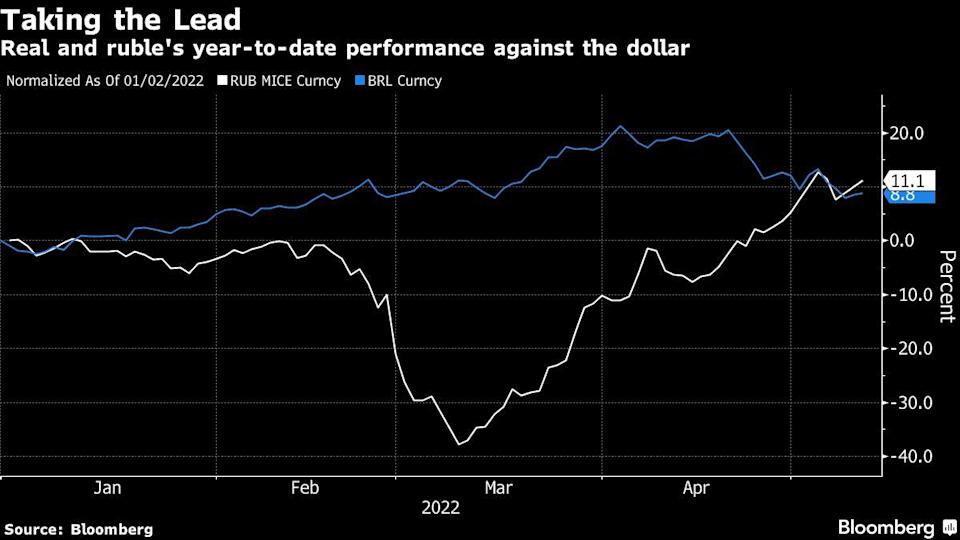

Two months after the Russian ruble fell below a U.S. penny, the transcontinental country’s fiat currency is the best performing currency worldwide. American economists are baffled by the “unusual situation” because a country facing stiff sanctions typically sees its fiat currency decline in value, but Russia’s ruble has done the exact opposite.

Russia’s Ruble Outshines the Euro and Dollar — Transcontinental Country’s Fiat Currency Shows Resiliency

On February 28, 2022, Bitcoin.com News reported on the Russian ruble sinking to record lows, and citizens started to withdraw lots of cash causing what many reports called a “bank run.” At the time, Russia was hit with strict financial sanctions from countries opposed to the war in Ukraine. Furthermore, the United States, the European Commission, and Western allies imposed restrictions on the Bank of Russia’s international reserves.

However, during the second week of April 2022, Bitcoin.com News reported on the country’s central bank slashing rates and pegging the ruble to gold. At the time, Russia’s central bank pegged the price of RUB to 5,000 rubles for a gram of gold. Russia also made it so “unfriendly” countries are forced to pay for gas with the ruble. Many international buyers have begun to comply with this rule, and are now paying in rubles for petroleum products. The country’s central bank also slashed Russia’s benchmark bank rate as well.

In April of that year, the Russian ruble returned to prewar levels. Since then, it has been resilient. In recent times, various headlines from Western-based media outlets have shown that the Russian ruble is the world’s best-performing fiat currency today. Speaking with CBS, Jeffrey Frankel, a professor of capital formation and growth at the Harvard Kennedy School remarked that “it’s an unusual situation” in regard to the ruble rise. The ruble has recorded record highs against the eurozone’s euro and the U.S. dollar.

In the same report, Tatiana Orlova, the lead emerging markets economist at Oxford Economics, said that the increase in commodity prices has been attributed to the ruble’s resiliency. “Commodity prices are currently sky-high, and even though there is a drop in the volume of Russian exports due to embargoes and sanctioning, the increase in commodity prices more than compensates for these drops,” Orlova explained. Orlova further detailed to CBS that there’s been a huge discrepancy between exports and imports in Russia. According to the Oxford economist:

This is a coincidence: as imports plummet, so do exports.

Orlova also discussed the capital controls Russia’s central bank implemented and how foreign holders of stocks and bonds cannot reap dividends internationally. “That used to be quite a significant source of outflows for currency from Russia — now that channel is closed,” the Oxford economist concluded.

Meanwhile, in the United States, the Biden administration is struggling with hot inflation and the president has a hard time discussing the issue, according to a report from the New York Times’ contributors Zolan Kanno-Youngs and Jeanna Smialek. Biden is claiming that “America is in a stronger economic position today than just about any other country in the world.” Biden continues to blame the Russian president Vladimir Putin for the U.S. gas hikes and calls it the “Putin Price Hike.”

What do you think about the Russian ruble’s performance in 2022? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.