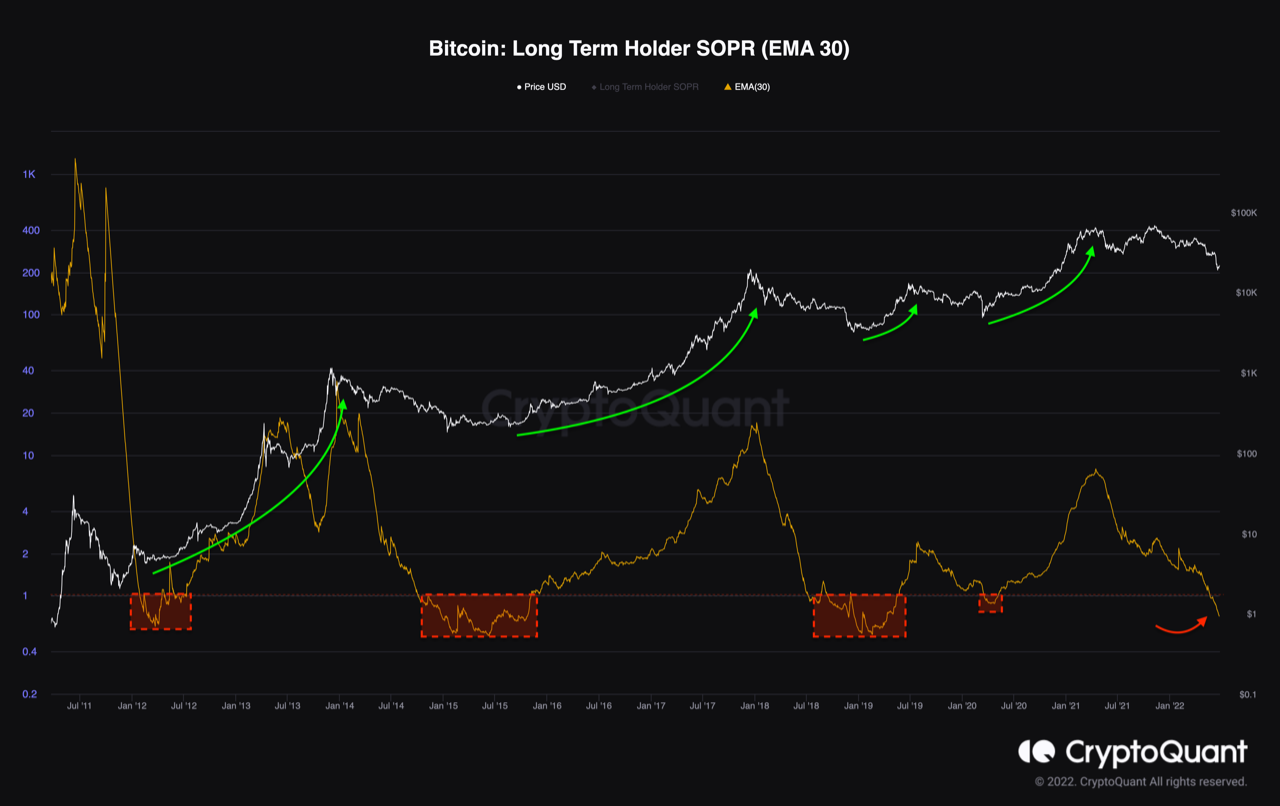

BTC long-term holders SOPR (EMA 30,) have shown a trend that may indicate more trouble in the future.

Bitcoin Long-Term Holder SOPR Has Dropped Below “One” Recently

According to a CryptoQuant analyst, BTC investors could be facing a few frustrating months. If history is any guide,

The “spent output profit ratio” (or SOPR in short) is an indicator that tells us whether Bitcoin investors are selling at a profit or at a loss right now.

To calculate the metric, we look at the transactions history for each coin sold on the chain to determine its last price.

A coin that has a previous sale price less than its current BTC value is sold at a loss.

However, if the cryptocurrency’s past price is higher than its current price it would indicate that the currency has lost value.

The SOPR value greater than 1 means that overall Bitcoin markets are selling profitably.

Bitcoin Coinbase Premium Gap Approaches Zero, Selloff Ending?| Bitcoin Coinbase Premium Gap Approaches Zero, Selloff Ending?

However, investors who have values less than 1 indicate that they are all experiencing some losses.

Now, the “long-term holder” (LTH) group includes any Bitcoin investor who has been holding their coins since at least 155 days ago without moving or selling.

Below is a chart that shows how the SOPR has changed over time for crypto specific to these LTHs.

It appears that the 30-day exponential MA value has dropped recently. Source: CryptoQuant| Source: CryptoQuant

This graph shows that the quant highlights all relevant areas for Bitcoin SOPR long-term holders.

It seems like during past bottoms, the indicator’s EMA-30 value has gone below one and trended sideways there for a while (except for the COVID-19 crash, where the metric didn’t stay in the zone for too long).

Bitcoin Whale Presence On Derivatives Still High, More Volatility Ahead?| Bitcoin Whale Presence On Derivatives Still High, More Volatility Ahead?

Recently, the LTH SOPR’s value has once again gone below one, suggesting long-term holders are realizing losses right now.

According to the analyst, although capitulations have led historically to bottom formations in the past, it might still be some time before there is actually a low.

BTC Prices

At the time of writing, Bitcoin’s price floats around $21.4k, up 11% in the past week. This chart shows how Bitcoin has changed in value over five days.

Price of Bitcoin seems to have jumped in recent days. Source: tradingView.com/BTCUSD| Source: BTCUSD on TradingView

Featured image by Kanchanara at Unsplash.com. Charts from TradingView.com and CryptoQuant.com.