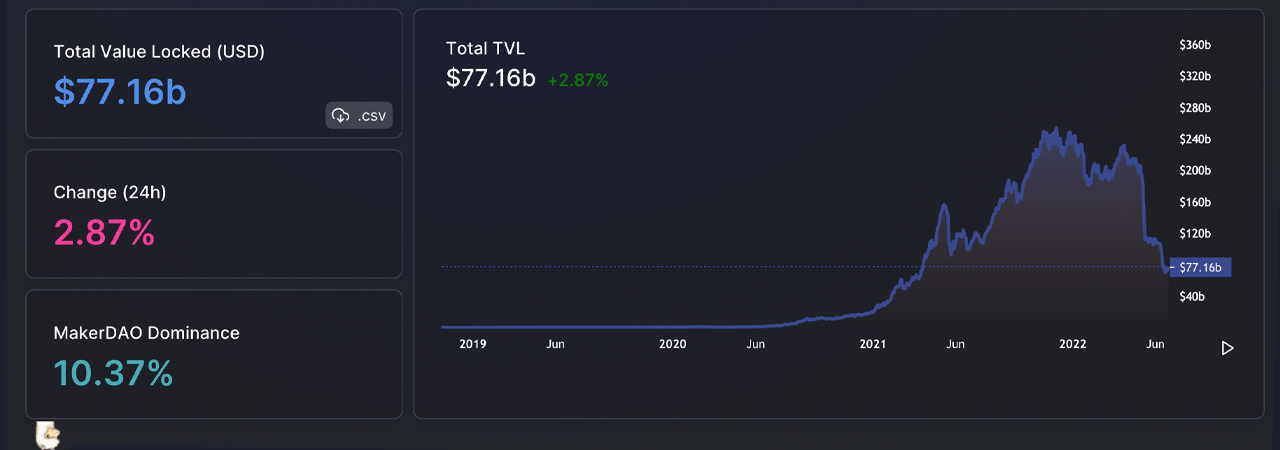

Although crypto prices are showing some improvement over the past few days, total value locked (TVL), across all decentralized finance ecosystems (defi), has improved. The TVL in defi has seen an increase of 7.19% since June 20, and the defi protocol Makerdao’s TVL dominates by 10.37% this weekend.

Defi TVL Improves, Cross-Chain Bridge TVL Slips, $100 Million Stolen From Harmony’s Horizon Bridge

The recent cryptocurrency bloodbath, which followed the Terra blockchain collapse, the Federal Reserve rate rise, and the financial problems surrounding Celsius (3AC) and Three Arrows Capital (3AC), has caused decentralized finance to take a major hit. Bitcoin.com News published a report on June 17 regarding the negative effects of the bear market on defi. Three days later, the TVL for defi fell to $71.98 billion.

Since then, there’s been a 7.19% increase as the TVL rose from $71.98 billion to today’s $77.16 billion. With $8 billion TVL, Makerdao has the biggest TVL of any defi project and is leading by 10.37%.

Makerdao’s TVL has increased 6.89% during the past seven days. Aave is the second-largest defi protocol by TVL size, at $6.59 Billion. Aave saw a 27.13% rise during this week. Ethereum holds 63.98% of the blockchain TVL distribution market with $49 Billion TVL.

Binance Smart Chain (BSC), which has 7.85% of $6.01 trillion locked, is now the second-largest chain in TVL. Market capitalization has increased to $280billion, an increase of 1.4% over the previous 24 hours, after the highest smart contract tokens reached $245billion last week.

Ethereum (ETH), which rose 12.7% in value against the USD, climbed 10.5% last week. Solana (SOL), avalanche (32.2%) and polygon (55.2%) increased by more than 50% over the past seven days.

The top three smart contract tokens list gainers over the last week included ronin, zilliqa and polygon. The TVL for the cross-chain bridge sector has fallen 60.4% despite smart contract tokens making some gains and defi’s TVL improving.

The cross-chain bridge TVL for 16 protocols has a value of $11.77 billion at the time this article was written. Polygon holds the record for cross-chain bridge TVLs with $3.6 Billion, which was locked June 25, at Polygon.

Convex Finance has caused some problems in the defi environment over the past seven days. asking users to review approvals while it evaluates a “potential front end issue.” Additionally, Harmony’s cross-chain bridge lost $100 millionA June 23rd theft.

“Note this does not impact the trustless [bitcoin] bridge; its funds and assets stored on decentralized vaults are safe at this time,” the Harmony team wrote about the situation. “We have also notified exchanges and stopped the Horizon bridge to prevent further transactions. The team is all hands on deck as investigations continue.”

Let us know your thoughts on the defi improving’s value and the gains smart contract tokens experienced during this week. We’d love to hear your opinions in the comments below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.