Following the prolonged weekend in the United States, the momentum of the cryptocurrency market is now waning. Bitcoin and other larger cryptocurrencies have been recording losses during today’s trading session and could continue to trend downside in the short term.

Similar Reading| TA: Ethereum Regains Strength, Showing Early Signs of Fresh Rally

The crypto market capitalization stands at $860billion as of the writing. There has been sideways movement in the last few weeks. As you can see in the graph below, this metric had been trending towards the negative since the late 2021. But it experienced a sharp decline in April-May 20, 2022.

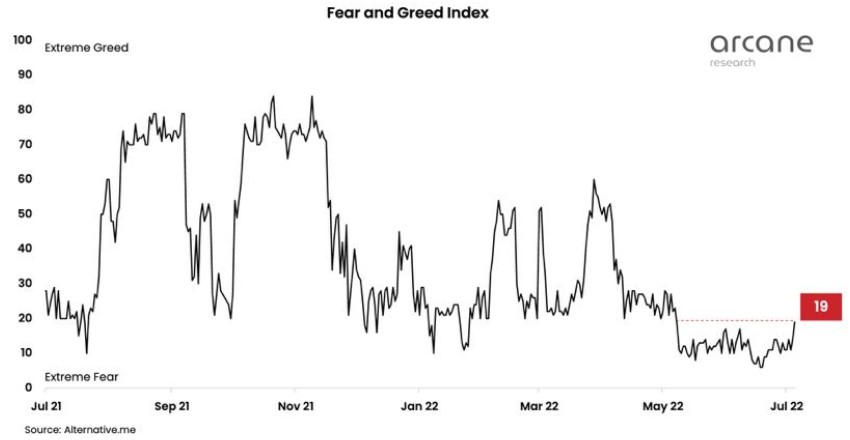

The general sentiment in the crypto market tended to be negative and the Fear and Greed Index recorded high levels of fear. When the Index is close to 10, 80 or 10 respectively, Bitcoin prices and larger cryptocurrency often find a bottom.

The crypto market did find a bottom in June when BTC’s price traded close to $17,000 and pushed the Fear and Greed Index to extreme levels. The market has seen a slight upward trend since then, with the top cryptocurrency trading at $17,000 and the new range of $18,600 to $21,000.

This area is the main resistance, along with $22,000. A recent Arcane Research report found that market participants feel more optimistic about breaking above these levels. According to the first, the market sentiment has changed over the last weeks.

The sentiment in the crypto market has been depressed for several months, but we’re seeing a slight improvement this week. After the Fear and Greed Index climbed to 19 yesterday, we’re at the highest point in two months. While we’re still comfortable in the “Extreme Fear” area, we’re now pushing towards the “Fear” area, and the market is slightly more optimistic (…).

Are you ready for more crypto downside?

BTC, ETH and other larger cryptocurrencies are tied to the crypto market total and performance. NewsBTC reports that the current sector’s impact is due to macroeconomic factors, rising inflation and interest rate hikes by U.S. Federal Reserve.

These factors’ influence over the market must mitigate before the nascent asset class can decouple from traditional finances. Any bullish momentum that exists in the meantime will continue to be vulnerable.

| Cardano releases a new update on Testnet. How will the price respond?

The Fear and Greed Index could be affected if Bitcoin’s price does not rise above $22,000 within a short time. According to Material Indicators’ Trend Precognition Indicators, it will likely see a retest at lower levels. Twitter: The analysts wrote:

The 21 Day Moving Average rejected BTCUSDT as well as ETHUSDT. We now see the Trend Precognition Trend Line A1 Slope Line moving over the D chart, indicating that there has been a loss of momentum.