On-chain data shows the Bitcoin exchange whale ratio has remained at a high value recently, a sign that could be bearish for the crypto’s price.

Bitcoin Exchange Whale Ratio On Verge Of Entering “Very High Risk” Zone

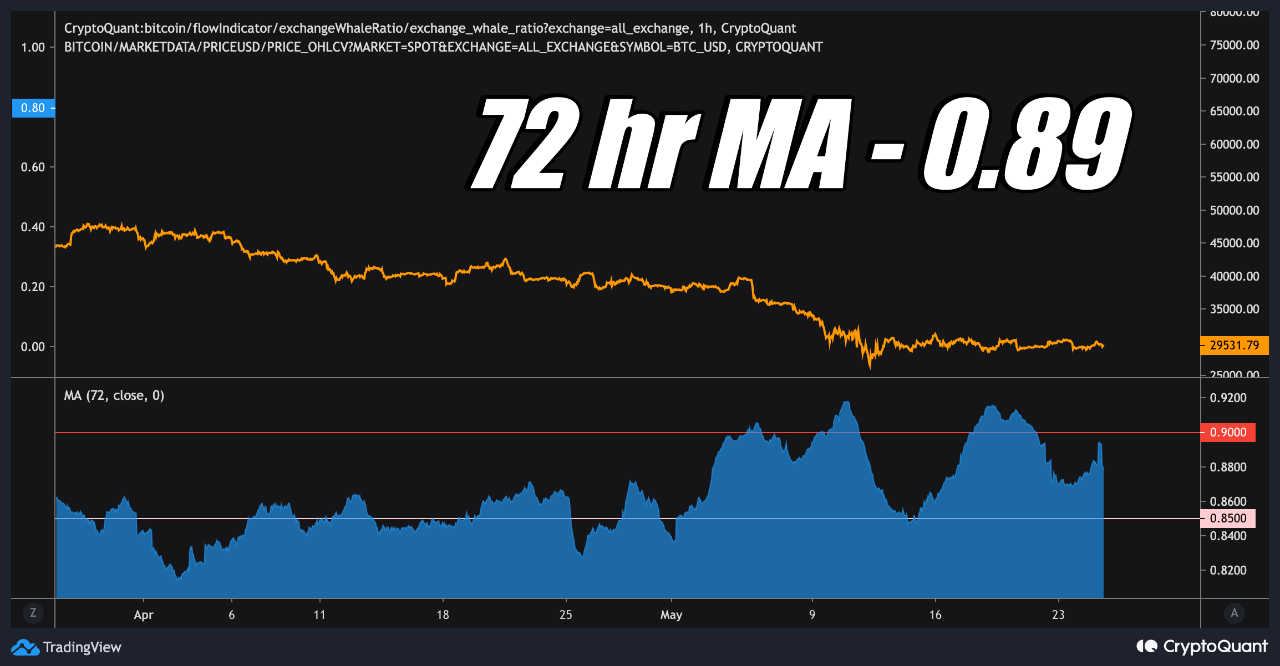

A CryptoQuant analyst explained that the 72 hour MA whale ratio was close to 0.90. That is the highest risk zone.

The “exchange whale ratio” is an indicator that’s defined as the sum of top ten inflows to exchanges divided by the total inflows.

The metric measures how large the transactions that are the largest in terms of dollars, and which usually belong to whales.

If this indicator’s value is greater than 0.85 it indicates that whales are receiving a large share of current exchange flows.

This is because investors often transfer Bitcoin to exchanges in order to sell it. It could indicate that whales may be dumping at the moment.

The indicator’s value usually remains above this threshold during BTC bear markets, or fake bull for mass dumping.

Read Related Article: The Bitcoin Trading Volume Drops From the Recent Top| Bitcoin Trading Volume Plummets Down From Recent Top

Lower values, on the other hand signify that there is a greater balance between whale inflows and the rest of market. The ratio’s value usually remains in this region during bull runs.

Here’s a chart showing the trends in the Bitcoin exchange whale rate (72-hour MA), over the last few months.

Source: CryptoQuant| Source: CryptoQuant

The above graph shows that the Bitcoin exchange whale ratio is currently at 0.89, which is higher than the threshold of 0.85.

According to the quant in the post, values above 0.90 may be considered the “very high risk” zone. This means that the current indicator value is close to 0.90.

Similar Reading: Investors may expect a downturn in Bitcoin and the market for the next 3 months| Investors May Expect Downside For Bitcoin And Ethereum Market For The Next 3 Months

In this month so far, the ratio’s value has almost always remained above the 0.85 line, with a couple of spikes above the 0.90 level.

According to an analyst, whales may be active at the moment due to FED May Meeting Minutes. If this ratio continues in the future it could mean trouble for Bitcoin.

BTC Prices

At the time of writing, Bitcoin’s price floats around $28.8k, down 2% in the last seven days. The crypto’s value has dropped 30% over the last 30 days.

Below chart displays the trends in the value of the coin during the last five working days.

The price of Bitcoin seems to have fallen over the last few days. Source: tradingView.com/BTCUSD| Source: BTCUSD on TradingView

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.