During the last 30 days, the price of bitcoin has lost more than 22% against the U.S. dollar but during that time, Bitcoin’s hashrate has remained above 200 exahash per second (EH/s). 16 different mining platforms have mined bitcoin, but the five top mining pools retained 71% of global hashrate.

The Top Five Pools Acquired the Most Bitcoin Blocks Last Month Out Of 16

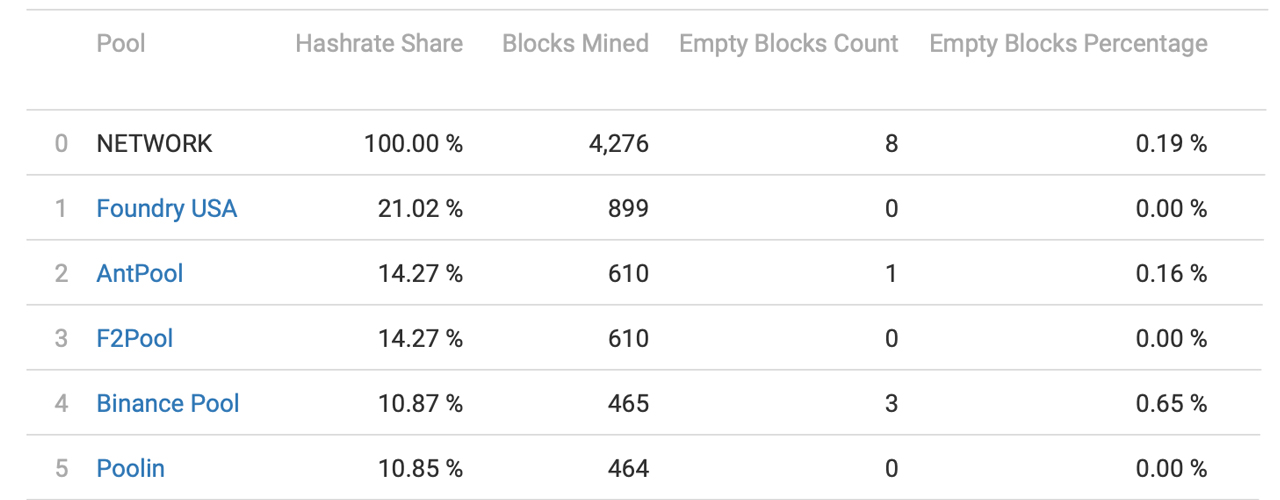

It is now May and in the past 30 days, 4,276 Bitcoin (BTC) Block Rewards were discovered. 26.725 bitcoins, which were newly mined from the block rewards of 4,276 found blocks, have been born to the system. While the network’s hashrate has been above the 200 EH/s zone, on May 2, 2022, Bitcoin’s hashrate hit an all-time high at block height 734,577. According to data from coinwarz.com, it was at 275.01 EH/s that day.

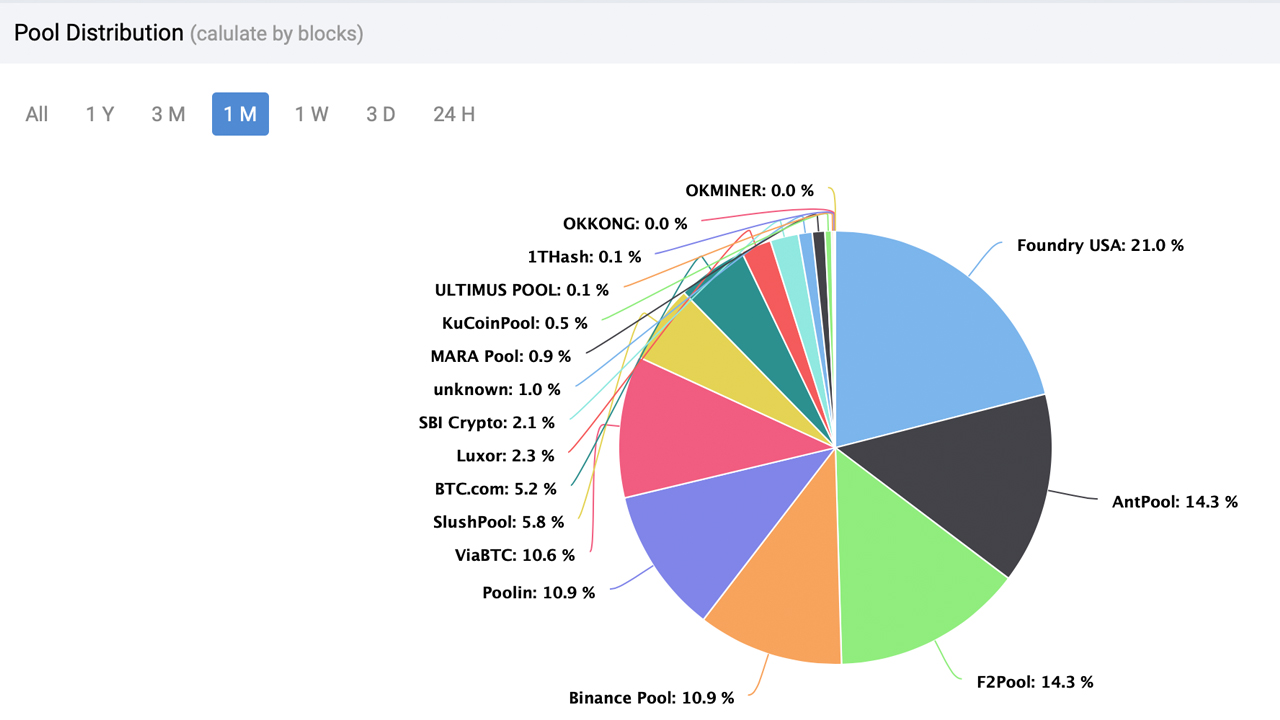

Statistics show that 16 known bitcoin mining pools mined BTC during the past 30 days and stealth miners, otherwise known as “unknown,” captured roughly 1.03% of the hashrate during the last month. From the 4,276 blocks found, 44 were mined by unidentified miners. They earned 275 bitcoin. Further data shows that the five largest bitcoin mining pools (BTC), captured 71% of global hashrate in the last month.

Foundry USA was the recipient of the largest block rewards, representing 21.02% in global hashrate. Foundry received 899 BTC in block rewards from the 4,276 rewards, and was also able to obtain 5,618.75 new minted bitcoins. F2pool (14.27%), Antpool (12.27%) and Binance Pool (10.87%) are the next five top bitcoin mining pools based on hashrate. Poolin is at 10.85%. The global hashrate last month was close to three quarters across all five mining pools.

A few factors are approaching that could change the hashrate distribution and one of them is BTC’s price. BTC seems to be going through a bearish market and a lower value could mean that smaller mining pool are affected. In 700 days the halving is taking place as well, and that means mined blocks will pay out 3.125 coins per block instead of today’s 6.25 BTC per block rate.

The Bitmain, Microbt and Bitmain will launch two new models during July. They produce 140 and 126 Terahash each second, respectively. The two new models produce a higher hashrate per second than most of today’s machines, and pools with access to them will benefit.

What do you think about Bitcoin’s current hashrate distribution? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons. btc.com

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.