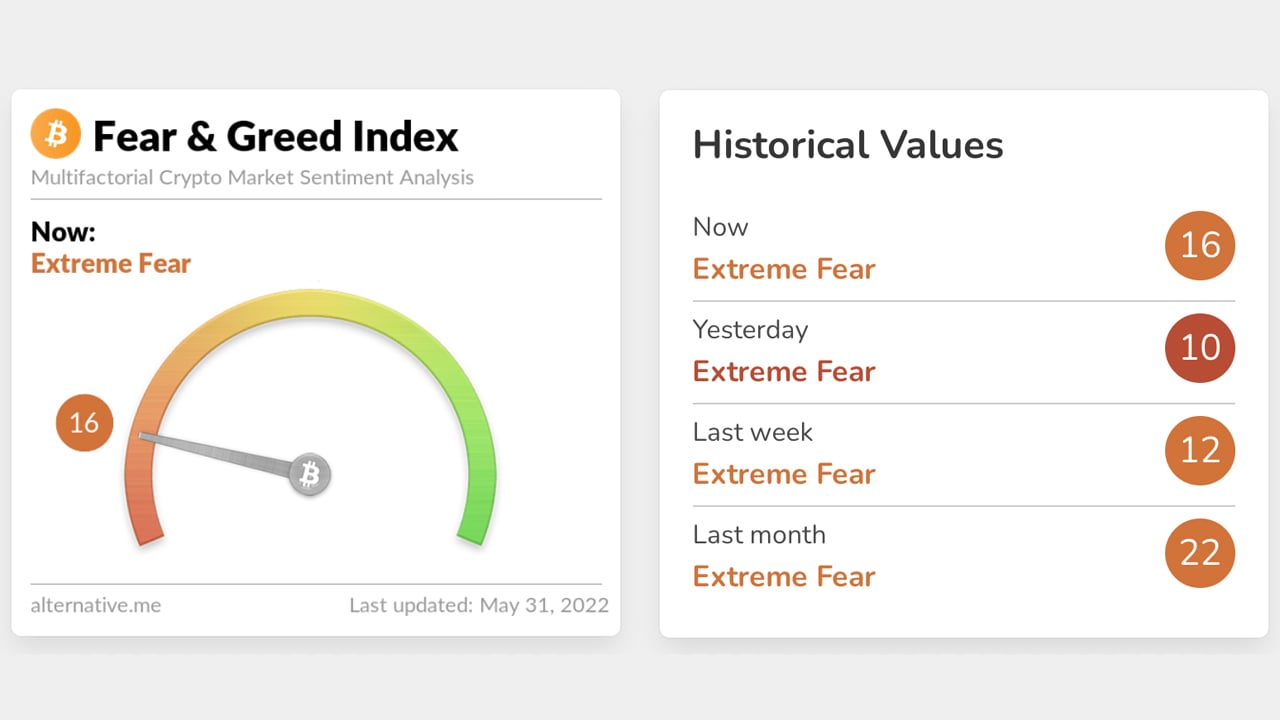

For a few weeks now, bitcoin sentiment stemming from the Crypto Fear and Greed Index (CFGI) has been in the “extreme fear” range. While bitcoin gathered some gains on Monday, the CFGI is still in the “extreme fear” position with a ranking score of 16 out of 100.

Crypto Fear and Greed Index Remains in ‘Extreme Fear’

Approximately 45 days ago, the Crypto Fear and Greed Index (CFGI) hit the “extreme fear” range with a score of 22. On April 15, bitcoin prices ranged between $39823.77 to $40,709.11 per one hour. BTC has fallen even further since then, with a May 12 low of $25,401. This is lower than July’s previous lowest. Today, if someone bought Bitcoin on May 12, they would have a gain of more than 24% compared to the U.S. Dollar.

Despite the gains during the past two weeks, the CFGI is still in the “extreme fear” zone and the ranking is even lower than it was on April 15. At the time of writing, the CFGI ranking score is 16 out of 100, but it doesn’t necessarily mean markets will remain gloomy. Alternative.me hosts the CFGI, which measures market sentiment. The website makes two basic assumptions.

- Extreme fearThis could be an indicator that investors are worried too much. This could indicate a potential buying opportunity.

- When investors are getting Too greedyThis means that the market needs to be corrected.

But extreme fear can lead to even more capitulation. The so-called buying chance may also be lower. One could assume that the current buying window is tied and that people will be happy to buy BTC as it falls. The CFGI’s simple assumptions are just that, as they may be accepted as truths, but they may not end up coming to fruition.

On the same token, if “investors are getting too greedy,” as the CFGI says, it doesn’t necessarily mean crypto markets will correct. It means that if someone followed such advice, it could lead to them selling BTC at lower prices than they would make if they waited. Then again, there’s always the age-old investment advice that says there’s nothing wrong with taking profits along the way.

Crypto market sentiment, at least according to the CFGI, has been in the “extreme fear” region for well over a month. Yesterday, May 30th, the index tapped a rating score of 10, meaning that the latest CFGI Score of 16 was an improvement. Google Trends metrics for the query “bitcoin” show interest has ticked up from the recent Terra fiasco.

Google Trends data (GT) worldwide shows that bitcoin interest was low before Terra LUNA/UST. But during that specific week (May 8-14), GT data shows the search term “bitcoin” skyrocketed to the highest GT score (100) since the second week of June 2021. The week after the Terra LUNA and UST market carnage, however, the GT data score for the term “bitcoin” dropped by 45%.

What do you think about the Crypto Fear and Greed Index tapping a score of 16 and remaining in the “extreme fear” zone? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.