The gas fee: What is the gas fee? In blockchain, it’s a cost that each user must pay to the network to complete a transaction. To complete a transaction, for example, a user can transfer Ethereum to another person. However, the miners have to package the transaction and place it on the Blockchain. This takes up computing resources and is known as the gas fee.

Gas economy

Imagine that each public chain is a society or a city, and gas would be the currency that users need for various activities in the city, and the economic designs of gas have far-reaching impacts on the public chain’s future development. We will show you today the importance of gas economics from both performance and value-capture perspectives.

Performance

– The frequent network congestion of Solana

In early May, Solana’s mainnet lost consensus, and block generation was suspended for 7 hours. NFT minting a new NFT-related project caused the network to go down. To increase the success rate in minting, users turned to bots to send transactions. The Solana mainnet was jammed by 6 million transactions every second. Also, because Solana transmits consensus message as a transaction message between validators and is therefore a special transmission, it caused the network to become jammed. The result was that the normal transmissions of consensus messages became impossible due to congestion.

Solana has not experienced this type of downtime before. In September last year, the public network was hit with a 17-hour-long downtime. This was due to massive trading volumes generated by bots on the blockchain during Raydium’s launch. The Solana downtime of 30 hours occurred at the beginning of January 2022, when the BTC market price plummeted from $44,000 to $33,000. This created many arbitrage opportunities. Meanwhile, the liquidation/arbitrage bots on Solana, which center on DeFi, kept creating massive transactions, which resulted in network downtime. If we compare Solana to an IT system of the same type, it is clear that there was a DDoS attack.

「A DDoS (distributed denial-of-service) attack refers to adding traffic from multiple sources to exceed the processing capacity of a network so that real users would not be able to acquire the resources or services they need. Attackers often launch a DDoS attack by sending more traffic to a network than it can handle or sending more requests to an application than it can manage.」

Instinctively, many people would think that Solana’s downtime is rooted in its public chain designs: the monolithic design of Solana inevitably leads to downtime.

The mainstream public chain uses two types of design at the moment: monolithic and modular. A modular architecture describes a distributed deployment that has consensus storage, execution, and consensus. The security of consensus layers is not compromised by the modular architecture. At the same time, mainstream designs adopted by Avalanche’s Subnet, ETH 2.0, and Celestia’s Rollup can all diverge massive transactions. On the contrary, Solana, as a system, is intended to facilitate fast transactions. However, security and scalability have been sacrificed.

The modular structure of a public blockchain isn’t the best because, although consensus was secure, each rollup can still experience downtime if it has to deal with large transactions over a short time. This means that the modular design has reduced the systemic risks for the public network (e.g. a rollup might halt while the rest of the chain can endure) The gas design is the real reason behind Solana’s downtime, and more network downtime is on the way if the design is not improved.

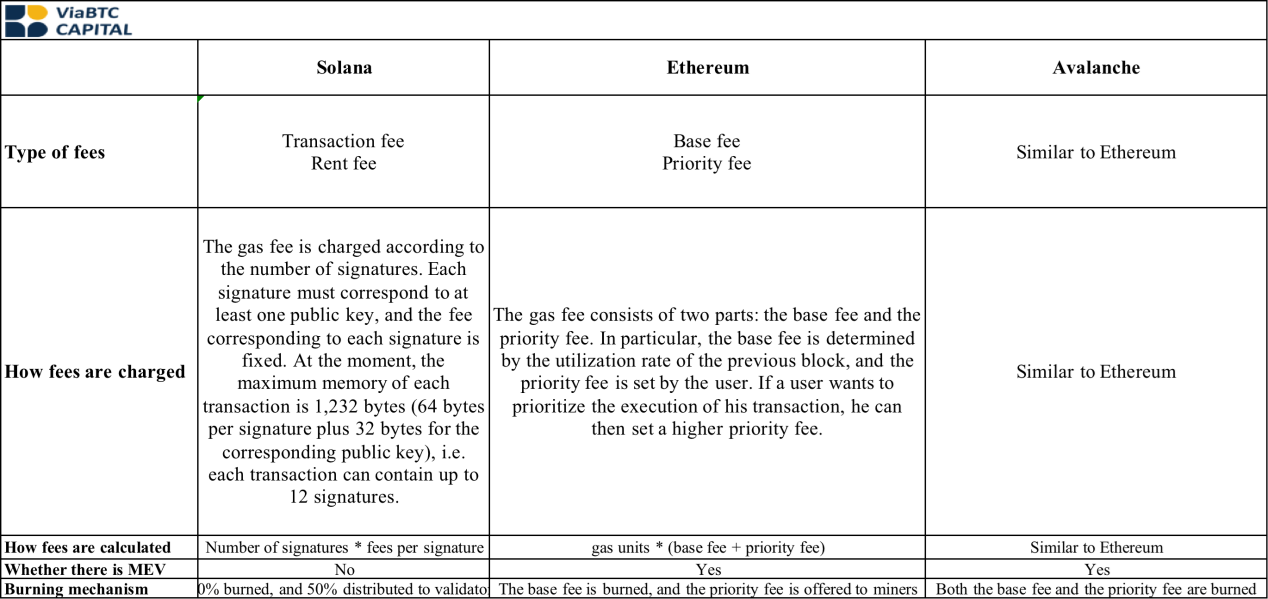

– The gas mechanisms of different chains

This figure shows three main public chain gas design. The number of signatures is the basis for the Solana gas fee. Gas fees are higher if there is more than one transaction. However, each transaction has a maximum memory limit and a maximum gas fee. This makes it easy to calculate the total cost for sending large transactions requests. Solana transactions aren’t sequenced. That means that the cost to send large requests will be lower than the profit, such as arbitrage, NFT minting and so on.To increase their chances of executing transactions, users might use bots. Also, this is the cause of the Solana downtime.

Avalanche and Ethereum share the same gas design. Each feature both the priority and base fees. Because transactions that have a higher priority would be the first to execute, this creates a problem in terms of sequencing. Users can use Avalanche bots to make large transactions on Ethereum, but they won’t be executed regardless of how many requests have been sent. This design reduces network disruptions due to large transactions on the economic level, and is cost-effective.

Source[1]

– Improvement by Solana

It has been proven that economic isolation serves its purpose more well than methodological isolation. Solana already began to create its own Fee Market, using a model similar to the priority fees. Meanwhile, Metaplex, Solana’s NFT market, will also adopt a new concept called Invalid Transaction Penalty, which means that users will have to pay a fee for invalid transactions when minting NFTs.

Capture of value

The market cap (native crypto) of a gas country is a measure of value capture. Two factors are important in determining the market capital of native coins: cash flow, and monetary premium.

– Cash flow

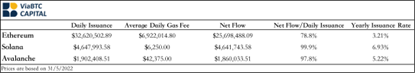

Public chains generally follow the same principle when charging the gas fees. This approach does not make sense from the standpoint of cash flow. While Ethereum is the most popular public chain, it has the highest net cash flow. However, the network continues to issue more Ethers. Additional issuance can be considered a subsidy. The daily net Ethereum expenditure would then reach $25.7 million, assuming the annual rate of 3.21%. Avalanche on the other side has an average income of $6250 and $42,000 per day, while Solana and Avalanche have $4.6 million and $1.86 millions respectively and a yearly rate of 6.93%, 5.22%, respectively. The high net expenditure & high issuance rate significantly dilute the market cap of the public chain coins.

Source[2]

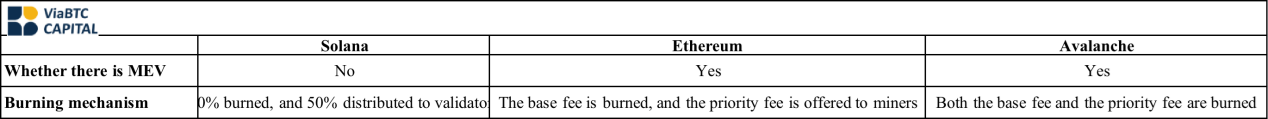

Let’s turn to the destinations of cash flows. Under Ethereum’s current mechanism, the base fee is burned, while the priority fee is offered to miners. Comparable to the gas burning and distribution mechanism of Solana, Avalanche which offer the gas fees to validators and the miner rewards, the miner incentive is an alternative design. It compromises value capture. Ethereum employs the PoW protocol for block generation. Many miners have adopted a business model in which the tokens they mine are used to fund the mining expense (such electricity costs and maintenance costs). Thus, miners are likely to get a portion of the gas fee. The gas fee should be given to validators as the operating costs for a node can’t be compared to a mine factory. Since there are not significant ongoing operating cost, validators are more likely to invest the rewards they’ve received in the nodes, which makes the ecosystem safer without diluting the value of the native coin. The best and most efficient way to gain valuee is by burning fees. This benefits token holders and node stakers alike. MEV is another source of revenue that public chains can rely on. Flashbots estimates that $600million worth of MEV was paid to miners between 2020 and now. However, this is conservative.

Source[3]

– Monetary premium

A monetary premium is the value of a public-chain coin in terms both of its storage and practical value. Large issuance is common for public chain coins, making them low value storage. Their practical value also forms the foundation of their market value. The ecosystem will grow and allow for payment methods to be made with public chain coins. NFT transactions can be settled with the public chain coin. Most public chains are also focusing on the practical value of the coins as their primary method for appreciation. That is why most have reduced gas prices to encourage traffic and attract new users. Some chains, however, have established foundations valued at hundreds of millions of dollar to attract more developers to create DApps for their community. It is an investment strategy that aims to bring in users early on and recover any costs later.

Conclusion

The gas design for a public network will impact its future growth. A poor design can lead to low value capture or performance bottlenecks. We can get an overview of a project through the gas designs when evaluating it.

[1] https://docs.solana.com/implemented-proposals/transaction-fees#congestion-driven-fees,https://ethereum.org/en/developers/docs/gas/,https://docs.avax.network/quickstart/transaction-fees/

[2] https://cryptofees.info/,https://moneyprinter.info/,https://solanabeach.io/

[3] https://docs.solana.com/implemented-proposals/transaction-fees#congestion-driven-fees,https://ethereum.org/en/developers/docs/gas/,https://docs.avax.network/quickstart/transaction-fees/