According to the U.S. Federal Trade Commission, more than 46,000 individuals reported that they had lost over $1 million in crypto-scams since last year.

FTC Says Scammers Stole Over $1 Billion in Crypto

The U.S. Federal Trade Commission published a “Data Spotlight” report on crypto scams Friday. The FTC is the only federal agency in the country with both consumer protection and competition jurisdiction in broad sectors of the economy, the regulator’s website describes.

Emma Fletcher is a senior data analyst at FTC.

Since the start of 2021, more than 46,000 people have reported losing over $1 billion in crypto to scams – that’s about one out of every four dollars reported lost, more than any other payment method.

In particular, 680 million dollars in losses from cryptocurrency fraud was reported for 2021. Crypto fraud losses amounted $329 Million in the first quarter.

Researchers also noted that $2,600 was the median loss for an individual.

People claimed that they paid scammers with bitcoin (70%), Ethereum (9%), and Tether (10%).

The regulator further explained that nearly half the people who reported losing crypto to a scam since 2021 said it started with “an ad, post, or message on a social media platform.” The top platforms reported by investors were Instagram (32%), Facebook (26%), Whatsapp (9%), and Telegram (7%).

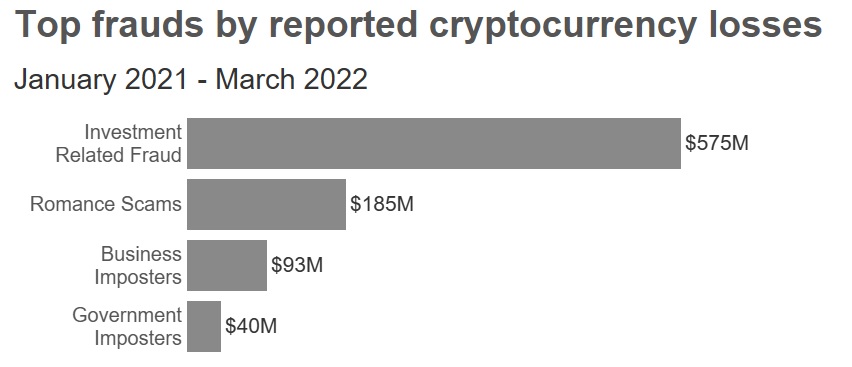

The FTC stated that most of the crypto fraud reported ($575million) was also investment-related. Romance frauds came in second with $185million of reported crypto losses since 2021

According to the regulator, people between the ages of 20 and 49 reported more often that they had lost cryptocurrency to scammers. People in their 30s were the worst affected. The median loss reported by an individual increased as they grew older, reaching $11,708 in the 70s.

Are you a victim of a scam involving cryptocurrency? Comment below to let us know.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.