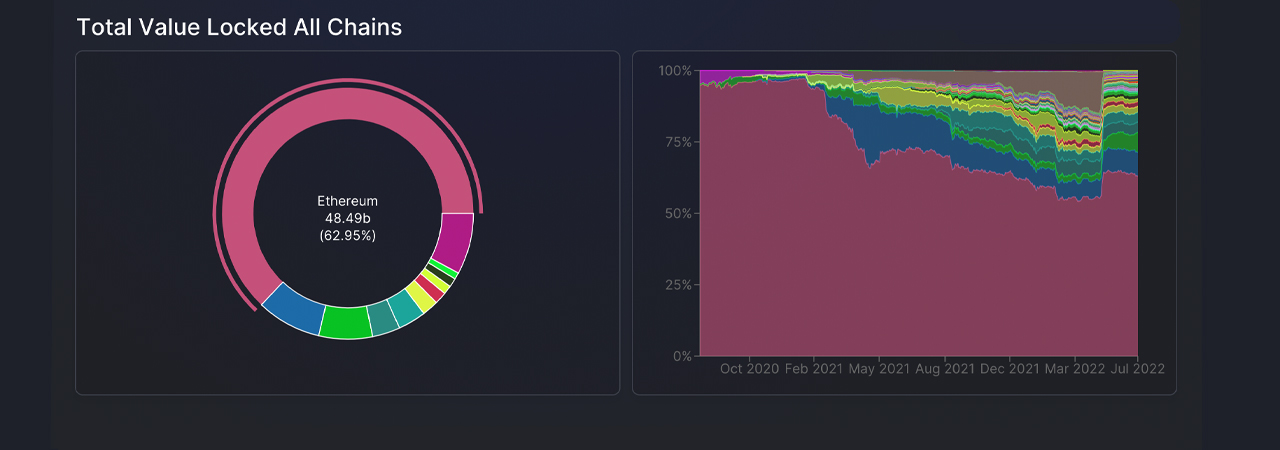

On June 19, Ethereum reached a $70 Billion low in 2022, which has seen the total value of decentralized finance (defi), increase by $7 billion. During the last seven days, the TVL in defi held within the Ethereum blockchain has increased by 4.47% as Ethereum’s TVL commands 62.92% dominance or $48.17 billion of today’s $77.11 billion. Meanwhile, Tron’s TVL skyrocketed this week, jumping 34.85% during the past seven days.

This Past Week Tron’s TVL Jumped by Double-Digits, Smart Contract Tokens Rise, Dex Applications Command Today’s Top Defi TVL Positions

Six of the top ten blockchains saw their TVL stats rise by double-digits during the week. BSC increased 7.02% and Ethereum rose 4.47%. Tron spiked at 34.85%. Avalanche had a 2.81% rise, Solana rose 8.10%, Cronos rose by 2.33%.

On Thursday, July 7, 2022, there’s approximately $77.11 billion locked in defi and that metric increased by 1.40% during the last 24 hours. The largest defi protocol TVL is Makerdao’s $7.54 billion or a dominance rating of around 9.78%.

Makerdao’s TVL dominance is followed by protocols such as Aave, WBTC, Curve, Uniswap, Lido, Convex Finance, Pancakeswap, Justlend, and Compound respectively. Makerdao saw a 1.56% increase this past week but the largest gainer in the top ten was Tron’s Justlend with a 90.15% spike last week.

Tron’s Justlend has $2.79 billion locked and at the time of writing, USDD supply deposits get 12.83% annual percentage yield (APY) and the borrow APY is 21.76%.

In terms of losses, the blockchain Fantom saw 6.7% leave the chain’s TVL and Arbitrum was the biggest loser out of the top ten list as Arbitrum’s TVL decreased by 11.01% this week.

Out of today’s $77.11 billion, 481 decentralized exchange (dex) applications command $24.67 billion total value locked, 155 defi lenders capture $17.55 billion, and 22 defi bridge applications currently have $11.31 billion locked.

In addition to the rise in defi’s TVL across various blockchains, the top smart contract platform tokens have jumped 5.6% higher in the last 24 hours to $272 billion. This week, ethereum (ETH), BNB jumped 10%, Cardano(ADA) was up 1.6% and solana [SOL] is up 13.3%. Polkadot was up 2%.

This week’s biggest gainers in smart contract tokens were counterparty (XCP), which rose 25.3% and komodo (+25%) by 25% respectively. Ubiq (UBQ) climbed 19.3% over the past seven days.

Cross-chain bridge TVLs combined lost 60.4% during the last 30 days and Polygon’s bridge is the largest with $3.55 billion TVL. Polygon’s bridge TVL is followed by Arbitrum, Avalanche, Optimism, and Near Rainbow.

USDC, WETH/ETH, USDT or ETH and DAI are the top digital assets that cross-chain bridge technology has enabled.

Protocols such as Piggbank DAO and Metavault DAO have caused the largest TVL losses in decentralized financing this week. Hermes Defi and Maple recorded the largest TVL protocol increase in defi over the last seven days.

Let us know your thoughts on the current state of defi and TVL growth by $7Billion. Comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.