While most cryptocurrency share common underlying technologies in the market for crypto, their designs are based on distinct economic models called tokenomics. Specific to be precise, certain cryptos are able to increase their supply as they age, while others maintain a constant supply. A few cryptos have a decreasing total supply, which can look deflationary. Deflationary cryptos is the name given to these tokens.

Most people are aware that cryptos which have fixed supplies, like Bitcoin, can be deflationary. Inflation is often viewed as a loss in value by most members of the Bitcoin community. A government is often able to control the whole financial system by issuing a currency in real world. The country can be vulnerable to an economic crisis, if it issues too many currency by the central bank and sets low interest rates while purchasing large quantities of foreign bonds.

Before publishing the BTC whitepaper, Satoshi Nakamoto had noticed that real-world currencies issued by the government are subject to inflation, which inspired him to develop an alternative store of value that’s similar to precious metals but is achieved digitally. Bitcoin’s flexible mining difficulty and mining reward mechanisms help it suppress inflation. Bitcoin’s singular design keeps it growing in value. Bitcoin’s fixed supply and the fact that it is half-reward for each block makes it deflationary.

Bitcoin, a deflationary cryptocurrency, is not only an innovative blockchain architecture and cutting-edge consensus mechanism but also represents a wider experiment to move the long-term stored value of the real world from the crypto space.

The benefit of a deflationary crypto currency is that it will be more expensive as both the total and circulating supply drop. This will increase the value and attract more users to invest in crypto.

A token deflationary could be made by using a percentage of token supply to either repurchasing or burning tokens, or simply repurchasing the tokens and keeping them. Burning tokens by hand is the most popular method. CET, the platform token for CoinEx’s global crypto exchange, can be deflationary by being repurchased or burned.

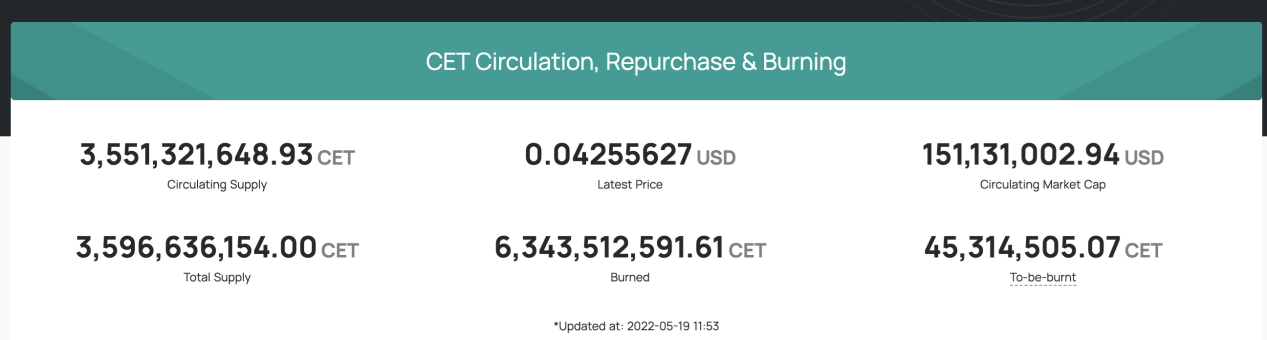

CET will be repurchased every day by CoinEx with half of its trading fees income. CoinEx will also burn all CET that it has repurchased during each month to reduce the supply to three billion. CET will be repurchased by CoinEx every day at 20% and burned until there is no more CET.

CoinEx currently has an estimated 3.5 Billion CET in total supply. According to its website data as of May 19, 2022, CoinEx has already repurchased or burned approximately 6.3 Billion CET. The CET price has increased as tokens are repurchased or burned. This attracted the interest of many cryptocurrency users. CoinEx will continue to purchase and burn CET. The circulating supply will drop and CET’s value as an ecosystem-based token, will rise.

Deflationary tokens are preferred by crypto users. As their circulating supplies decrease, deflationary tokens’ value will go up. In other terms, owners of deflationary crypto tokens will have a greater net worth.