Between June 13 and June 27, or roughly two weeks, Tron’s stablecoin USDD dropped lower than the $1 parity and slipped to a low of $0.928 per unit on June 19. USDD gained $0.98 to $0.99 in the seven-day period and reached $1 on July 3rd.

Tron’s USDD Stablecoin Climbs Back Above $0.98 per Unit

USDD stablecoin, which was issued by Tron, lost value below its $1 perity. Prior to that day, the stablecoin’s chart looked similar to an electrocardiogram flatline holding a stable value of around $0.994 to $1.

Between June 13th to the 15th, however, USDD’s fiat value slipped to a low of $0.964 per unit. Tron Reserve DAO secured the stablecoin by securing it with crypto assets like tron (TRX)And usd coin (USDC). The value of bitcoin (BTC), as well as a variety other popular crypto assets fell significantly during this time.

The crypto economy was shaken on June 18th, and at 2:05 p.m. ET BTC reached a 2022 lowest of $17.593 per unit. The following day, Tron’s USDD hit the stablecoin’s all-time low at $0.928 per unit.

Eight days later, on June 27, USDD managed to get back to the $0.98 to $0.99 range, and it’s been trading for that price ever since, with one brief spike to $1 per unit on July 3. The stablecoin experienced a 2-week drop in its rate. However, Tron Reserve DAO added more collateral to the project.

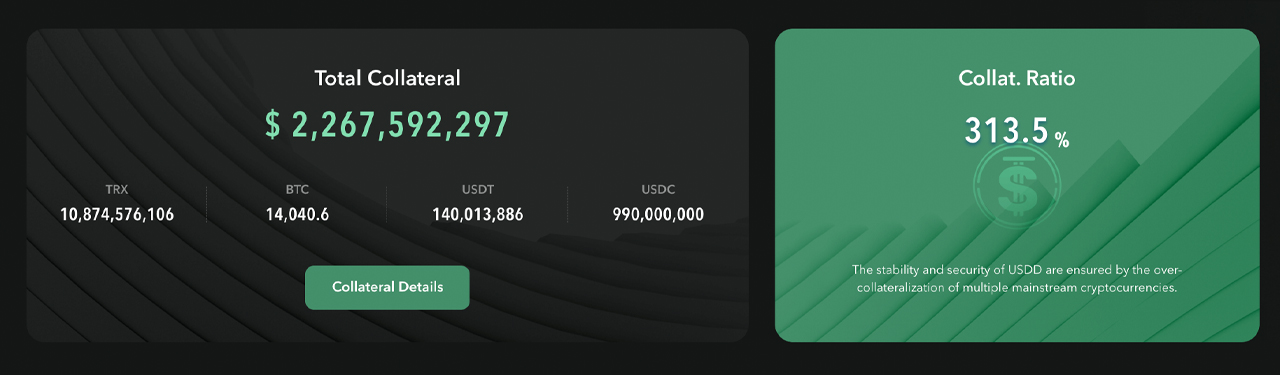

At the time of writing, the project’s reserve page notes that there’s 723.32 million USDD in circulation. With four crypto assets supporting the project, the web page reveals that USDD has been overcollateralized at 313.5% as of the writing.

The assets include 10.874 trillion tron, 14.040.6 bitcoin and 140 million tether. There are also 990 million US dollars. Two weeks ago, USDD experienced a drop in price. This was due to the downturn in crypto markets. A few other stablecoins saw their prices fall as well.

The Market Cap Remains Stable for the Top 9 Stablecoins

Bitcoin.com News reported on Abracadabra’s stablecoin MIM slipping to $0.91 and the Waves stablecoin neutrino usd (USDN) sliding to $0.931 per unit. USDD’s price has remained stable over the past week. USDN trades for $0.987 and MIM swaps for $0.993.

Tron Reserve DAO continued to function. bolster the stablecoin’s backing with reserves and it’s been purchasing backUSDD may also be used to purchase assets. Stablecoins can be used with assets. seen instancesWhere the currency’s value is lower than the $1 expected parity. Stablecoins such as nubits and empty set dollars, titan and basis cash all have failed, which has prompted concern about possible future failures.

This concern was directed towards some of industry’s largest stablecoins as well as smaller stablecoin capitalizations, which have less liquidity. According to market valuation, nine of the most stablecoins have traded stable for $0.98 to $1 each token.

How do you feel about USDD rising back to the $0.98- $0.99 area? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.