BitMEX Pros

- A few of the best professional platforms for trading derivatives

- Leverage trading up to 100x

- Trading fees are low

- Easy to use, user-friendly features

BitMEX Cons

- Email/ticket-based customer support

- As been mired by controversies

- This is not for novice or inexperienced users

Decentralized Finance is a major trend in the blockchain industry. The global cryptocurrency market cap reached an all time high of $1 trillion.

The total value of cryptocurrency is $3 trillion. All investors, financial institutions and individuals are interested in crypto. A crypto exchange account is required to purchase and sell digital currencies. But choosing from the many available exchanges can be confusing.

CoinStats is a regular review of the most popular platforms, and provides information about their strengths and weaknesses.

BitMex, a crypto and derivatives trading platform that allows traders to trade futures or perpetuals for a variety of crypto assets, is very popular.

This ultimate BitMEX review will reveal everything you need to know about the BitMEX exchange, its features, services, trading fees, etc., to help you decide if it’s a suitable exchange for you.

So without further ado, let’s get started!

What’s BitMEX?

BitMEX Company Overview

Business Overview BitMEX is the Bitcoin Mercantile Exchange. It’s headquartered in Seychelles and operated by HDR Global Trading Limited. HDR Global Trading Limited (BitMEX), was established under the International Business Companies Act of Seychelles 1994. It operates out of Hong Kong.

BitMEX is Arthur Hayes and Ben Delo launched the website in 2014.The ed platform offers professional-grade Bitcoin derivatives trading. BitMEX launched perpetual futures trading in 2016 as the first cryptocurrency trading platform. BitMEX is the leading trading platform for leveraged trades over the past 8 years. BitMEX offers Bitcoin leveraged Swap contracts that allow trading at up to 100x leverage. They also have no expiry dates. BitMEX was thus able rank high among Bitcoin exchanges that have the largest volume.

The BitMEX exchange trading is complicated and only professional traders who are able to trade high-risk assets should be able to do so. The exchange hasn’t got any user complaints or controversies, although it has faced several lawsuits where it was alleged of market manipulation, trading against its customers, money laundering, and breaking international compliance laws. In 2020, the Commodity Futures Trading Commission charged BitMEX with violating anti-money laundering laws in operating a virtual currency exchange while doing business out of the U.S. and letting U.S. customers trade crypto on their platform, although it wasn’t allowed to operate in the U.S.

Despite BitMEX’s lack of regulatory compliance and its founders’ criminal charges in the U.S., the exchange is on its way to becoming the world’s largest regulated derivatives exchange. BitMEX implemented identity verification in 2020 for all its users.

BitMEX has since established itself as the world’s leading derivatives exchange with advanced trading tools, a professional user interface, and some of the deepest liquidity for Bitcoin perpetual futures contracts in the market. BitMEX is a trading environment for advanced traders that offers both margin and futures trades and perpetual contracts.

Although the BitMEX mobile app doesn’t have all of the exchange’s products and features, it allows users to manage their trading positions on the go seamlessly.

Supported Cryptocurrencies

BitMEX was created to be used by more skilled professional traders. This means that there are a limited number of cryptocurrency available. Most altcoins that have gained popularity with everyday retail users aren’t listed on the exchange. As of the writing date, the exchange supported the following cryptocurrencies.

BitMEX supports tokens of decentralized exchanges, such as UniSwap (and Sushiswap) and Sushiswap.

Services

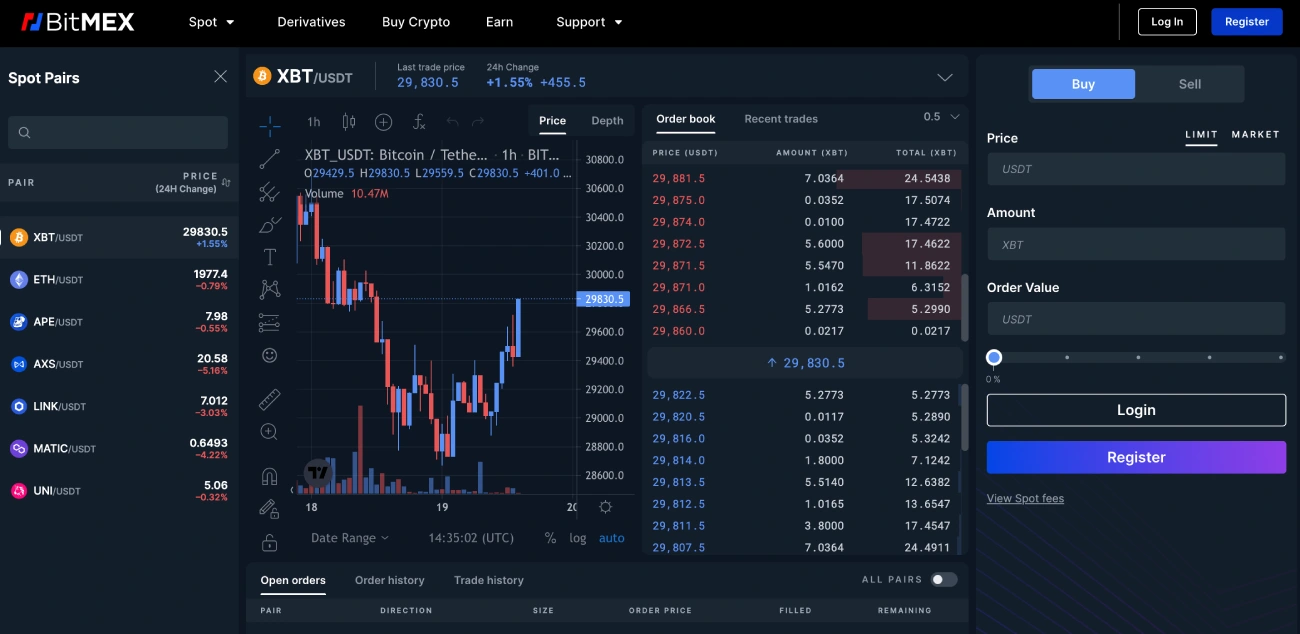

It The BitMEX exchange was not created for casual, new or retail traders as they might find the exchange’s interface a bit confusing. Veteran traders instead use the technical tools on the platform to trade margin or other derivatives strategies. The most widely used crypto trading tools on the platform include:

- Bitcoin Leverage Trading with 100x (However this isn’t a fixed multiplier, but rather a minimum equity required determined by the Initial Margin or Maintenance Margin levels.

- Trade execution and market data at low latency

- High-quality APIs for pricing and crypto trading

- BitMEX users can earn up to 10% on their idle funds

- BitMEX futures contracts allow users to trade Bitcoin derivatives, at a predetermined cost.

- Perpetual contracts and futures have no expiry dates due to margin-based spot trading at Bitcoin index prices.

- BitMEX Upside profit contracts that allow traders to take part in bull-runs of assets like Bitcoin

- The Profit Market Order (or profit market order) is an option that’s executed when the market hits a trigger point.

- A Profit Limit Order is an order that sets a limit on a trigger market price.

- Traditional futures contracts have high liquidity

- This calculator calculates profit and losses to assist traders in assessing the potential risks associated with trades.

- BitMEX’s trading engine is an automated Python bot designed to make it easier for users to trade efficiently and faster.

- BitMEX Market Maker supports many API keys, which provide an excellent starting point to trade and the ability to implement new trading plans.

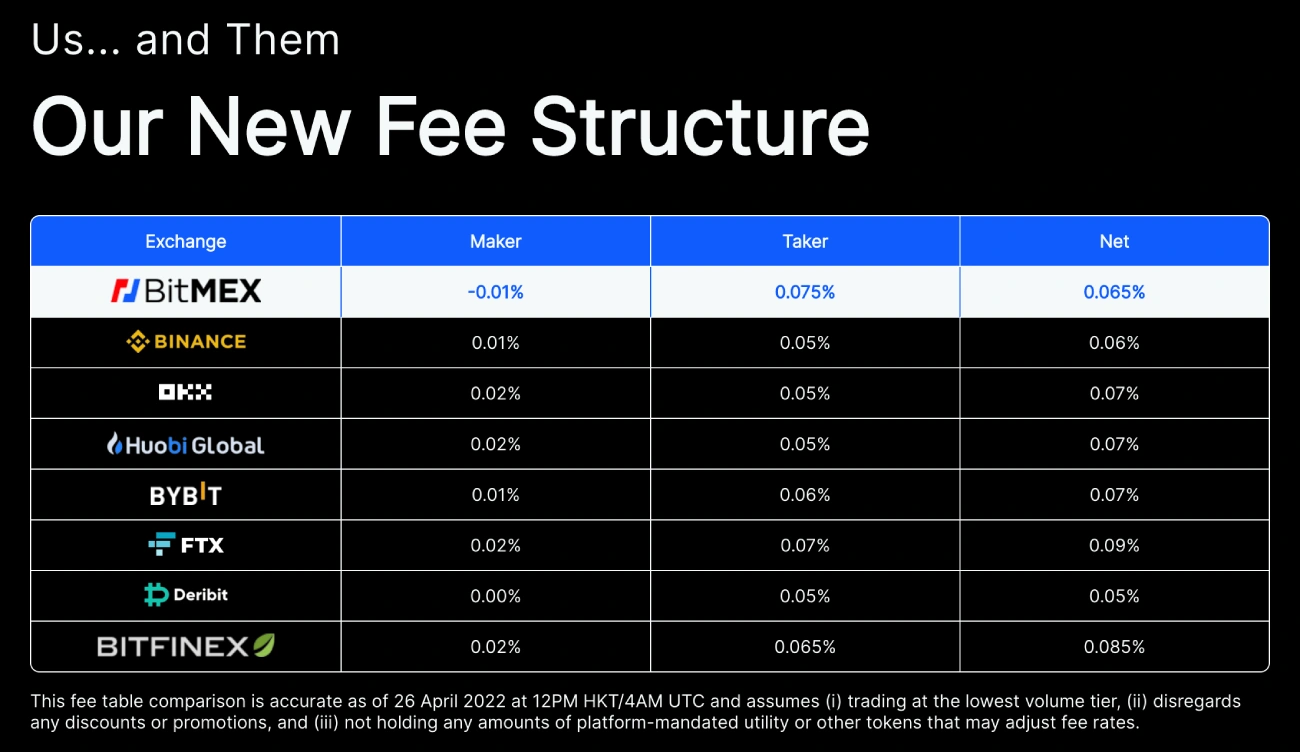

Commissions for trading

BitMEX charges some of the most affordable fees on the market. Price takers pay 0.075% commission for their trades. Price makers get 0.01 percent rebate per trade. BitMEX does not charge any fees to deposit Bitcoin or withdraw Bitcoin. The only fee that BitMEX users must pay is the Bitcoin network service fee. USDT (USDTether) deposits can also be made free of charge. However, USDT withdrawals will incur an Ethereum gas fee. BitMEX offers different fee structures to high volume traders. You can find more information at BitMEX Fees. BitMEX also offers different fees for trading perpetual swap contracts and futures trading.

BitMEX allows users to trade cryptocurrency with the lowest fees possible in crypto.

Is BitMEX safe

As investing in cryptocurrencies and other Initial Coin Offerings (ICOs) is highly risky and speculative, the trading platform must imply robust security measures to protect users’ funds from cyber attacks, hacks, etc. BitMEX has many security options, including cold storage, two-factor authentication and cold storage. To protect BitMEX from illegal elements and other activities, KYC verification is required for BitMEX users. BitMEX offers several security options, including:

- Multi-signature cold walletsBitMEX is a crypto exchange that securely holds most cryptocurrency assets offline in cold wallets located at geographicly distant locations.

- Two-Factor Authentication: Users will need to create two-factor authentication with third-party apps such as Google Authenticator in order to use the cryptocurrency exchange.

- The Whitelist for Withdrawal of Wallets: Whitelisting allows users to choose which crypto wallet they want to send their crypto assets.

These are the key features that make BITMEX a reliable and secure trading platform.

Set up a BitMEX account

It is easy to set up BitMEX accounts. To create your BitMEX account, you will need an email address that is valid and a password. An email verification will be sent by the exchange to confirm your email address. To get verified, you need to provide a valid photo ID, a presence capture video or selfie, your location, your citizenship, and how you’ll fund your account. After the verification you will be able to trade on the exchange.

You can deposit using the following methods

BitMEX supports only crypto-tocrypto trading. BitMEX users can’t deposit fiat currencies to their trading accounts. The only payment method available on BitMEX is bitcoin, meaning you’ll have to deposit bitcoin to your Bitmex account to buy cryptocurrencies at the current market price.

BitMEX accepts withdrawals and deposits made from several crypto wallets. CoinStats Wallet, which is the safest wallet to deposit and withdraw to BitMEX accounts, is also one of our most trusted. To make barcode-based deposits, users can use BitMEX’s mobile wallet.

BitMEX currently integrates BANXA & MERCURYO fiat payment gateways. This provides users with a safe way to buy crypto using fiat.

You can track your assets if you already own BitMEX assets. Connect your BitMEX to CoinStats to get started.

Customer Support

BitMEX doesn’t offer chat support, phone support or customer service via email. Support tickets can be opened and emails sent to customers. Users who use margin trading or 100x leverage trading may find this a problem. They can suffer huge losses due to the lengthy waiting periods. BitMEX users have been growing in number, so user complaints have also increased. Users complain about problems withdrawing funds, market manipulation, and complicated user experiences. Even though customer service is available to answer any question or clarify any misunderstandings, there have been numerous accusations against the exchange for market manipulation.

Final Verdict

BitMEX has been the most trusted exchange among seasoned traders. It’s a peer-to-peer cryptocurrency derivatives trading platform that offers leveraged contracts and is one of the largest margin trading platforms worldwide. You can sell and buy trading contracts in cryptocurrencies, as well as margin trading.

BitMEX has a very simple interface that allows advanced traders to use a variety of trading strategies such as traditional futures, margin trades and leverage trades. It also offers a profit and loss calculator that helps you make better margin trading decisions. The exchange’s high leverage of up to 100x and low trading fees makes it an attractive choice. While the exchange offers several advantages, its drawbacks include the limited number of supported cryptocurrencies, the exchange’s lack of regulatory compliance, and its founders’ criminal charges in the U.S. Additionally, the customer support on the exchange is only ticket/email-based, which doesn’t provide a quick resolution for urgent issues.

However, the BitMEX exchange has maintained its credibility and secured its users’ interests over the years.