Bitcoin’s (BTC) prices have finally begun to rise after a third consecutive week of losses. BTC’s price has effectively rebounded from the important support level of $37,500, despite an impending Federal Reserve rate hike.

Bitcoin Poised for a 10% Jump

Numerous analysts like Michael van de Poppe and The Wolf of All Streets are positive about the bullish trend. The Bitcoin price is currently above $39,000.

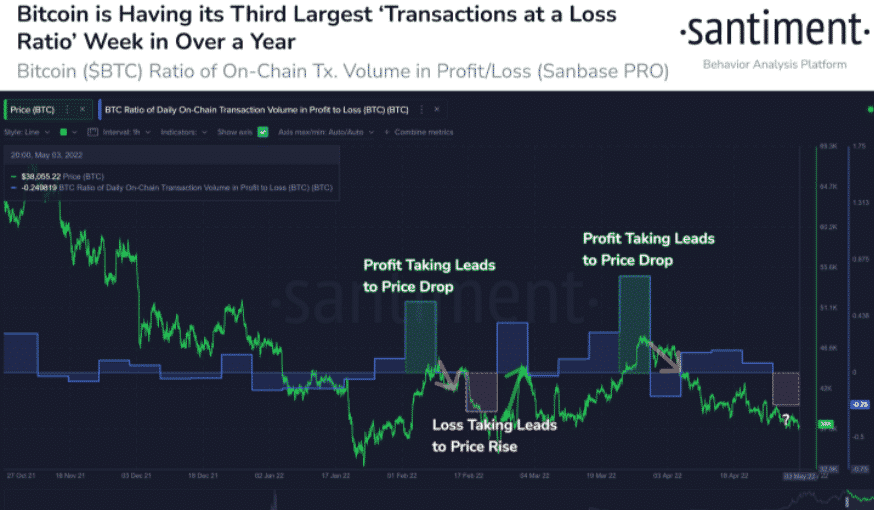

Santiment, a provider of on-chain data, tweeted May 4 that historical data showed a 20% rally due to BTC transactions. The data was negative at the same levels as February 16-22. The week’s Bitcoin Ratio of On-Chain Transactions Volume in Profit/Loss statistic is the third largest capitulation in a year.

Technical improvements are leading to many traders and analysts predicting a price rise over the next few days.

Michaal van der Poppe says that Bitcoin (BTC),’s price will increase from the current levels. He stated,

“Bitcoin starts to look way better at this stage. Odds that the event tonight is a ‘Sell the rumour, Buy the News’ event are increasing.”

The Wolf Of All Streets was a well-known crypto trader. predictedA rebound in Bitcoin prices is possible if it crosses above the trendline. If the BTC price stabilises above $39,000, a big increase could be expected.

Bitcoin On-Chain Transactions Volume. Source: Santiment

PlanB claims that the Bitcoin price trend is being tracked by the $55K original S2F model. It was first released March 2019. He believes that Bitcoin will rise in value.

Bitcoin prices (BTC) have risen by more than 5% within the last 24 hours and are now at close to $39,000 The whales are still accumulating at the bottom of dips which has led to a significant increase in trading volume. A drop below critical support has not been seen by the BTC. This suggests that there could be a rally in the coming days.

Recommended Reading: Bitcoin is now worth $40,000, as More Countries adopt Cryptocurrencies| Bitcoin Briefly Tops $40,000 As More Countries Adopt Crypto

BTC Trades Sideways

BTC traded sideways for the last few days. The price fell below $40,000 on April 26, with BTC trading at a loss. Despite reaching swing highs of nearly $48,000 on April 26, the price is already beginning to fall. BTC lost 45 percent of it’s value and retreated. BTC buyers, on the contrary, feel weary because the price is trading sideways within a tight range since April 25, but it has been moving in the right direction.

B

BTC/USD trades sideways. Source: TradingView

A daily close below the session’s low, on the other hand, would disprove the bullish price assumption. The lowest point of the downside would then be at $36,000.

BTC/USD currently trades at $39874, an increase of 5.63 percent over the previous day. CoinMarketCap shows that Bitcoin/USD is the most popular cryptocurrency according to market capitalization. It has a 24 hour trading volume of 35,528,442,016.

Will Bitcoin Shoot Over $40,000 — Or Drop To $35,000?| Will Bitcoin Shoot Over $40,000 — Or Drop To $35,000?

Volatility falls

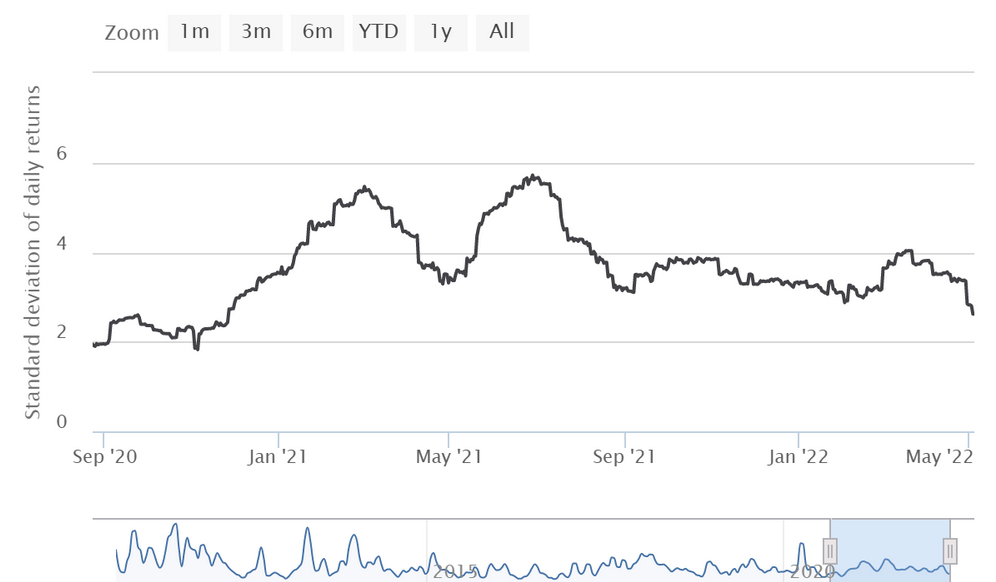

Bitcoin’s historical volatility is at 18-month lows, according to statistics released by the Buy Bitcoin Worldwide webpage. The expected 60-day average bitcoin value was 2.62%.

Last time bitcoin (BTC) volatility dropped this low was in November 2020. This is when the orange currency broke through $10,000 and began this bullish cycle.

Image Credit to Buy Bitcoin Worldwide

The local level of thirty-day volatility was at its lowest point on April 27, 2022. But, signs are already beginning to show that it’s recovering.

The Bitcoin Volatility Index (BVOL), similar to the stock market’s VIX, shows how much Bitcoin’s price changes on a given day in relation to its previous price.

In July 2021, Bitcoin’s volatility was at its highest point. The cryptocurrency’s flagship currency was two times more volatile in a period of 30 days than it is today.

Featured image taken from Pixabay. Chart from TradingView.com