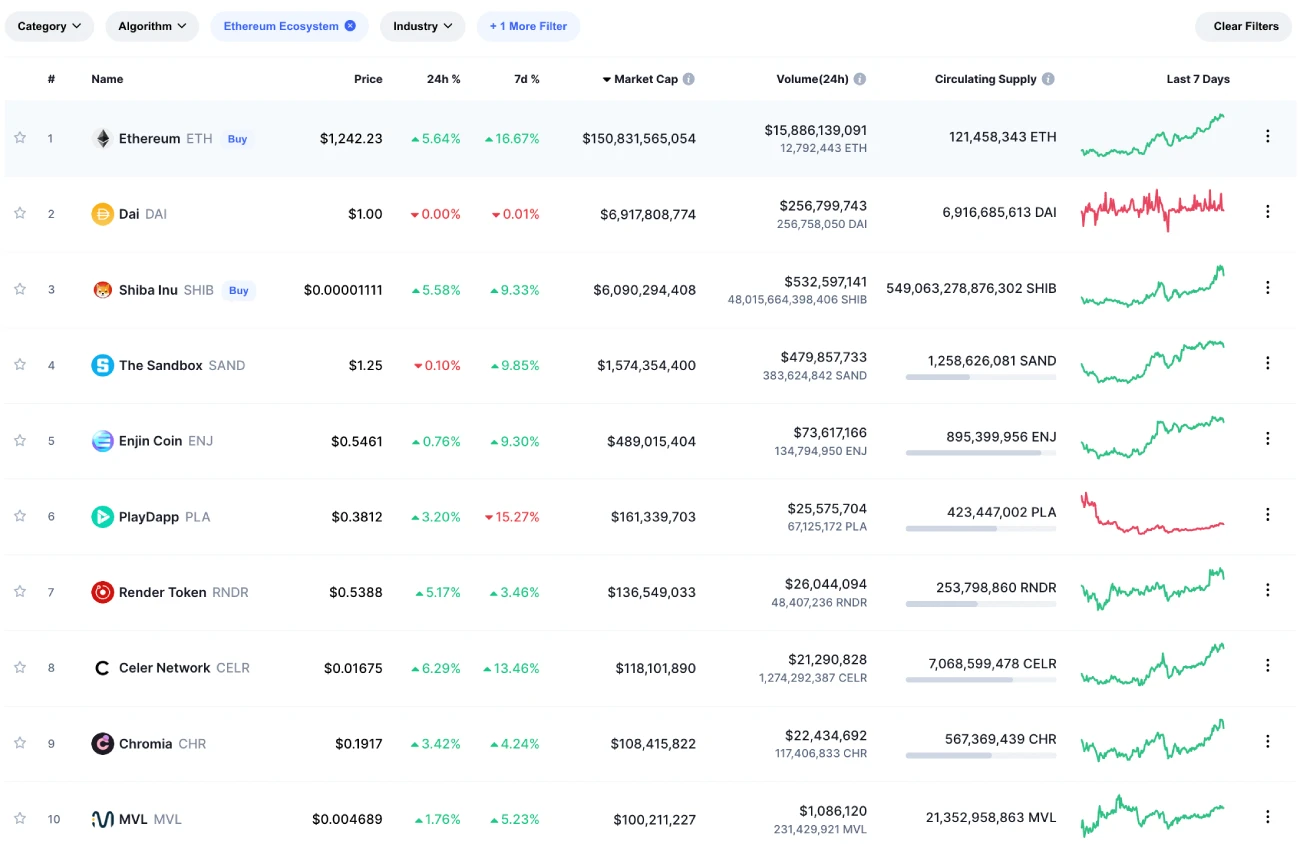

Here’s a list of the top 10 tokens by market cap running on the Ethereum Network.

This list contains several top tokens such as USD Coin stablecoin and Shiba Inu me coin.

Although Solana may be a new platform, it features many tokens and decentralized exchanges. It also has lending/borrowing protocols. NFT marketplaces, as well as a significant amount of tokens.

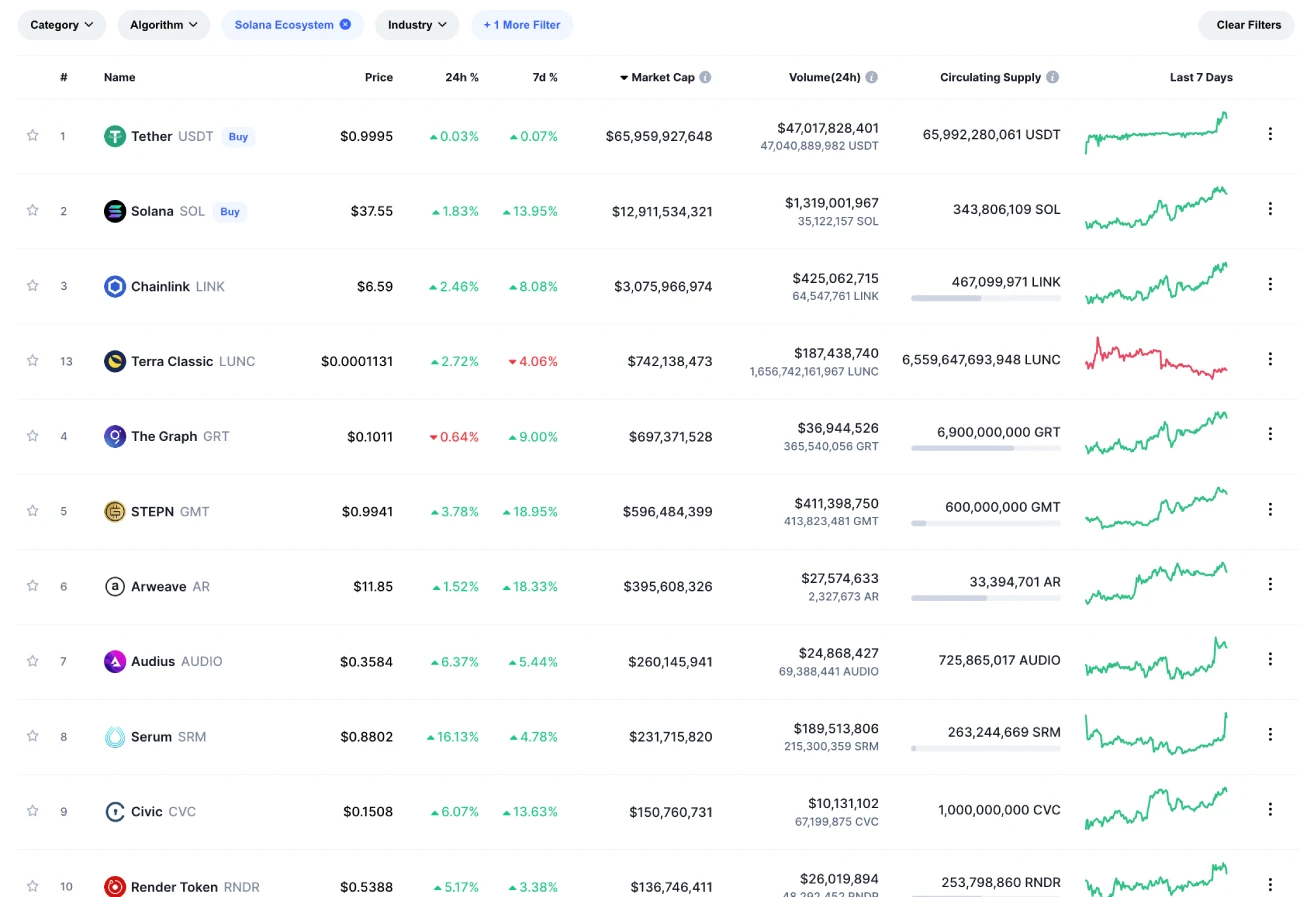

Below is a complete list of all the Top 10 Tokens that are currently running on Solana.

The list includes the leading cryptocurrency Chainlink (LINK) and the move-to-earn platform STEPN’s token GMT.

NFT Trading

The DeFi industry has become a vital part of NFTs, or non-fungible tokens.

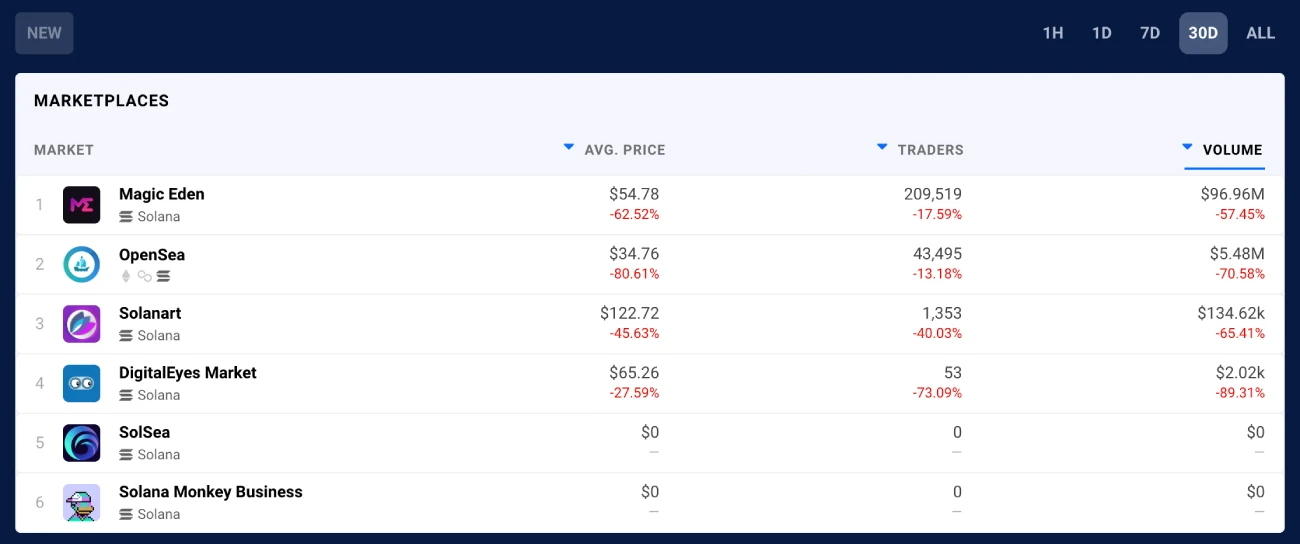

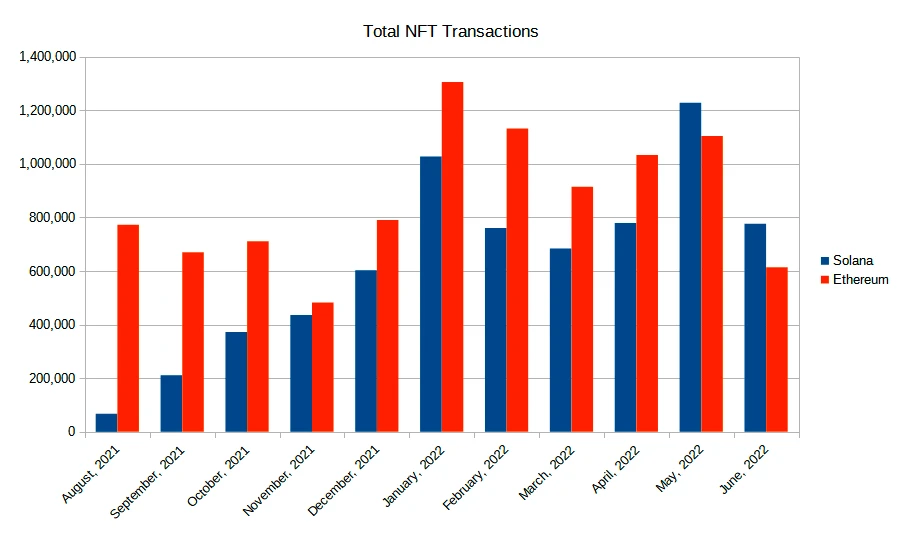

Opensea is the largest NFT trading platform. It started out on Ethereum, but recently, it announced that they have partnered with Solana. As a result, Solana’s NFT trade boomed, competing in volumes with Ethereum.

Additionally, Solana’s native marketplace Magic Eden significantly contributed to the success. DappRadar reports that Magic Eden’s growth has been remarkable since April.

As a result, Solana’s monthly NFT transactions have surpassed Ethereum’s over the last few months.

Why is Ethereum Network so unique?

Ethereum is the platform that underpins the whole DeFi market, which includes the growing NFT market. Ethereum Networks has the biggest crypto marketplace platform, and it’s no surprise why.

Ethereum has nearly 3,000 DApps (decentralized applications) hosted on its blockchain as of June 20, 2022. There are more added each month. Ethereum’s popularity could be explained by its top-notch security, reliability, and reputation. The Ethereum Network has its drawbacks, however.

Ethereum is always looking for ways to improve transaction speed and scalability. To help solve this problem, Ethereum has created several Layer 2 protocols.

Solana’s Uniqueness

Solana has been positioned as the solution for all Ethereum problems such as low transaction speed, high fees and scaling, as well as high gas prices.

Solana can reach a speed of over 50,000 TPS, and Solana’s unique consensus algorithm makes it one of the fastest blockchains in the industry. Another advantage is Solana’s extreme cost-effectiveness, as the project implements new tokenomics for lower fees. Solana’s blockchain is also more eco-friendly and sustainable than Ethereum.

The Solana ecosystem, however, is not as secure and efficient as Ethereum when it comes to DApp security or decentralization.

Solana, in summary, is a great choice for developers and users fed up by the slow development speed and high gas costs of Ethereum.

Solana against Ethereum: The Final Verdict

Both platforms have been extensively discussed in relation to transaction speed, gas charges, scaleability, ecosystem, consensus mechanism, and other factors. Let’s sum the results up:

- Ethereum is a more stable and reliable ecosystem than Solana, which is much smaller.

- Solana has the potential to scale and is one of the most efficient and fast-growing ecosystems. The Ethereum Network, however, is congested.

- Solana utilizes an innovative Proof-of-History technology powered by unique algorithms. Ethereum relies on the PoW consensus mechanisms for verifying transactions.

- Solana allows for low-cost transactions while Ethereum charges notoriously high fees.

- Solana only uses about a third of the electricity resources required to power the Ethereum virtual machines. Ethereum is yet to move to the newer Ethereum 2.0.

- Although Ethereum was hacked in the past, it is now considered safer than Solana.

- Ethereum 2.0 has been promised since years. It is now scheduled for September 2022. However, Solana developers work much more quickly.

- Solana boasts a higher level of decentralization for Ethereum. Although both networks experienced some unpleasant events in the past they are now leading the way for decentralization.

Conclusion

If you’re still wondering which of the two projects is a better investment and whether you should invest, the answer is still up to you. This research will allow you to make informed decisions about your investment.

Solana or Ethereum will be based on your priorities and needs. Ethereum is safer and more reliable, but it’s also more costly, more energy-intensive, and slower. Solana is much faster, cheaper, and more sustainable than Ethereum, however it’s smaller and less centralized. This guide does not offer financial advice. Prioritize carefully. Every trader needs to do their research before they invest in the volatile cryptocurrency market.

Most Frequently Asked Questions

Although they share many similarities, Solana and Ethereum have different characteristics. They differ on transaction speeds, fees, decentralization, consensus mechanisms, as well as other aspects such transaction fees.

Ethereum is a much more established DeFi platform that has been developed by large numbers of developers. Solana on the other side is much more recent and offers faster, cheaper, and without any congestion issues, transactions. It all depends on what you need and expect.

As of June 2022, Solana can process over 50,000 transactions per second (TPS), while Ethereum’s TPS stands at approximately 13. Ethereum is moving to Ethereum 2.0. It will eventually process more than 100,000 transactions per hour once it is upgraded.

Ethereum takes up over 60% of the DeFi market, while Solana’s share is merely 3.6%. Due to the high speed of transactions, Solana’s project is still under development.