Bitcoin’s price reached $20,080 per bitcoin on Monday, 15 June 2022. It was the lowest price since mid-December 2020. A large number of crypto supporters are debating whether or not the drop is the market’s bottom or if the fall could lead to deeper losses. Bitcoin is currently 70% lower than the $69K all time high (ATH). However, historically, bitcoin has dropped around 80% from previous ATHs.

Bitcoin Will Fall More Than 80% this Time Around

As the crypto currency’s leading asset, bitcoin (BTC), has dropped 35% in the past 14 days, it has been a difficult few weeks. It is now being called a bear-market by speculators who have switched from predicting it to saying that it is.

During the past few days, there’s been a lot of capitulation and on Monday, hundreds of thousands of crypto traders were liquidated for close to $1.30 billion. Bitcoin dropped to $20,080 per BTC on Tuesday, two days after that. The last time BTC was traded at such a price was mid-December 2020.

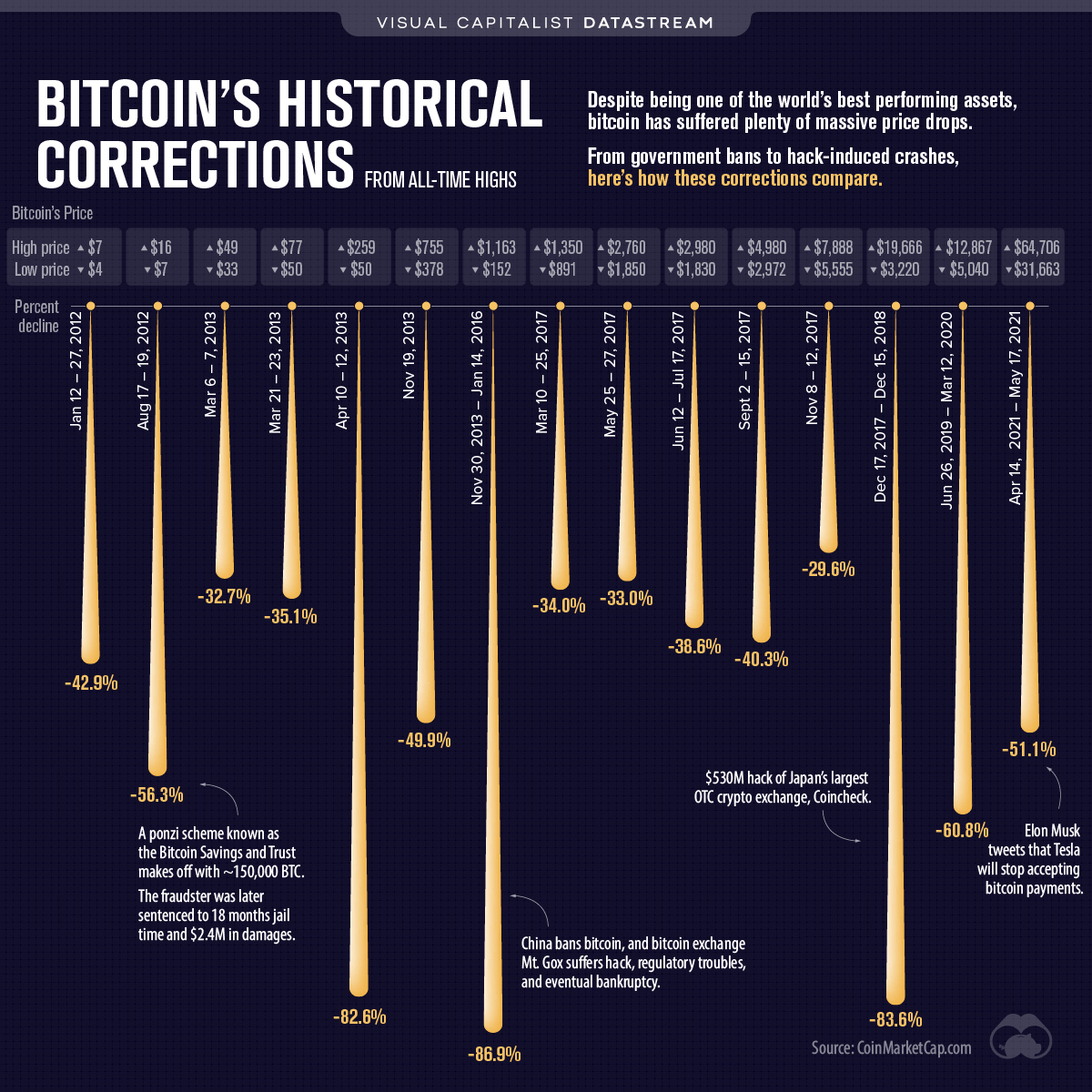

Bitcoin is currently down 70% from its November 10th, 2021 $69K ATH. BTC (BTC) fell over 80% in the last bull runs, 2013-2017. Coingecko.com’s founder, Bobby Ong, tweeted about bitcoin’s falls from the past bull runs and he included ethereum (ETH) in the 2017 runup.

For instance, after BTC’s price high in 2013 of around $1,127 per unit, by 2015 BTC was down 82% at $200 per coin. Ong’s tweet shows that In 2017, BTC jumped to $19,423 per unit but by 2018, the price dropped to a low of $3,217, which was 83% lower than the price high.

Coingecko’s co-founder, Ong, explained that the price of ethereum fell 94% in 2017-2018. Ong’s tweet was published on June 11, 2022, and at that time, BTC’s USD value was 59% lower than the ATH, and ETH’s value was 69% lower. At the time of writing, ETH’s dollar value is 75.4% lower than the crypto asset’s all-time price high ($4,815) reached on November 10, 2021.

Let’s do some math.

There is a possibility of a bottom $BTCETH will eventually hit $360 with a bottom at $12,000 for the ETH/BTC pairs at 0.03.#Bitcoin #Ethereum #bearmarket $ETHBTC

— Colin Talks Crypto – CBBI.info (@ColinTCrypto) June 15, 2022

Of course, there’s a lot of speculation and theories about whether or not BTC’s price will go lower from here. An 80% drawdown from BTC’s ATH in 2021, would be roughly $13,800 per unit. The USD value of ether would drop by around 90% from its ATH in 2018. Some speculators believe BTC will reach $12K per unit, while ETH may tap $360 per Unit.

The Pre-Halving Highs Are Overturned by a Drop Below $19K, Bitcoin miners struggle, and global markets continue to be shaken by macroeconomic disasters

So far, since the crypto economy’s ATH last year, more than $2 trillion in value has left the crypto ecosystem. Trader are concerned about the next round of halving. Prices will be higher when miners receive 3.125 BTC for each block. The pre-halving highs will be erased if prices fall below $19K for BTC. ASIC mining rigs that are profiting steadily at current BTC exchange rates of $0.12 per kWh and BTC currency rates of 0.09K/BTC (kWh) only seven ASIC mining units.

Bitmain’s Antminer S19 XP with 140 terahash per second (TH/s), using the same electricity cost of $0.12 per kWh, gets an estimated $3.49 per day in profit. Microbt Whatsminer S50S produces 126 TH/s and earns $1.51 per daily in BTC profits with the same electricity costs. Machines producing 84 THB/s at $0.12/kWh aren’t profitable unless they have access to cheaper electricity.

These signs, along with the thousands of employees who were laid off in the past few weeks, arguably indicate that this bear market is here. There is still uncertainty about whether the 80%+ drawdown this cycle will be completed and for how long.

There’s also the macroeconomic disasters and concerns over rising inflation, central banks’ hiking rates, and the ongoing war between Ukraine and Russia. Bitcoin steadily rose towards its ATH as Americans and people from other nations received stimulus payments. Although bitcoin and crypto markets have never seen a Covid-19 lockdown, it is not known if the crypto market has been affected by current conditions.

What do you think about bitcoin’s current price cycle? What do you think about the ATH’s 80% decline? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons. Feature Illustration Contributor Vlastas. Chart by Venture Capitalist Datastream.

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.