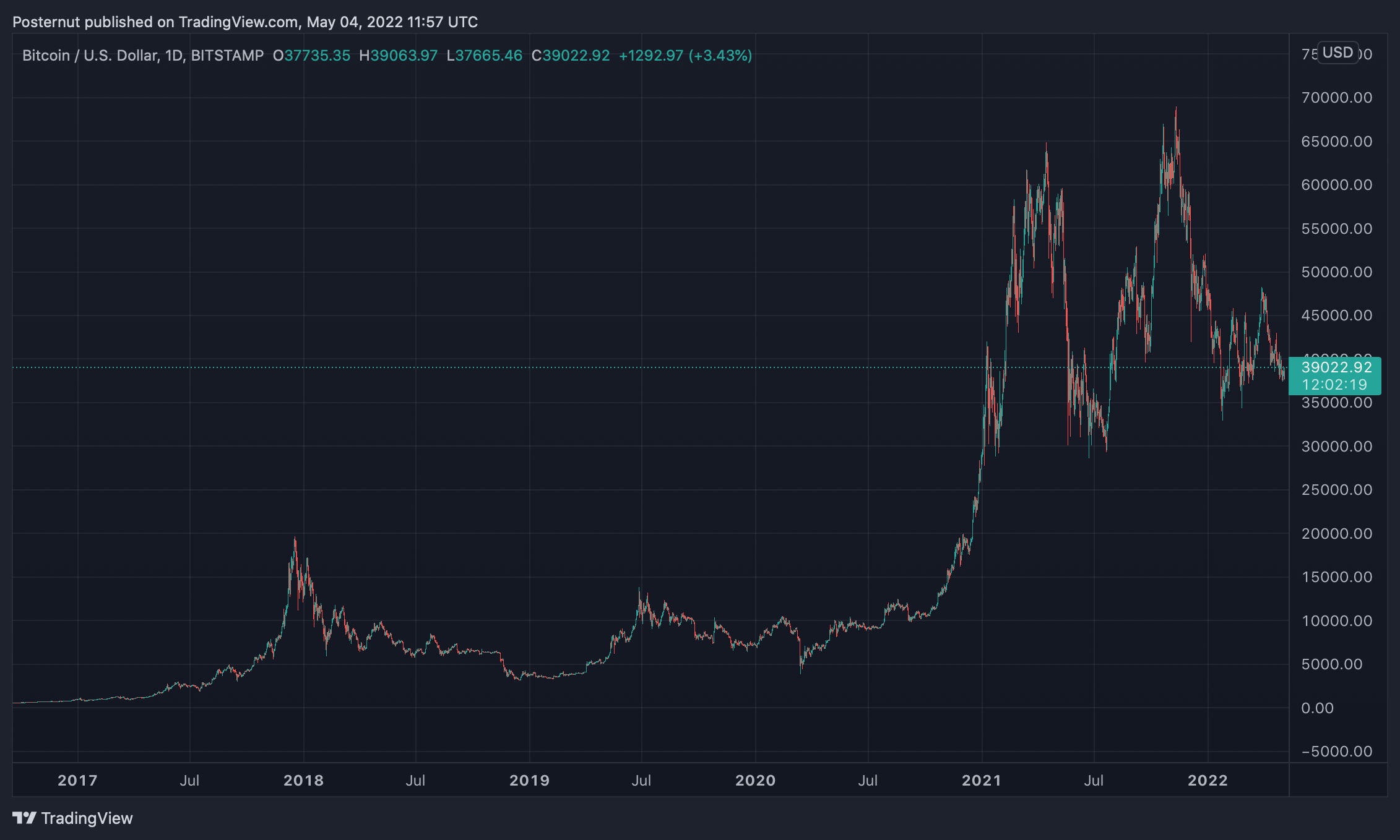

It’s been six months or roughly 180 days since bitcoin reached an all-time high at $69K per unit on November 10, 2021, and bitcoin’s USD value is down 45% from that point. Typically after bitcoin’s price tops, the bear market that follows leads to a large 80% or more decline in value. However, because the recent price top resembles the growth from April 2013 to November 2013, bitcoin’s current bearish decline may not be so large this time around.

An 80% Drop From Bitcoin’s High Would Lead to $13,800 per Unit

Bitcoin markets have been bearish over the last six months after reaching the crypto asset’s all-time high (ATH) at $69K last year. While prices are dreary for many, it’s made people wonder how long the downward cycle will last.

Using today’s bitcoin (BTC) exchange rates against the U.S. dollar indicates that the leading crypto asset has lost 45% so far. BTC usually falls significantly after it peaks. After a few tops, BTC dropped over 80% below the high.

BTC’s April 2013 all-time high price of $259 was broken by a plunge to $50 per unit in May 2013, which saw it drop an estimated 82.6%. From November 2013’s all-time high of $1,163 per unit to January 2016, BTC’s value slid by 86.9%. If bitcoin’s USD value was to shed 80% from the recent $69K high six months ago, the price would drop to a low of $13,800 per unit.

Theory of a Softer Bear Market

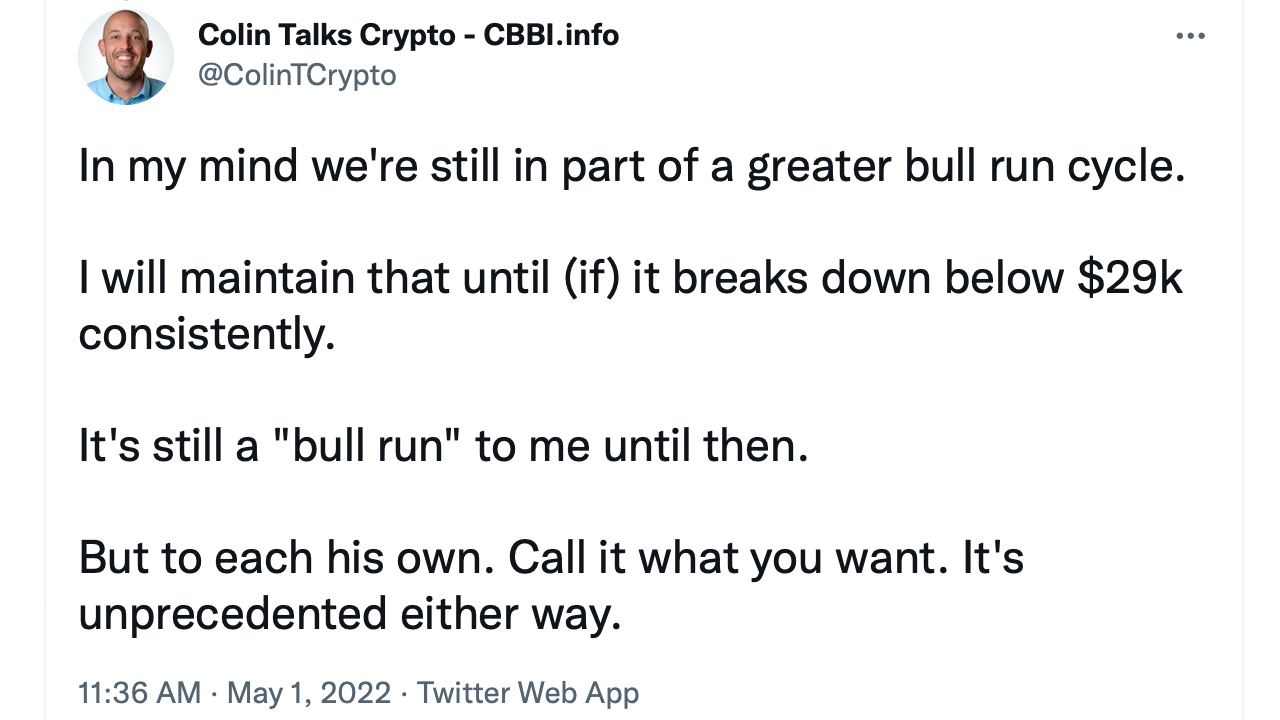

However, there’s a chance that the current bear cycle may be shorter and less impactful this time around. While BTC has seen at least three 80% or more drops, it’s seen a lot more 32-51% drops. One reason bitcoin’s bottom may not be so harsh is because the crypto asset’s peak was not that huge. Actually, bitcoin’s last bull run saw a longer period of time and a lower percentage gain than its all-time peak. The crypto advocate and Youtuber ‘Colin Talks Crypto’ discussedThe softer bearish market theory was confirmed on May 1.

Between the peak on August 17, 2012 ($16), and the peak on April 10, 2013, ($259), BTC gained 1,518.75%. The bitcoin gain between April 10, 2013’s peak ($16) and November 2013, peak ($259) was the result of that cycle. BTC gained 1,590.97% between the December 2013 peak and December 2017.

However, this time, it was 250.85% between the December 2017 peak and the November 2021 summit. It’s been the lowest percentage gain of all the major bull runs in the crypto asset’s lifetime. The lower jump higher could lead to a softer bitcoin bear market that’s much less drastic than an 80% or more plunge.

Additionally to the shorter ATH, it took over 400 days to reach the 2021 ATH. Prior to 2017, the bitcoin bull market lasted just 200 days. This is roughly half of what it was. While the bear market’s current impact may seem less severe in some ways, its duration may still be quite significant compared to previous bear markets.

What do you think about the possibility of a softer bear market that’s less harsh than the previous 80% plunges bitcoin experienced in the past? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.