Bitcoin is moving between $18,600 and $21,000, suggesting that it may be creating a new range. BTC’s price has seen some recovery during today’s trading session and might experience some volatility due to the U.S. Independence Day is July 4Th.

Solana (SOL) Stuck Below $33 In Past Days As Bearish Pressure Still Intact| Solana (SOL) Stuck Below $33 In Past Days As Bearish Pressure Still Intact

Bitcoin is trading at $19500 as of the writing time, with a profit of 4% in the 24 hours since the beginning.

Ali Martinez, an analyst has provided data that shows a rise in Bitcoin holdings at addresses with between 100 and 10,000 BTC. The whales are adding more than 30,000 BTC each day to their bitcoin holdings.

Martinez also records more than 40,000 BTC being sent to crypto exchanges. This is because the supply of Bitcoin on these exchanges will be smaller, which means that it is more difficult to sell on the market.

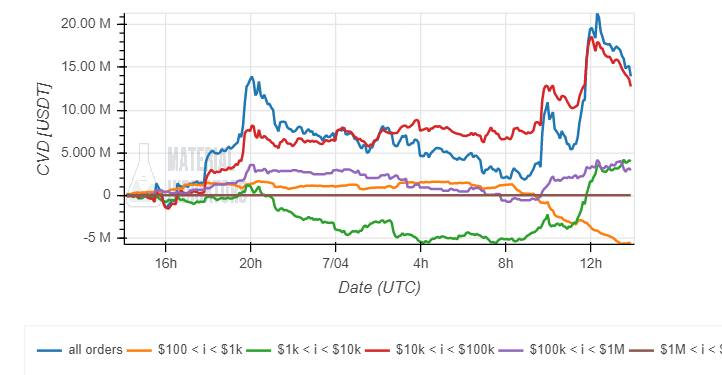

These market dynamics translated into this weekend’s price action. In addition, Material Indicators recordsAn increase in purchasing pressure by investors who offer a high bid (purple on the chart below), which coincides closely with short-term whale accumulation.

These whales have been the “most influential” over the BTC’s price action and could be hinting at more gains. Material Indicators also recorded bullish momentum on the weekend’s price action.

In fact, every investor class except retail and massive whales with over $1 million in bid orders seems to be buying into BTC’s price action, as seen in the chart below.

Other data providedSantiment has recorded a large increase in the number long positions across all exchange platforms. This coincides with the U.S. holiday, but it’s not necessarily good news for these operators:

Early hours of 4,ThThe US has experienced a significant increase in #longs during the hour prior to July 2022. Trade optimism is often associated with holidays. This means that there should be more caution about whales punishing those who are too eager.

What is causing pain on the Bitcoin Market?

Although there may be some signs of bullish price action, caution should be taken with the increase in long positions. Bitcoin and other cryptocurrency could be in for more trouble if the macroeconomic outlook is less positive.

Trading desk QCP Capital claims its bullish outlook is “waning” on the back of the U.S. Federal Reserve’s (Fed) intentions of slowing down inflation in the country. This financial institution is increasing interest rates to achieve this purpose, causing havoc on global markets.

Initially, some experts believed the Fed was going to attempt to conduct a “soft landing”, and bring down inflation without harming the economy. As the Fed has found itself in a difficult spot, this possibility could have been dismissed. QCP said:

Fed Governor Williams stated the “need to get real rates above zero”. The Fed will likely ignore any recession risk and continue raising rates aggressively in order to achieve their goal of 3.5%-4.4% per year.

Similar Reading| T: Bitcoin is still in downtrend. What could spark a sharp upturn?

In addition to all of this, financial institutions are reducing liquidity on global markets and shrinking their balance sheets. The crypto market is only getting worse.

8/ Balance sheet expansion was the driving force behind the crypto bull market. Price movements will be affected if there is a contraction on this scale.

— QCP Capital (@QCPCapital) July 4, 2022