Bitcoin trading began in 2009 via peer-to-peer and initially through PayPal. It took only a few months for the first ramp to be launched. Mt Gox, and its predecessors, were, like most, basic and centralized. In less than 10 years, crypto trading was a vibrant business with billions of dollars traded each day.

For billions of dollars worth of assets, exchanges can be used to move them between chains and users. They will play a greater role as the cryptocurrency industry grows and more crypto is adopted. With Decentralized Finance (DeFi), the industry’s leader, this is a great time to see their role grow.

DeFi and the Role Of Liquidity Agregators

In less than three years, DeFi commands billions in Total Value Locked (TVL), with demand stemming from the sub-sphere’s value proposition.

DeFi allows anyone to get funds, and it is decentralizing financial services using smart contracts. It’s exciting, but it requires reliable ramps that have sufficient liquidity so token swaps can be smooth and trustless.

The BNB Chain, Ethereum, and other leading smart contracting platforms are the launch points for decentralized exchanges. They offer relatively high levels liquidity. There are over a dozen active blockchains that host crypto projects, and most traders use liquidity DEX aggregators to move between them.

One user interface allows for smooth exchange of tokens in different DEXes. For example, oneInch can aggregate DEXes. Liquidity aggregating DEXes reduces the time required and increases user access to DeFi.

However, liquidity aggregating DEXes are a huge part of DeFi. Most are single-chain or multi-chain. This allows its users to bridge assets but None have cross-chain aggregation abilities. As a result, traders receive fewer tokens than they would if they could access liquidity on multiple chains at the same time… Oh, wait. You can.

Chainge Finance: The Best Pricing, Cross-Chain and Swift Settlement

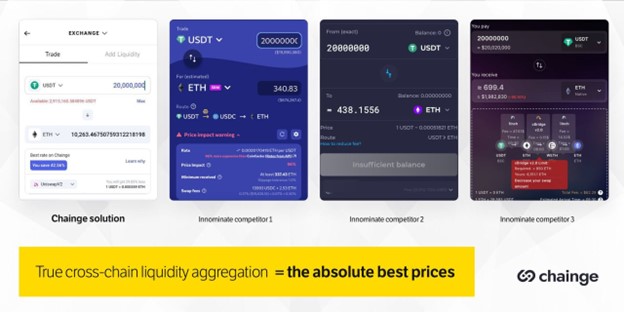

There’s a huge problem that Chainge Finance is currently tackling. The cross-chain liquidity DEX aggregator’s developers have released a blockchain-based trading venue laser-focused on ensuring traders swap assets in the most liquid environment ensuring the best rates.

Chainge Finance allows you to swap tokens through an easy-to-use mobile interface. It also offers useful asset management tools that are used by more than 400k users. This platform has a TVL totaling over $160 million, and an aggregated liquidity exceeding $40 Billion. Chainge Finance offers a variety of distinguished tools, including spot, futures and options, digital assets that can be used across multiple chains, time framing, cross-chain roaming, as well as universal digital assets.

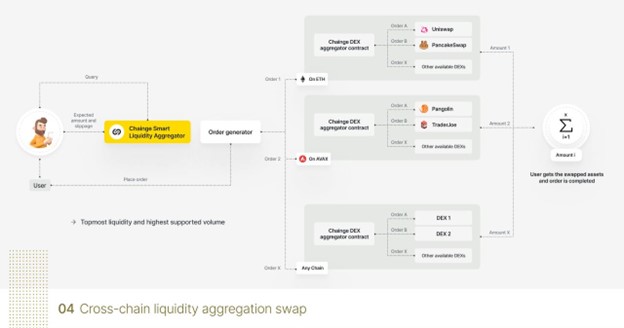

Every order initiated from Chainge Finance will be queried in all 20 supported DEXes and “crawled” for the best prices. The order is complete once the chords are struck. is split across multiple liquid chainsTraders can get the most competitive prices. The part taken can be conveniently viewed in the app’s order details section.

Chainge Finance achieves this by using its smart-router, which leverages DCRM technology as well as a swap pathfinder algorithm. Smart Router searches multiple DEXes to find the lowest slippage rates and establishes a route that allows for quick settlement.

Example

The smart router queries the DEXs to determine the real-time liquidity of the token A/B pair.

Gas cost aside, the smart router is the best way to complete the order.

To illustrate, there is the amount that can be swapped on Ethereum by Uniswap DEX plus the amount that can be swapped on Ethereum chains in Sushiswap DEX and Pancake DEX. This will add up until you reach the swap total.

These steps will be followed after an order has been placed by the user:

- No matter which chain token A it is, Token A will be wrapped in the Fusion Chain

- It is signed the agreement to dispose of all token-A universal assets upon fusion

- To call proxy swap smart contracts, the burn receipt can be used on different chains.

- Swap orders will be executed within the margin of slippage.

Notable: A slippage margin exceeding 10% will result in the swap deal being only partially complete. The user will then immediately receive any remaining tokens.

These use cases should highlight the many benefits of Chainge Finance’s cross-chain liquidity aggregater aka This is the best DEX in the marketplace.

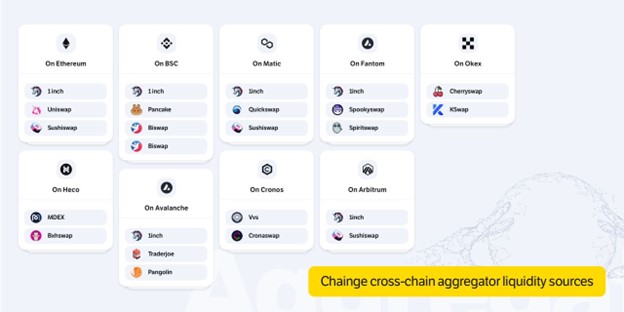

Chainge Finance has Incorporated Over 20 DEXes and 1 Aggregor in 9 Chains

Notably, Change Finance’s DCRM Technology is patented and developed by Fusion Foundation in partnership with some of the world’s leading security and cryptography experts, including Louis Goubin, Professor of Computer Science at the University of Versailles, and Pascal Paillier, Ph.D.

Chainge Finance already integrates with over 20 DEXes as well as 1 aggregator on 9 most popular blockchains (with many more being added). Chainge Finance, for example, integrates with Ethereum 1inchUniswap, SushiSwap. They have also chosen VVS, Cronaswap, and Uniswap in the Cronos Blockchain.

The DeFi protocol has been well thought out and stands out from the rest. This protocol was designed to address existing problems such as inconveniently low liquidity, which can lead to unfavorable swapping rate and eliminate the need for cross-chain bridges.

Chainge Finance created a platform that allows traders to swap cross-chain assets with confidence in highly liquid environments at high swap rates. They can also manage crypto assets supported by the highest-grade security protocols.