Bitcoin is continuing to slide after it lost 33% during the past seven trading days. BTC fell close to 6% over the last 24hrs and was now moving towards its next support level. BTC has shown tremendous choppiness, with BTC hovering at $23,000 support and falling again.

Bitcoin bounced back from the $20,000 level, as it was slightly higher at the time. Bitcoin can drop from the current level of price to reach the $17,000 support level.

After the US Federal Reserve increased interest rates by 50basis points or more, traditional financial markets have also suffered.

As the bears have driven out all of the buyers, the sellers have now seized control of the market.

A Day of Bitcoin Price Analysis

BTC traded at $21,000 per day on the daily chart. BTC traded last at that price in December 2020. BTC’s price has dropped steadily since it lost $28,000 of its support. The coin’s immediate resistance was $22,000

Support zone values were $19,000 to $16,000, respectively. A consistent sell-off can propel Bitcoin to $13,000, given the huge bearish momentum it has gained. Bitcoin volume traded rose and was now in red, signifying bearish assertions in the market.

Technical Analysis

The one-day chart showed that buying strength fell sharply. The cryptocurrency was vastly undervalued as of the writing. Relative Strength Index fell below 20 which can be a sign that the market is bearish. The RSI showed market seller strength.

A severe sell-off is usually followed by a price reversal. However, the other indicators suggest that bearishness could continue in the near future. BTC’s price was lower than the 20-SMA, which indicated that the sellers had been driving market momentum.

The one-day chart shows that other indicators are showing the same picture due to higher selling strength. The Awesome Oscillator also determines price momentum, and potential trend reversals. AO flashed red histograms that were linked to a market sell signal.

Parabolic SAR indicates which direction the market is heading. If the candlesticks are in the middle of a dot, it means that the asset’s price is falling. The coin was therefore considered bearish. BTC could trade at the $22,000 level if the buying power returns to the market.

Related Reading| TA: Bitcoin Shows Signs of Recovery, $23K Presents Resistance

What is The Metric saying about Investors

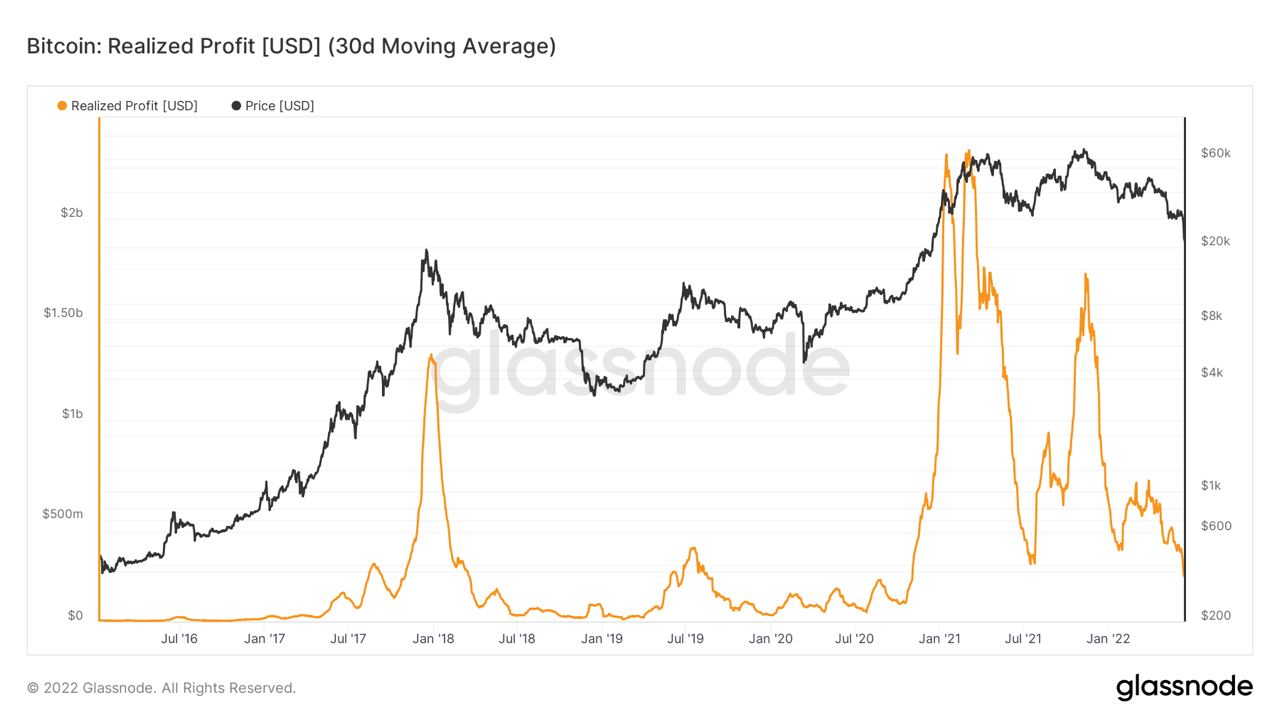

Due to the prolonged bloodbath on the market, Bitcoin’s realized profits have appeared to be declining. This is the sum of all profits made on each successful trade.

Retail investors might withdraw their funds if there is a drop in realized profits. Investors might lose faith and decide to withdraw their investment if there is an increase in outflows.

Bitcoin Crash Sends Institutional Investors Running For The Hills| Bitcoin Crash Sends Institutional Investors Running For The Hills