In recent years, blockchain and cryptocurrencies have seen rapid growth. Although the many benefits of blockchain are overwhelming in terms of efficiency, speed and cost savings, as well as increased speed and costs, it still needs to be adopted widely.

Technical scalability is a major concern that could hinder the adoption process for public blockchains. In order to ensure security and decentralization, blockchain networks need a lot of processing power. This makes them less scalable.

One of the most significant drawbacks to the Bitcoin network is its scalability.. This is where blockchain Layers 1 & 2 come into the picture in their attempt to offer a solution to the scalability challenge.

Stacks (STX) is a Layer 1 blockchain project that attempts to solve Bitcoin’s scalability issues by modifying the base protocol of the blockchain network. The Bitcoin network serves as the lastity and security layer of smart contracts that are contained in and executed within the Stack Blockchain. Stacks says it will add smart contract functionality the Bitcoin blockchain. This is without altering or cluttering up the Bitcoin mainnet. The merging of smart contracts with Bitcoin’s functionality will boost the mass adoption of Bitcoin.

Continue reading to find out more about Stacks, and how you can buy STX.

Let’s get started!

What Is Stacks, (STX)?

Stacks allows non-fungible tokens (NFTs), smart contracts (DApps), and other layer-1 blockchain solutions to be added without affecting Bitcoin’s security or stability.

These DApps are open and modular, which means that developers can build on top of each other’s apps to add extra functions that would be impossible in a traditional app. Because Stacks employs Bitcoin as its foundation, everything that occurs on the network is settled on the most extensively used and arguably the most secure blockchain in operation – Bitcoin.

The Stacks token, STX, powers the platform. This facilitates smart contract execution and transaction processing. It also allows for the registration of new digital asset on the Stacks 2.0 Blockchain.

The platform was previously called Blockstack, but it was renamed Stacks in Q4 2020 to “separate the ecosystem and open source project from Blockstack PBC” — the corporation that created the original protocols.

In January 2021, Stacks 2.0 was officially launched.

Stacks Key Features

Bitcoin-based construction

Stacks brings new functionality to Bitcoin. It employs Bitcoin as a trusted foundation layer for all transactions. The Stacks Blockchain allows for decentralized applications and smart contracts. It also supports the creation flexible, transferable virtual assets. Apps developed on Stacks are able to accept Bitcoin payment.

Clarity Smart Contract Language

Stacks has deployed its own Clarity programming language to help it bring smart contracts to Bitcoin and facilitate the ecosystem’s security. Clarity publishes smart contracts on blockchain nodes using predictable source code.

Clarity lets users set their own terms for transactions.

Documentation of transfer

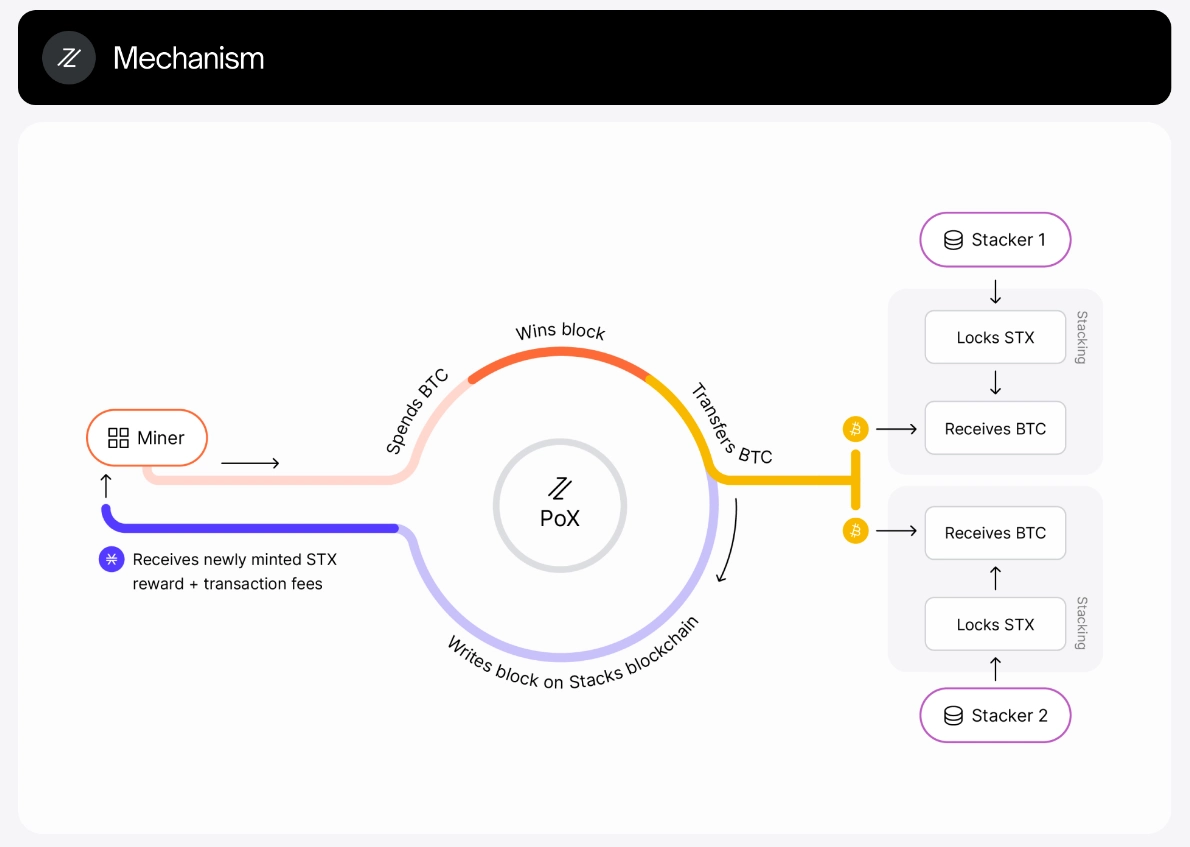

Stacks utilizes the Proof of-Transfer consensus (PoX) mechanism. This makes Stacks extremely scalable, decentralized and without causing an environmental impact. PoX uses two blockchains – the secure Bitcoin blockchain to secure new chains on the Stacks blockchain without requiring new Proof-of-Work chains and cryptocurrencies.

Proof-ofTransfer removes the possibility of burning cryptocurrency. Instead, the blockchain’s new security is provided by mined cryptocurrency.

The PoX mechanism also facilitates the network’s reward protocol by allowing Stacks token holders to receive rewards in Bitcoin.

Stacks Founders

Stacks was established by Ryan Shea and Muneeb Ali, founders of Blockstack PBC in New York. Blockstack PBC was formerly known as Hiro Systems PBC. It is just one of the many companies that uses the Stacks platform.

After receiving a Master’s and Ph.D. from Princeton University in computer science, Muneeb Ali cofounded Stacks. Hiro Systems PBC’s CEO is he.

Ryan Shea served as the co-CEO at Hiro Systems PBC between 2013 and 2018, before he left it to start a stealth-mode software startup. Shea worked in software development before joining Stacks.

Stacks has been launched by many renowned venture-capital firms such as Y Combinator (Winklevoss Capital), Digital Currency Group and Y Combinator.

What is Unique About Stacks?

Stacks aims at solving Bitcoin scalability by adding more features without having to fork or change the original Bitcoin network. It’s linked to the Bitcoin blockchain through its Proof-of-Transfer (PoX) consensus mechanism, which requires miners to pay in BTC to mint new Stacks (STX) tokens. Furthermore, STX token holders can stack (rather than stake) their tokens to receive Bitcoin as a reward.

Clarity, a brand new language for smart contracts, was launched by Stacks. Because of its simplicity, it is both secure, and simple to create. Algorand (ALGO), a blockchain, also utilizes this smart contract-centric programming languages.

STX was also first cryptocurrency to become SEC-qualified for sale in America. Stacks can now conduct a Reg A+ $28 million cash offer for STX tokens.

STX Tokenomics

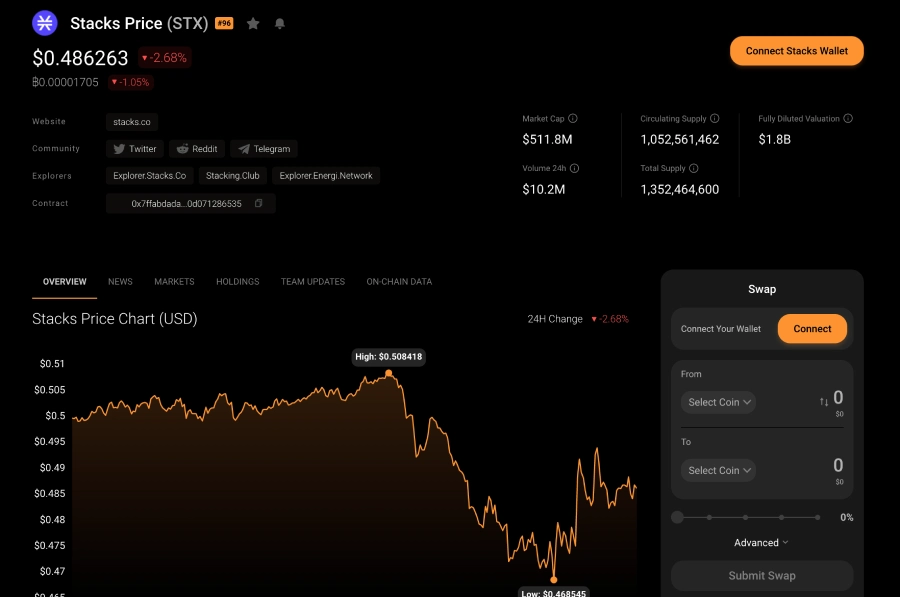

The STX price, the 24-hour trading volume and market cap are all available. Also, check out total supply, maximum supply, circulating, total, and max. Supply, historical statistics You can also find updates about STX prices live on CoinStats

The draft Stacks 2.0 whitepaper draft (v0.1) indicates that 1000 STX per block would be issued within the first four-years, before decreasing to 500 STX/block during the following four, 250 STX/block the next four, and 125STX/block for the remainder of the time.

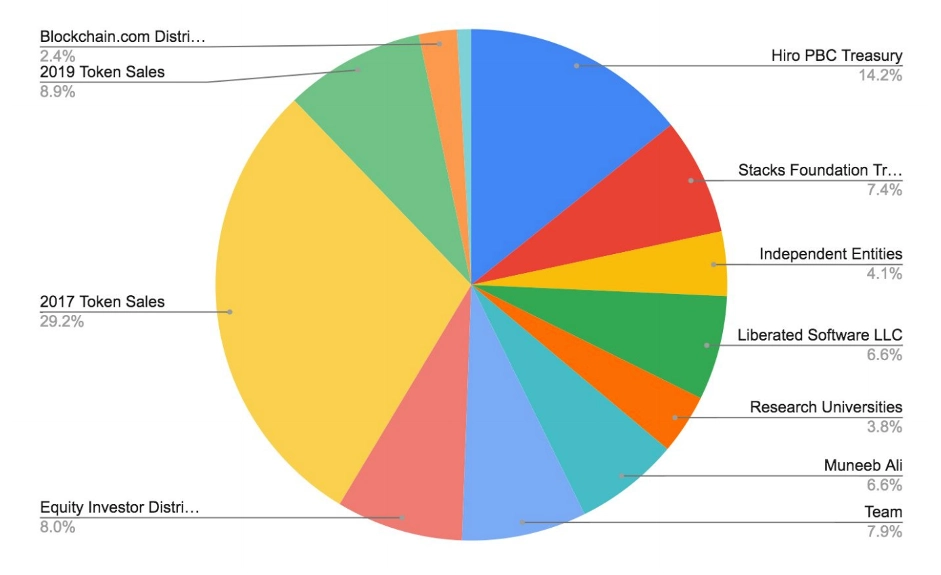

Creator received 6.6% from the original genesis supply (1.2 billion STX), and the Stacks team got 7.9%.

How secure is the Stacks Network?

The Bitcoin blockchain was the foundation of the Stacks blockchain. Bitcoin is a Proof of Work blockchain. This means that thousands of nodes and miners work together to protect the network from attacks. It makes it economically and computationally impossible to disrupt the network. Stacks leverages Bitcoin’s high level of security since Stacks’ transactions are settled on Bitcoin.

Stacks has its Proof-of-Transfer consensus mechanism (PoX), which allows users to send BTC and mine STX. This makes it possible for Stacks use the capital and security of Bitcoin to power smart contracts and DApps.

Where to buy Stacks (STX).

These are the 5 top exchanges that allow you to buy Stacks (STX), cryptocurrency using a debit or credit card, or bitcoin (BTC).

Binance

Binance is one among the biggest and best-known cryptocurrency exchanges. Buying Stacks on Binance (STX), comes with low fees and more liquidity. This exchange allows you to quickly buy or sell to take advantage of market movements.

The exchange can be used by investors from Australia, Canada Singapore and the United Kingdom. Residents of the United States cannot currently purchase stacks (STX).

KuCoin

KuCoin offers the lowest fees and best services. It’s a well-known cryptocurrency exchange and has grown immensely since its early days of allowing only crypto-to-crypto trading. KuCoin provides many services such as P2P and purchases with credit cards or debit cards. You can buy Stacks (STX), cryptocurrency, and more than 500 popular tokens including new ones.

The exchange is currently open to residents of the United States.

Coinbase

Coinbase, a NASDAQ-listed cryptocurrency trading platform, is one of America’s most beloved exchanges. It accepts clients from more than 100 countries including Canada, Australia and Singapore.

Over 70,000,000 Coinbase users have traded more than 460 Billion USD. Security is Coinbase’s top priority, with 98% of customer assets stored in secure offline storage. Easy-to-use, the platform supports trading in more than 140 cryptocurrencies. It’s is available on PC, Android, and iOS.

This exchange accepts US residents except Hawaii.

MEXC

MEXC is a Seychelles-registered cryptocurrency exchange founded in April 2018. The exchange accepts USD, EUR and VND deposits as well CNY and VND withdraws. MEXC has over 245 coins, 374 trading pairs, and continues to extend support for DeFi coins.

BitMart

BitMart, a crypto trading platform allows you to trade across various financial markets. This exchange supports more than 100 cryptocurrency pairings, including Bitcoin, Ethereum and Tether. It is also available for intermediate and novice traders.

This exchange now offers a futures marketplace with leveraged trading that can reach 100x as well as DeFi services, such as lending and borrowing.

How to Purchase Stacks

Take a look at our detailed guide to purchase Stacks immediately!

Step 1: Select a Crypto Exchange

You can purchase and sell Stacks via various cryptocurrency exchanges. Compare them all to find the one that offers the most features, including low trading fees and an intuitive interface. You can also get 24-hour support. Make sure to verify that the crypto exchange allows you to pay using your preferred method of payment, whether it is a bank transfer, credit or debit card. Some exchanges offer advanced trading tools, such as limit and market orders and crypto loans.

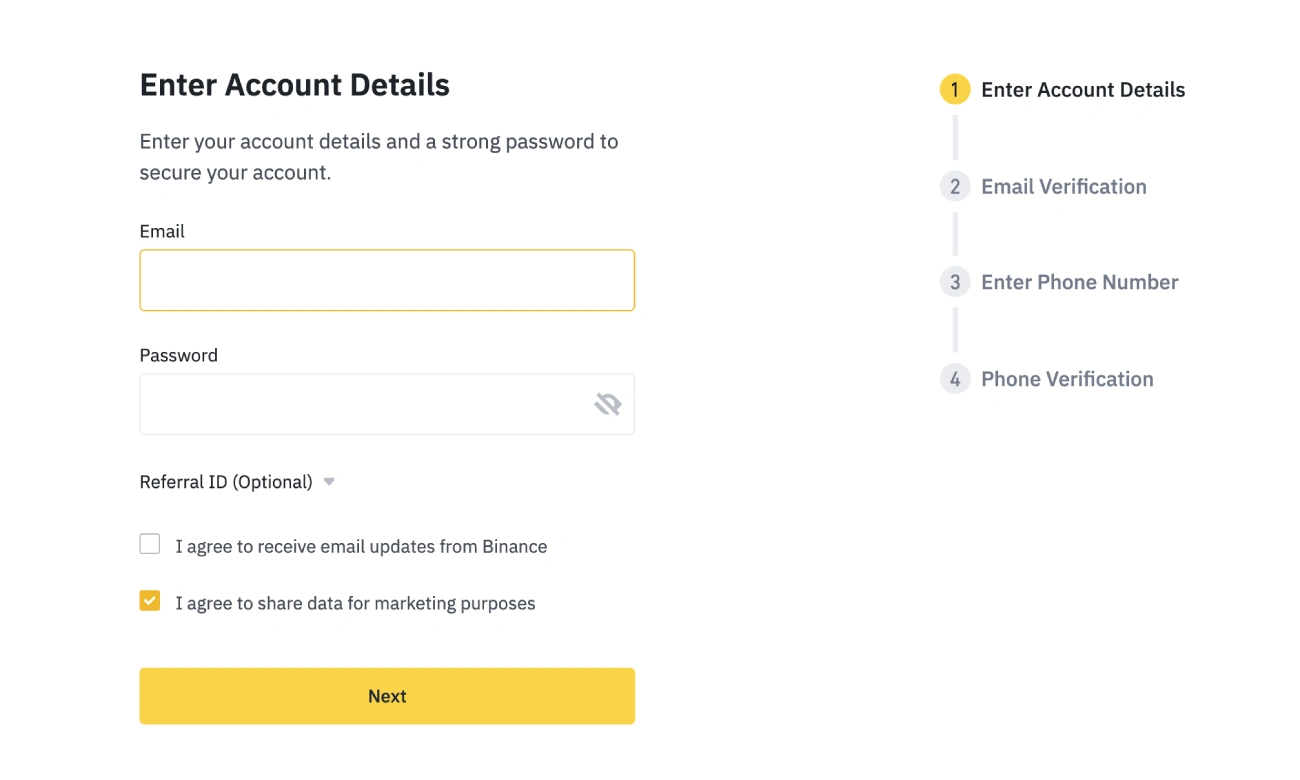

Step 2: Register

The next step after selecting an exchange that is reliable, opening a trading account for STX. The requirements vary depending on the platform. Most purchases on centralized exchanges will require personal information such as your name, email address, contact number, social security number, home address, and a copy of your driver’s license, passport, or government-issued ID. This information is required to verify that you are able to purchase Stacks in fiat currency using your bank account.

Once you have submitted your account application, please check your email to find the account verification code. Enter the code in order to verify your account and then start trading. It’s advisable to enable two-factor authentication (2FA) to keep your assets safe.

Step #3: Fund Your Account

You will need to deposit funds after verifying your account. You can choose from a variety of payment options, including a bank transfer or credit card. The location and your preference will dictate the type of payment you make.

Bank Account

Although a bank transfer to a local account usually comes at no cost, it is worth checking with the exchange before you deposit funds.

You can choose to use a credit or debit card:

To top-up your account, you can link your card. After you are connected to your card, it is possible to either make one-time purchases or establish monthly payments. You should know that purchasing cryptocurrency with your credit card may result in an additional cost.

Cryptocurrency:

You can purchase Stacks and trade it for other cryptocurrencies such as BTC or a stabilizecoin. Since this varies between exchanges, you’ll need to look for STX on the spot market to view the available trading pairs.

Step 4: Purchase Stacks STX

You’re now all set to buy STX. The buying of Stacks works in a similar way to other cryptocurrencies. It is also easy across platforms. You should search for the Stacks token in the search box, check the STX price, and click on the “Buy STX” button.

Next, enter either the amount of STX you want to purchase or your fiat currency. Most exchanges will quickly convert the amount so that investors know how much they’ll pay and how many STX tokens they’ll get. Verify that all information is correct before you finalize your STX order. Also, ensure that you’re buying Stacks STX and not similar or lookalike tokens.

If you don’t already own a CoinStats account, register one to buy Stacks from CoinStats.

Storing STX

Once you’ve completed your Stacks purchase, the next step is to select a crypto wallet to store your coins safely. While your coins may be stored in your brokerage wallet, we recommend that you create a private wallet using your unique set of keys. You can choose between hardware and software wallets depending on what investment preference you have.

CoinStats Wallet is one of the best software wallets for managing all your DeFi and crypto in one place – a single crypto wallet for buying, selling, swapping, tracking, and earning on your crypto!

These cold wallets (also known as Ledger and Trezor) are among the most secure options. They offer offline secure storage and back-up functionality. They are best suited for users who have a lot of tokens.

Selling stacks

Follow these steps to cash your STX at the exact same exchange you purchased it.

1. Register to your exchange account if you own STX.

If you have kept your Stacks STX in a digital wallet, compare crypto exchanges to choose where to sell it.

2. You can place a sale order.

You can choose how much STX to sell.

3. Close your transaction.

Confirm the price and other fees to complete the STX sale

Can I buy STX from Binance

Binance offers a variety of options for you to buy Stacks (STX), securely and with very low fees.

Here are the steps you need to follow in order to buy Stacks via the Binance app:

Step 1. Register for a BinanceAccount

To buy STX you first need to create an account. It will function as your crypto-buying platform. You also have to verify your identity.

Step 2: Deposit the funds

On the Binance website top left, click the “Buy Crypto” link to view the deposit options available in your country. Select the preferred payment method you wish to use, like a bank wire, debit or credit card, and P2P trading.

Step #3: Get STX

After depositing funds into your account, search for the STX token in the search box, check the STX price and click on the “Buy STX” button. Your order must be placed within 1 minute at the current price or it will be adjusted to reflect the market price after 1 minute. Click Refresh to see your updated order total.

Step 4: Stake or trade your stacks (STX).

To earn passive income, you can keep your STX tokens, either in your crypto wallet or trade them for other coins.

Are STX and STX good investments?

Consider your options before you invest in crypto. Take into account the following:

Distribution:During 2017-19, STX tokens weren’t made public. The founders and unnamed private investors split them. The tokens went liquid in January-2021 after a three year lock period.

Regulation:STX was originally introduced in the United States by the SEC. It was classified as a security and not a currency. This led to regulatory concerns. According to Stacks developers, this decision was allegedly overturned in May 2020. The SEC did not issue a statement.

Adoption:STX has not been widely accepted. There are only a handful of people who can mine STX, compared to the number of slot machines available. Due to their environmental impacts, the crypto industry is moving away from consensus mining mechanisms. It’d be beneficial to perform a more in-depth investigation of the sustainability of STX mining compared to other eco-friendly cryptocurrencies.

Supply: STX’s future supply is limited to 1.8 billion, with 1.25 billion already in circulation.

Closing Thoughts

Stacks (STX), thanks to its distinctive features, makes a significant contribution to blockchain. It’s reasonable to assume that Stacks’ services will increase Bitcoin acceptance and usage in the crypto industry since it provides users with the benefits of combining smart contracts with Bitcoin functionality.

The Stacks blockchain’s incredible functionality allows us to foresee the network’s success in the industry. Stacks appeals to the users as it lets them earn BTC simply by participating in the network.

Our CoinStats blog provides information about crypto exchanges, portfolio trackers and tokens. We also offer in-depth buying guides that explain how to buy different cryptocurrencies.

Advice on Investments

Information on this site is for informational purposes only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products or instruments. This information does NOT constitute financial advice or investment advice.

Because cryptocurrency can fluctuate and be subject to secondary activities, it is important to do independent research and to get advice. You should only risk losing what you have invested. Trading stocks and CFDs can be risky. CFDs can result in losses between 74 and 9% for retail investors accounts. Before making an investment, you should carefully consider your situation and seek advice. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.