The value locked in decentralized finance (defi) protocols has lost 17.77% over the last 30 days, falling from $221.67 billion to today’s $182.27 billion. Statisticians also show significant losses in total value locked (TVL), across many defi protocols, over the past seven day.

Defi Protocols Shed Considerable Value

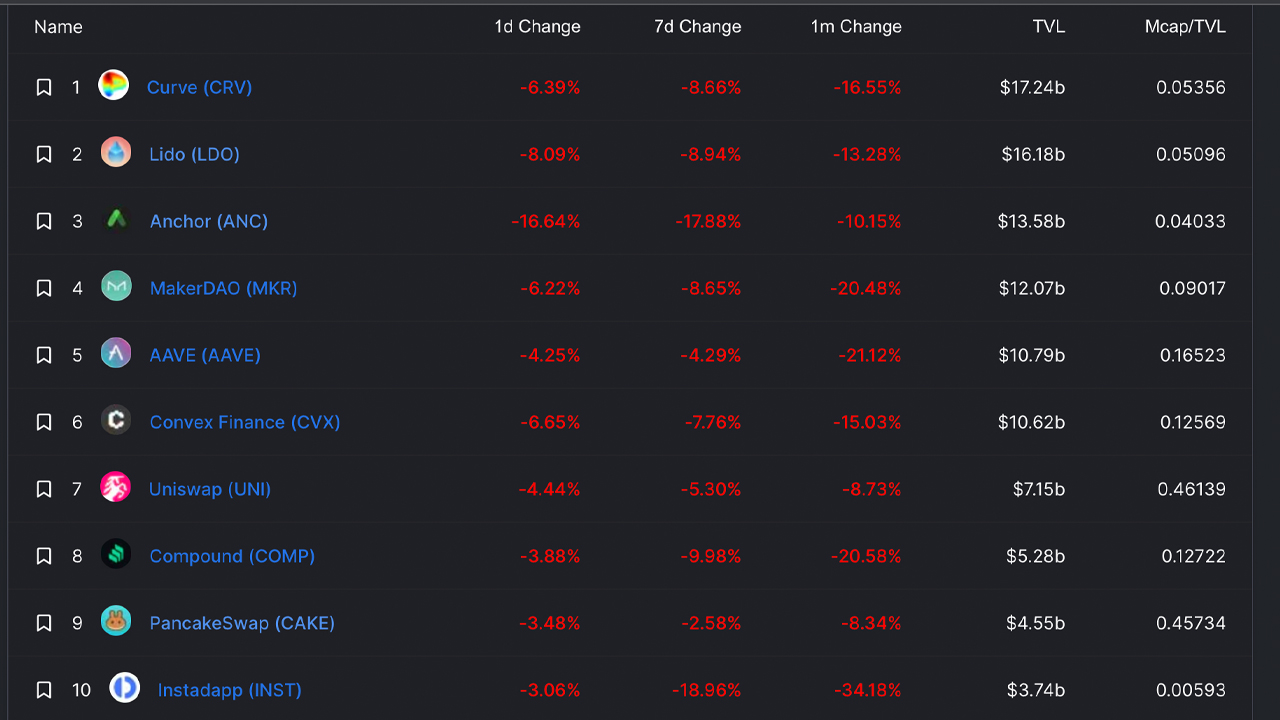

Since April 8, 2022, 17.77% has been removed from defi’s TVL. This is a significant loss in the value of decentralized financial (defi!) protocols. Curve Finance lost 16.55% in TVL this month while Lido saw a 13.28% drop in value in the past 30 days. Curve Finance is currently the biggest defi protocol. Anchor’s TVL is down 10.15%, Makerdao has dipped by 20.48%, and Aave’s TVL has lost 21.12% this past month.

Two protocols saw substantial 30-day TVL gains which include Aave’s version three (v3) and Tron’s Sunswap protocol. Curve Finance is the biggest protocol today by TVL, with a drop of 6.25% in the TVL in Defi. As of Sunday afternoon (ET), Curve’s $17.24 billion TVL currently dominates the aggregate by 9.46%.

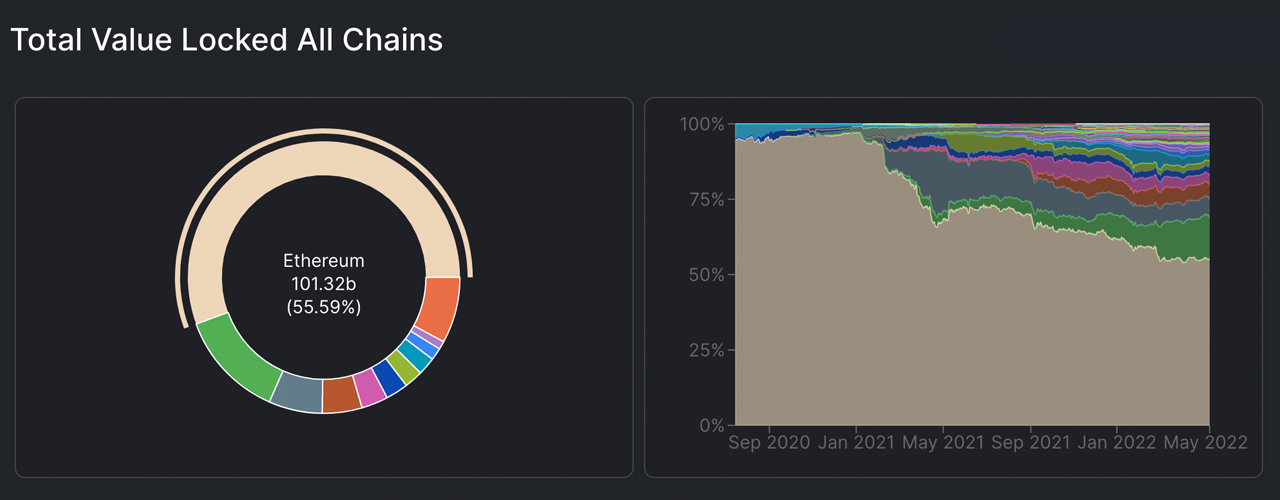

Ethereum is still the dominant defi TVL, with 55.59% of $182.27 Billion TVL held by Ethereum. The ETH chain holds $101.32Billion. Terra is the second largest, in terms of defi TVL, as Terra’s $23.44 billion represents 12.86% of the defi TVL aggregate. Binance Smart Chain, (BSC), is the third largest blockchain in defi. It holds 6.37% of total. This is approximately $11.6 billion.

According to market capitalization, $546 billion is the total value of smart contract platforms today with tokens. The top smart contract tokens lost 6.1% collectively over the last 24 hours. The TRX has risen 5.3% in the last 24 hours, but tron (TRX), still managed to rise 5.3%.

The coin’s 19.4% loss today was the result of counterparty (XCP) being one of the largest losers in smart contract tokens. Terra (LUNA), which also lost a large percentage, had lost double digits in the past 24 hours. LUNA’s USD value fell 11.1% today. Cross-chain bridge TVLs have also fallen 21.1% over the past 30 days according to statistics. There’s currently $16.78 billion TVL across a myriad of blockchain bridges.

Avalanche (Polygon), and Arbitrum are today’s top cross-chain Bridge TVLs. Today, the top three most leveraged crypto assets on cross-chain bridges are USDC (wrapped ethereum) and USDT (tether). While the entire crypto economy has lost 5.1% in value over the last 24 hours down to $1.65 trillion, it’s likely the value locked in defi will follow.

How do you feel about decentralized financing market actions? Please comment below on your views.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.