Millions of investors worldwide enjoy the income created through staking rewards, an income paid to crypto owners who help regulate and validate a cryptocurrency’s transactions. DeFi protocols provide great incentives for crypto token holders and help them lock into smart contracts that can be risky.

Participating in stakes will earn you rewards. You can earn more coins by participating in staking with Coinbase, which optimizes your staking opportunities.

Continue reading to find out how to stake on Coinbase and increase your staking returns significantly. Also, learn about the best crypto assets to choose.

Let’s get started!

Consensus Mechanism

A central authority, such as a DMV database or DMV databank, controls all possible data and provides updates. They also maintain genuine records.

However, distributed systems such as blockchain networks can work independently without any central authority. By involving millions of people around the world, public blockchains can act as self-regulating networks. They verify and validate transactions that occur on the blockchain. These publicly-shared ledgers must be fair and functional.

This important mechanism is called the consensus mechanism. It refers to rules that are used to reach agreement, trust and security in a distributed computer network.

Proof-of Work (PoW), and Proof-of Stake (PoS), are the two most popular consensus mechanisms. Each of these algorithms works according to different principles.

Proof-of-Work (PoW)

PoW (or common consensus algorithm) is an algorithm which requires participants to show that they have done the necessary work to be eligible to accept new transactions onto the blockchain. Bitcoin is the most well-known cryptocurrency network. PoW is their preferred method of mining. However, Bitcoin’s mining mechanism requires high energy consumption and a longer processing time, which raised a lot of controversy against it.

Proof-of-Stake (PoS)

PoS, a low energy-consuming variant of the PoW algorithm that uses staking to verify transactions, is an alternative. The participant nodes are responsible for managing the public ledger according to their virtual currency tokens.

Anyone who holds a certain number of coins may earn validation rewards, which allows them to verify transactions when necessary. Many crypto owners choose to invest in coins instead of trading them.

What is the Work of Staking?

Blockchains that use the PoS consensus mechanism can only be used for stakes. Validators are those who hold crypto on a PoS-based blockchain. Validators provide value to the network by locking assets for an agreed-upon ‘staking period’ and earn rewards in return. Based on how many staked coins are there, PoS validators will be chosen.

Take-out pools

Staking can be started by individuals who have sufficient assets to qualify as validators on the blockchain network. They can also use staking pool if they don’t have to invest large sums of crypto tokens. A staking pool is a tool allowing stakeholders to pool in their tokens to give the staking pool operator a validator status and earn staking rewards for their computational resources’ contributions.

Staking on Ethereum Network can require 32 Ethereum tokens. This is roughly $40,000 for an average investor.

Mining vs. Staking

Mining and staking are different in that transactions must be validated by a consensus mechanism. Staking and mining are used to generate PoW.

Below are some differences in mining and stake ownership:

| MINIMING | TRADING |

| Complex mathematical problems are solved by miners | By locking their funds, certain nodes can validate blocks. |

| First miner to complete the puzzle wins a block. | Nodes verify a new block of blocks by locking down native tokens within a smart-contract. |

| Mining involves specialized equipment that consumes a lot energy. | Vitalik Buterin says that stakes consume a small amount of PoW energy. It can result in a savings of 99%. |

| Higher work efficiency (computational ability) means higher chances of being rewarded. | A higher number of tokens staked means a greater chance to be selected for new blocks validation and receiving rewards. |

How to Select a Staking Platform

While staking reward promises easy money, any trader must be careful when selecting a staking platform. The wrong decision could lead to losing staked cryptocurrency and staking rewards. These are some factors to be aware of when you make the decision.

- Do Your Own Research

Do your research thoroughly before you give any of your financial resources to an escrow platform. Scammers are not uncommon, so never take the founder’s word as the only basis for your decision. - Learn How Crypto Staking works on each Platform

Read the platform’s terms and conditions carefully. It is easy to forget many issues, like: Does the wallet work without Internet access? How much minimum staking is required? Do staked cryptos have to be subjected to a cooling process before they can be unstaked? - Don’t Chase the Highest APY.

High returns don’t equal safety. Take your time to choose a platform you can trust based on its experience, reputation, users’ reviews, and the possibilities to earn interest. Be careful and don’t chase the highest possible annual percentage yields or rewards without considering other factors.

This Coinbase review from CoinStats may help you to make an informed choice. Articles like “What Is DeFi” will help you understand the benefits of this system.

Coinbase Staking

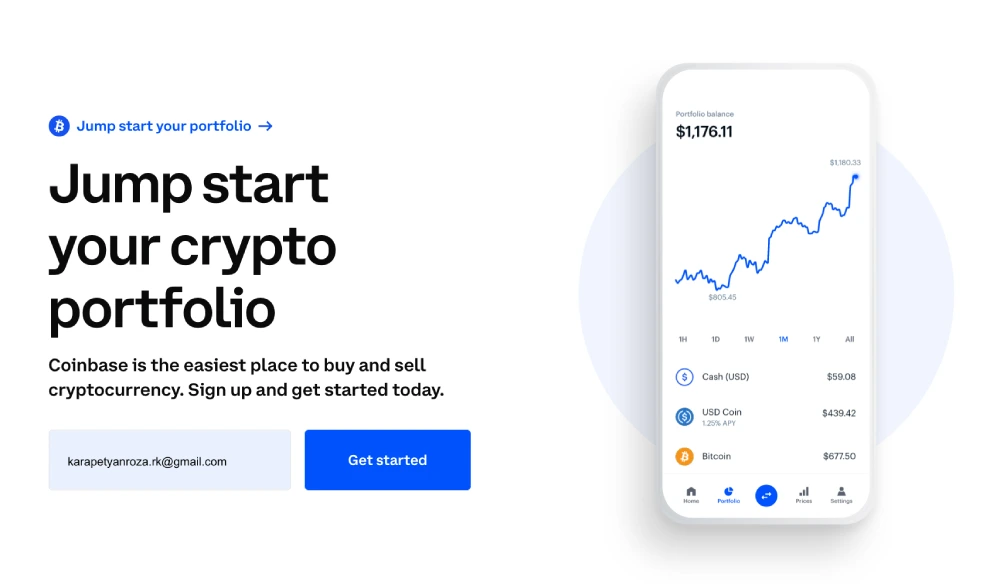

Coinbase has been around for 10 years and is a safe, secure platform to stake cryptocurrency. Coinbase offers a mobile application that makes it easier to stake crypto on-the-go. Business accounts cannot earn rewards on Coinbase.

Let’s take a closer look at Coinbase staking and the rewards and tokens available for traders wishing to stake crypto.

How Coinbase Staking Works

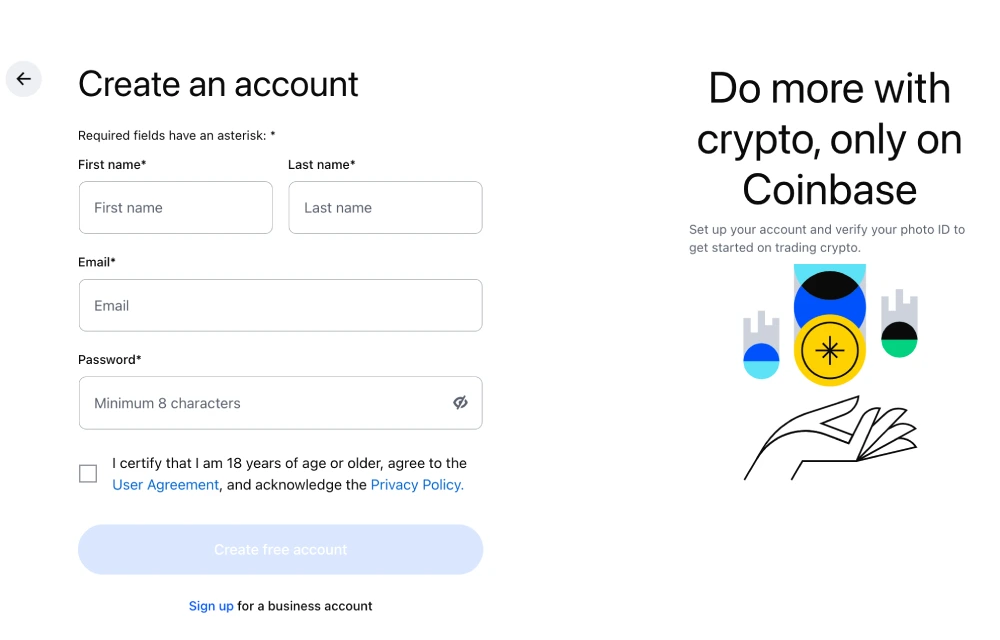

You must first open a Coinbase account in order to place a stake on Coinbase. This is a simple process that requires only a few mouse clicks.

Coinbase will require KYC verification to be able to stake crypto.

This is a step-by-step guide that will make it easier.

- Make a Coinbase profile.

- You can use your bank account to purchase major cryptos such as Bitcoin (BTC), or Ethereum (ETH).

- You can swap the BTC and ETH to get the crypto that you desire on Coinbase.

- Earn rewards by taking your tokens.

Learn more about which tokens offer specific benefits and how they are distributed. Coinbase also recommends keeping these important points in mind.

Things to Remember

- To begin to stake tokens, you might have to agree to certain terms and conditions. Be sure to read the conditions.

- Users maintain full ownership of their staked crypto; however, Coinbase “may or may not” replace the staked ETH tokens, i.e., ETH2, in case of a slashing incident. Additional information is available on the platform.

- Coinbase retains the right to withhold a small amount of certain assets with “lockups at the protocol level.” The precaution is to ensure a user has liquidity and can cash out the crypto as needed.

- All staking rewards are subject to a commission. You should read carefully the User Agreement before you start staking crypto. This will detail all possible fees as well as commissions.

You are eligible to receive stake rewards

These are the essential requirements to stake crypto on Coinbase

- KYC verification: All applicants must be able to verify their identity.

- Each crypto is given a minimum balance.

- This minimum balance can be either maintained by Coinbase or transferred to another wallet.

- Coinbase Pro is not eligible for rewards.

Tokens Available for Coinbase Staking

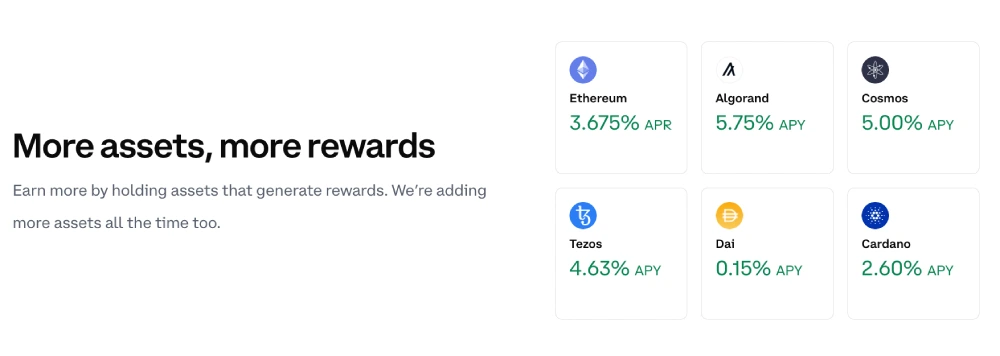

Currently crypto investors are holding Algorand, Cosmos, Ethereum (ETH), Tezos(TXZ), Cardano and Cosmos on Coinbase.

| Cryptocurrency | A minimum balance is required | You get rewards for your efforts |

| Algorand, ALGO | 0.01 Algo | Quarterly |

| Cosmos (ATOM) | ATOM 0.0001 | 7 Days |

| Ethereum (ETH). | There is no minimum balance | Daily |

| Tezos (XTZ) | 0.0001XTZ | Three days |

| Cardano (ADA) | $1 in ADA | Five days |

Reward for each Eligible Token

- Algorand, ALGOIn 2022, a new reward system was introduced that distributes rewards every three months or quarterly.

- Cosmos (ATOM)The first payment is distributed within 7-14 days, and each subsequent reward within seven days.

- Ethereum (ETH). After 14 days the first reward and every reward snaps will be credit.

NOTICE: Ethereum Network is still not fully transitioned to Proof-of-Stake; Coinbase therefore issues this warning about ETH staking

“ETH2 staking rewards will be reflected in your account under Lifetime Rewards and will be updated regularly. At this time, staking rewards won’t be added to your overall staking balance, and you won’t be able to access them.” - Tezos (XTZ)The initial reward for staking XTZ takes between 35-40 days and the subsequent rewards take 3-7 days.

- Cardano (ADA)It takes approximately 20 days to send the first reward, and five days for every subsequent reward.

As the platform expands, so might the list of assets. The Coinbase website, and the Coinbase mobile application reflect all changes.

Crypto Staking has both risks and rewards

Staking cryptocurrency is an exciting venture. However, every trader must be aware of all the possible risks. So let’s talk more about the advantages and disadvantages involved in staking.

Get Rewards

- Passive income generation

There’s nothing wrong with storing your crypto, hoping for price appreciation. If you believe the other crypto is better, you can swap it for one. But, stakes can bring you more benefits than just price appreciation. - It’s simple and fast

The process of stake is simple and fast. A trader who joins a stake pool rather than being solely validator can have a starting amount that is relatively low.

There are risks

- The price of crypto is highly volatile and could cause funds to be lost. To keep track of the changes in crypto prices, use portfolio trackers.

- Volatility is higher for smaller coins. Some smaller coins offer better APYs. In other words, you adopt a high-risk/high-reward strategy while staking smaller cryptocurrencies that might not be acceptable for all traders.

- Your funds must be locked for a period of time in order to staking. If the asset depreciates during this time, you won’t be able to repair the damage.

Commonly Asked Questions

Can I trade or send tokens while they’re passively earning rewards?

Crypto staking should allow you to cash out. It could be affected by your banking and transaction histories, as well as general transactions history.

Sometimes, trades or cash-outs can be delayed as investors wait for Coinbase’s unlocking of the funds. If this happens, traders will receive a notification via Coinbase.com as well as the email or app.

How can I get rewards from Coinbase vaults

Coinbase vaults can be a great way to earn rewards. However, that’s only the case if the crypto in question is eligible for rewards. For a full list of tokens that can be staked on Coinbase, see the above.

NotificationCurrently, storing ETH2 and ADA in a vault won’t earn you any rewards.

Is the reward estimated equal to the actual payout?

Your Coinbase account reflects an estimate of a possible reward based on the network’s description. However, the network’s actual distribution might differ from the estimate. The estimation is based on Coinbase’s prior staking performance for that cryptocurrency.

Is the reward rate going to be equal?

The protocol can set the reward rate, but it is subject to fluctuations. Rates can be affected by other factors such as the level of validation, the stake amount, inflation rates for savings, etc.

Are rewards guaranteed?

Coinbase cannot guarantee any specific staking reward to customers over time.

Is staking a taxable event?

Coinbase’s taxation law is U.S.-based. Therefore, U.S. customers must declare their earnings from Staking Rewards. The Internal Revenue Service’s 1099-MISC is eligible for rewards over $600.

How is the annual percentage yield calculated and what is its meaning?

Annual Percentage yield (APY), which is the amount you earn each year for depositing funds in your account, is a calculation that takes into consideration the annual average. The APY project is based on historical calculations. Coinbase specifies that this rate is “set by the applicable asset protocol,” and Coinbase itself does not set, control, or influence it in any way.

Every network has its own reward system, and each network uses its own APY. Coinbase, however, charges a commission for each transaction. You can find all the information in the agreement.

Conclusion

Now you should have an answer for the question “How to stake on Coinbase?” Although it is simple to stake, there are significant risks. Even on the safest platform in the market, staking can still result in a loss of funds due to a token’s price depreciation.

There are amazing rewards for purchasing the Coinbase tokens.