Coingecko data shows that Ethereum has seen a minor recovery, as well as large-sized cryptocurrencies, since the writing of this article. Over the last weeks, the second cryptocurrency by market capital has trended to the downside and was briefly seeing below $1,000 at certain places.

TA: Ethereum Could Resume Decline Below $1,100, Bears In Control| TA: Ethereum Could Resume Decline Below $1,100, Bears In Control

Ethereum (ETH), currently trading at $1,180, has suffered a 35% drop in 7 days and is now worth $1,180. According to economist Alex Krüger, ETH’s price records a 20% loss and 20% profit during today’s trading session which could be a first in the cryptocurrency’s history.

$ETHToday, he has made a 20 percent intraday roundtripper.

20% Down, and then 20% Up

We are not certain if such an event has occurred before.

— Alex Krüger (@krugermacro) June 15, 2022

Ethereum, like Bitcoin is responding to the negative effects of macroeconomic situations. BTC (and ETH) were able to regain bullish momentum after the U.S. Federal Reserve announced a 75-basis points rise in interest rates. This was followed by a series of liquidations, and negative news about the crypto market.

Potentially driven by overextended selling pressure, and panic amongst crypto investors, ETH’s price bounced back from around $1,000 to its current levels. Krüger believesThis price action fits within a long-standing market pattern.

(…) since December. Hawkish market expectations => prices tank in anticipation => hawkish FOMC => assets rally. Priced in part. This is not a common practice. This has been so consistent it’s developed into a pattern. It won’t last forever.

In the days ahead, volatility could increase in the market. Krüger believes the market could continue to positively react to the FED’s announcement as it was within expectations. The bounce may continue. He said:

The market liked Powell’s hawkishness. Short rates higher (in response to increased hawkishness), long rates lower (in response to increased credibility in the Fed’s ability to reign in inflation). We can only hope that this holds true and that we will see continued growth.

Ethereum Under Short-Term Buying Stress

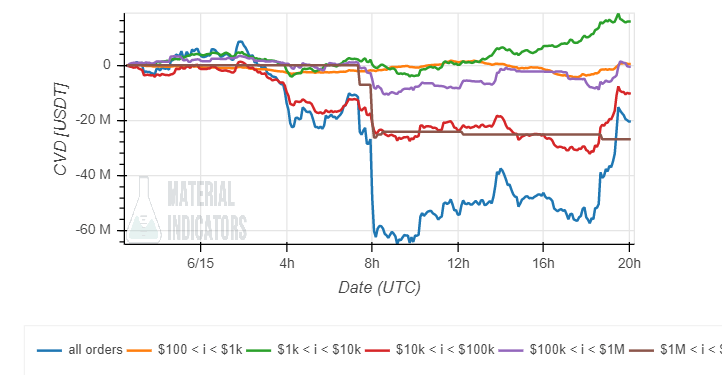

Data from Material Indicators shows an increase in the buying pressure of ETH on cryptocurrency exchange Binance. Fast all classes of inverters switched from buying to selling the price action during shorter timeframes.

| Tron falls sharply as sun scrambles to save Stablecoin

This could contribute to ETH’s current momentum and possibly push the cryptocurrency to previous levels. However, ETH whales (in brown on the chart below) sold into today’s price action and could get in the way of any sustainable recovery.