Decentralized finance (defi) has been hit hard by the recent crypto market rout as the total value locked (TVL) across 118 different blockchains has slipped below the $100 billion mark to today’s $74.27 billion. Today’s TVL for defi is more than 70% lower than its record high of $253.91 trillion on December 2, 2021 (ATH). Moreover, since December 2021, the top smart contract platform tokens have lost 70% in value against the U.S. dollar as well, sliding from $823 billion to today’s $245 billion.

The Market Carnage continues to hammer Defi, and Top Smart Contract Platform Tokens Report Significant Losses

Although cryptocurrencies, including bitcoin (BTC), were the most valuable in terms of market value, their values fell significantly, decentralized finance (defi) and smart contract tokens (defi), overall, have suffered tremendous losses.

When Terra’s LUNA and UST falloutThe flames are now lit Problems with Celsius, Three Arrows Capital (3AC).The lack of trust and algorithmic stabilitycoins has continued to fuel the defi fires. Bitcoin.com launched six days earlier. reportedHow smart contract coins and defi were smashed by major blows. At the time there was $104 billion worth of value in a multitude defi protocols.

The total value locked in today’s defi is the current (TVL). $74.27 BillionThis is 70.74% less than the record high of $74.27 billion on December 2, 2021. The defi protocol Makerdao dominates the pack with 10.43% in terms of the application’s TVL of $7.75 billion out of the $74.27 billion.

In the 24 hours since the end of the previous day, all TVLs across the 118 various blockchain networks have dropped by 6.03%. Makerdao’s TVL shed 15.19% during the past seven days and the second-largest protocol in terms of TVL size Aave lost over 40% last week.

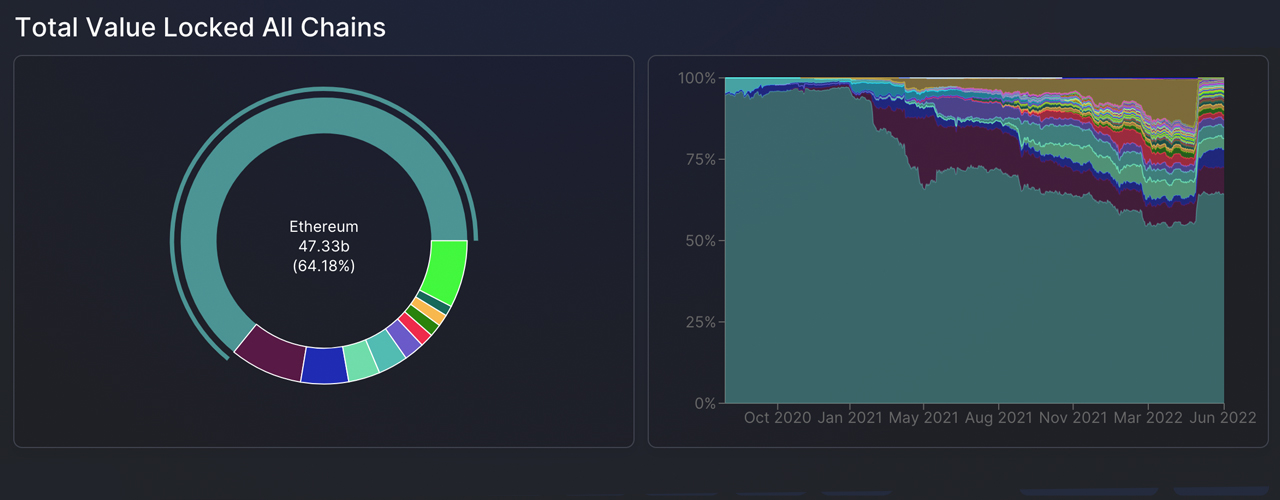

Today, ethereum holds the supreme position in the cryptocurrency market The largest TVLSize out of all blockchains, $47.33 trillion or 64.18% aggregate locked. Binance Smart Chain, which holds $6.06 Billion or 8.22% (of the $74.27 Billion) in defi today is second largest defi block chain.

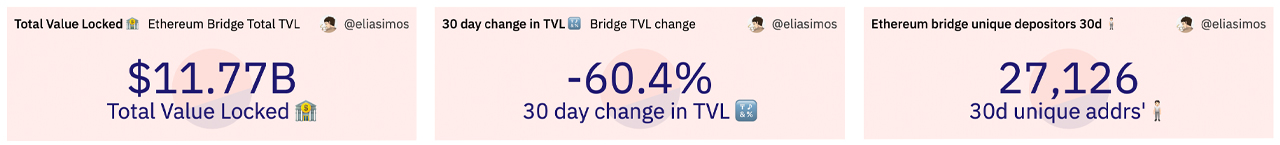

Tron has the third-largest network of blockchains in terms TVL with 3.99 billion, or 5.42% of all the total value across the 118 chains. According to Dune Analytics, cross-chain bridge value from Ethereum dropped by more than 60% in the last month. Metrics.

Tokens are commonly leveraged in Defi. Smart contract platform coin have lost over 70% since December. In December 2008, market capitalization was just $823 billion for all tokens on the smart contract platform. It is now hovering around $245 billion.

Ethereum (ETH), the most popular smart contract platform token, commands $131.50 Billion of $245 Billion. ETH has fallen 39.3% in the past seven days, and many smart contract tokens suffered significant losses over the week.

Binance coin (BNB), Avalanche and cardano lost 34% each, while cardano dropped 22.5%. Cardano (ADA) fell by 22.5%. Polokadot(DOT) declined by 20.7%. Solana (SOL), lost 22.3% over seven days. The only smart contract coin that has not fallen this week was chia (XCH), which is currently up 1.2% against U.S. dollars.

How do you feel about defi’s value falling to new lows? What are your thoughts on the losses that smart contract tokens suffered over the past year? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.