TokenInsight 2021 Crypto Trading Industry Annual Review says that industry is continuing to grow. 2021’s trading volume reached $112 Trillion, about half being futures contracts (57 trillion) and 43% spot trading (4 trillion). The total volume of crypto trading increased by 3.37 percent year-over-year. Futures contracts have experienced the greatest growth, with spot growing 2.3 times and delivery contract 2.36 times respectively. Review’s overall findings show rapid growth of the futures markets in 2021. It has now surpassed the spot market and become a mainstream investment channel, which indicates the market’s growing popularity.

Contrary to spot markets lacking diversity, futures and especially linear contracts allow investors to make high-leverage, long-term profits without needing to own different cryptos. A growing number of investors in crypto are now looking into futures markets because they offer this advantage. A large number of investors are aware of the excellent market potential of futures. The futures category is also gaining attention. Crypto exchanges have the potential to gain market share in futures markets and see rapid growth in trading volume if they improve their futures products and offer more user-friendly trading options.

Futures markets have become the preferred investment option for many cryptocurrency users. However, most people new to the industry are unable to access futures contracts. First, there are many differences in the futures markets, which is a platform for trading cryptocurrency derivatives. Second, they lack unified standards. Futures contracts provided by various crypto exchanges have different structures and terms. For instance, futures contracts provided by some exchanges are complicated and require high learning costs, while others offer professional-exclusive futures mechanisms that are not friendly to beginners.

Investors who are just starting out in the futures market need to take into account product simplicity and ease when selecting a futures trading platform. CoinEx Futures is a great choice in this regard as it strives for easier futures trading.

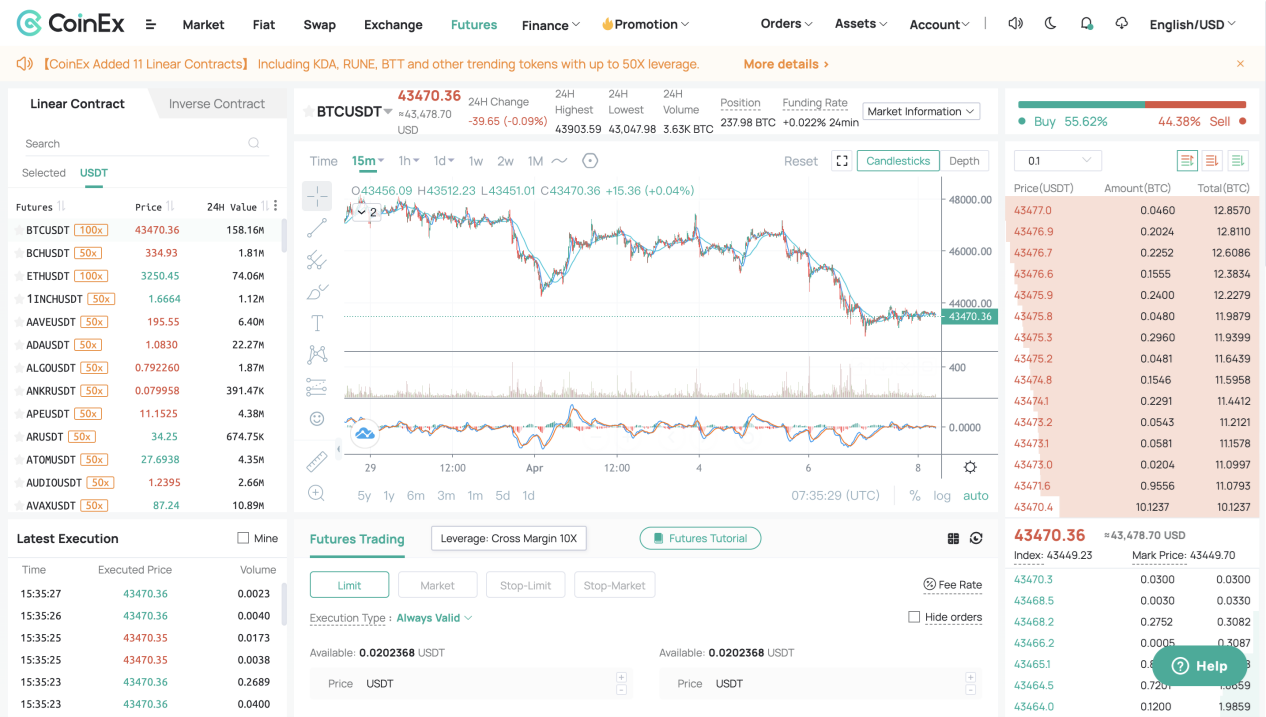

I. CoinEx Futures: A simple webpage & An intuitive futures segment

CoinEx is a very simple website for futures trading. Once they have entered the futures page, the user can choose a market to trade linear/inverse contracts. After selecting a market, the market will display the current market conditions as well as any orders.

Secondly users will find the Futures Tutorial to help them learn the basics of futures trading. After watching the videos and answering the questions, newbies will feel more confident in trading before they open a position.

II. KYC-free futures trading: CoinEx preserves traders’ anonymity

II. KYC-free futures trading: CoinEx preserves traders’ anonymity

Users do not need to undergo KYC authentication when trading futures with CoinEx. This solves an operational problem facing crypto users from certain regions/countries. At the same time, the exchange protects users’ assets with multiple security strategies. CoinEx promises that crypto assets are 100% protected, so users can start positions and make profits without any worries.

III. CoinEx allows users to reduce position risk more easily through multiple futures trading platforms

CoinEx provides multiple options for futures, including Auto-deleveraging, the Insurance Fund and the Funding fee. This allows users to manage their positions and minimize risk. CoinEx Futures’ Index Price is calculated from the average spot price of multiple trading platforms. It also features an exception-processing logic. This ensures that the Index Price is stable when the prices provided by one platform become significantly volatile. It also eliminates futures traders’ worries.

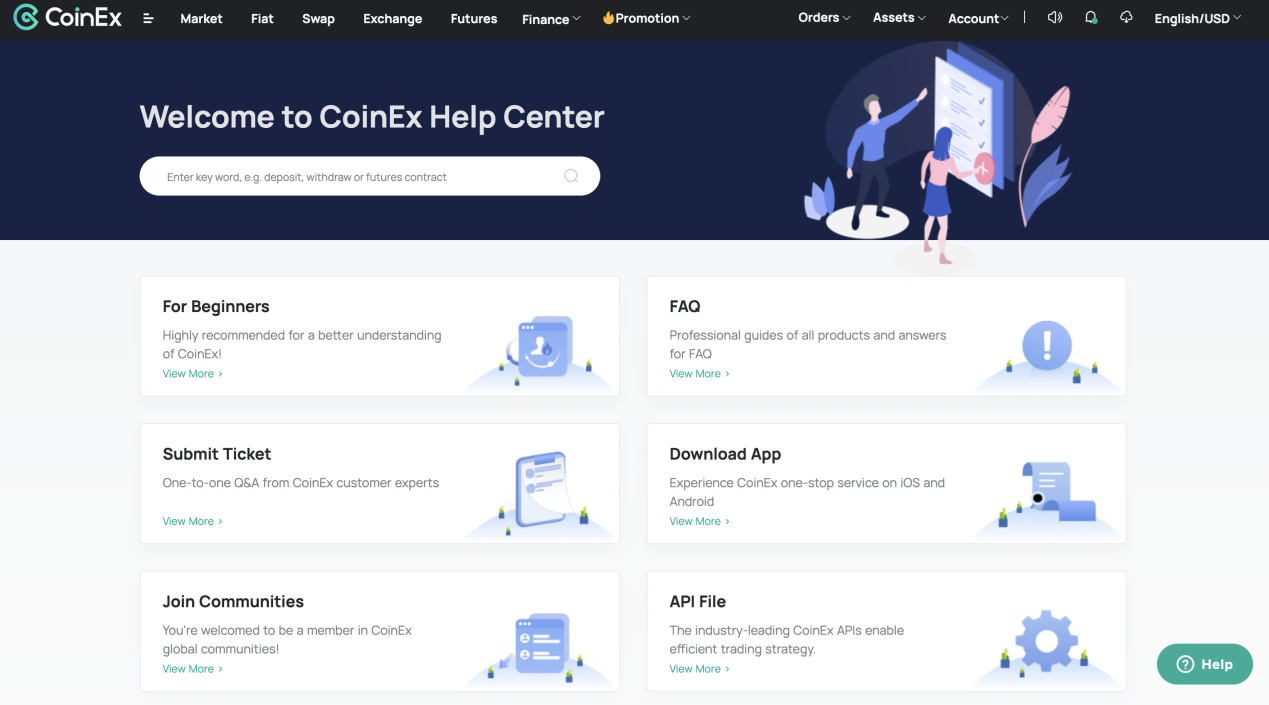

IV. The all-inclusive Help Center offers step-by-step instructions on futures trading.

CoinEx provides a comprehensive, professional Help Center. This allows you to learn about blockchain technology and how to trade cryptocurrency. Users can quickly learn about futures through simple videos and illustrations, along with simulated trades. They can search the Help Center for futures terminology definitions.

CoinEx gained a large user base over the five years that it has been in existence. This is due to its established product ecosystem, easy trading and excellent customer services. CoinEx released data in 2021 that showed a significant increase in futures trading volumes. This is a strong indicator of the fact that CoinEx Futures is becoming more popular among crypto investors. CoinEx currently offers 100+ futures markets. The exchange will keep its futures focus and provide a wider range of options for futures. It also offers a simpler, more efficient trading experience.