Bitcoin is moving in a sideways direction from its current level, with little guidance for lower times. The worst selling pressure for Bitcoin in many years has passed, but the cryptocurrency is still at its 2017 high.

Crypto Trading Volumes In India Sink Due To Heavy Taxation, What’s Ahead?| Crypto Trading Volumes In India Sink Due To Heavy Taxation, What’s Ahead?

Bitcoin is trading at $20.140, with a profit of 4% in the last 24 hour. NewsBTC yesterday reported that market sentiment has turned more positive since the Crypto Fear and Greed Index rose from Extreme Fear.

Mike McGlone Senior Commodity Strategy, Bitcoin and crypto market is near 2018 drawdown level. At that time, the nascent asset class experienced a similar bearish trend which pushed BTC’s price to a 75% loss from its ATH.

The $3,000 price mark became a significant bottom and saw an accumulation period that lasted for many years. BTC reached a new low in 2020. It was close to $3,000.

Following that event, cryptocurrency saw a rise into the price discovery market. The macro-economic environment is different this time, so Bitcoin might retest the $17,000 yearly lowest point, however McGlone says it may have reached a level that long-term owners could reap dividends in 2022’s second-half.

(…) the Bloomberg Galaxy Crypto Index nearing a similar drawdown as the 2018 bottom and Bitcoin’s discount to its 50- and 100-week moving averages similar to past foundations, we see risk vs. reward tilting toward responsive investors in 2H.

Since its inception, BTC’s price has historically found a bottom around previous all-time highs. McGlone claims there are conditions for $20,000 to operate as this pivot support level in 2022 on the back of a decline in “risk measures” against the traditional market.

The $20,000 price of Bitcoin may seem like $200 in 2015, $2000 in 2016, and $3000 in 2018. Bitcoin and Ether risks are declining vs. equities. The potential for US regulation (Lummis Gillibrand cryptocurrency plan) is a sign of mainstream maturity.

Bitcoin’s Short Term Outlook shows Improvement

Bitcoin’s ability to maintain above $20,000 over shorter time frames has been remarkable despite declining traditional markets and strong U.S. dollars. As investors de-risk in current macroeconomic conditions, the U.S. dollar is nearing a 20 year-old record.

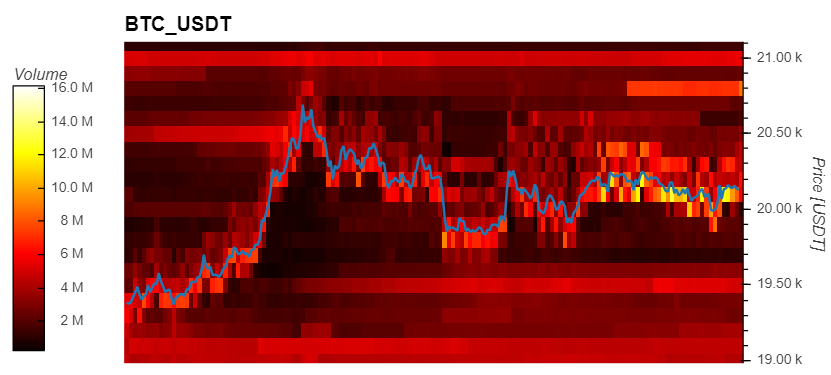

Data from Material Indicators (MI) records around $20 million in bid orders for BTC’s price from $20,000 to $19,000. In case there is further decline, these levels can be used as support as BTC Whales keep accumulating.

Similar Reading| Bitcoin faces another rejection, can bulls save the day?

Larger BTC investors have been buying into the cryptocurrency’s price action over the past week. Over the past week, addresses with 100-100,000. BTC gained 30,000 BTC.

Addresses with 100-to-10000 addresses were found in the last week $BTCAbout 30,000 more #BTCto their holdings, while 40,000 #Bitcoinwere removed from the known #cryptocurrencyExchange wallets pic.twitter.com/vRC7cJYvbZ

— Ali Martinez (@ali_charts) July 4, 2022