Investors will pay attention to the U.S. central banking this Wednesday. Federal Reserve policymakers are likely to aggressively raise the benchmark rate. The week ended with significant losses for the U.S. top stock indexes, while the Nasdaq composite suffered its worst performance in four months since 1971. The crypto markets also had a tough week, with the U.S. dollar dropping 8.99% since April 25 to $1.967 trillion.

Fed to Raaise Benchmark Interest Rate Aggressively. Dutch Bank ING predicts a 50bp hike and a QE tightening announcement

Many economists, financial analysts and traders expect that the Federal Open Market Committee will increase interest rates aggressively next week. Reuters’ authors Lindsay Dunsmuir and Ann Saphir reported on Friday that there may be “big Fed rate hikes ahead” and the authors also cite two reports that claim “hot inflation is peaking.”

“U.S. Federal Reserve policymakers look set to deliver a series of aggressive interest rate hikes at least until the summer to deal with hot inflation and surging labor costs, even as two reports Friday showed tentative signs both may be cresting,” the report explains.

The Reuters report was not the only one. The ING Group, a multinational Dutch banking and financial service corporation, believes that a major hike will be announced on Wednesday. According to ING’s report, Jerome Powell (Federal Reserve Chair) and the FOMC are likely to announce a 50 basis-point increase. ING’s report says that “inflation worries outweigh temporary GDP dip.”

“The Federal Reserve is widely expected to raise its policy rate by 50 basis points next Wednesday as 8%+ inflation and a tight labour market trump the surprise 1Q GDP contraction attributed to temporary trade and inventory challenges,” ING Group’s report published on April 28 notes. While 50bp is a large raise, ING also believes the Fed will reveal a tightening plan when it comes to the central bank’s monthly bond purchases.

“We will also be looking for the Fed to formally announce quantitative tightening on Wednesday,” ING’s report details.

Wall Street Beats Gold, and Macroeconomic Advantages are Reaped

All major U.S. stock indices were in a state of shock on Friday after Wall Street shut down for the day. Nasdaq, the Dow Jones Industrial Average, S&P 500, and NYSE all dropped significantly before the start of the weekend. Reportsdemonstrates that the Nasdaq Composite saw its success worst four-month start in over 50 years and S&P 500 dropped like a rock on Friday as well.

“By the end of trading on Friday, the selloff had gotten worse and we were staring at the worst start to a year since the Great Depression,” Barron’s author Ben Levisohn wrote.

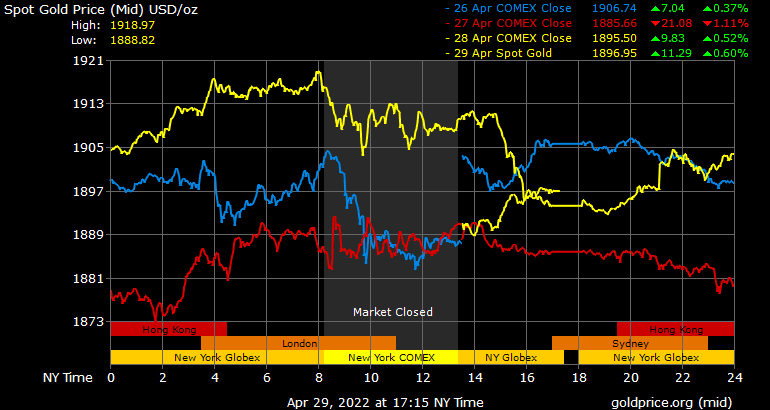

The storm brought gold some of its benefits, and it saw an increase in the price of precious metals against the U.S. dollars heading into Saturday. Fine gold prices have risen 0.08% to $1,896 per ounce over the last six month. Presently an ounce fine gold can be bought for $1,896 per pound. Gerald Celente is a trends forecaster who believes precious metals will rise so long as inflation continues to climb.

“The higher inflation rises, the higher safe-haven assets gold and silver rise. And, when the Banksters raise interest rates, it will bring down Wall Street and Main Street very hard… and the harder they fall, the higher precious metal prices will rise,” Celente tweetedOn Saturday.

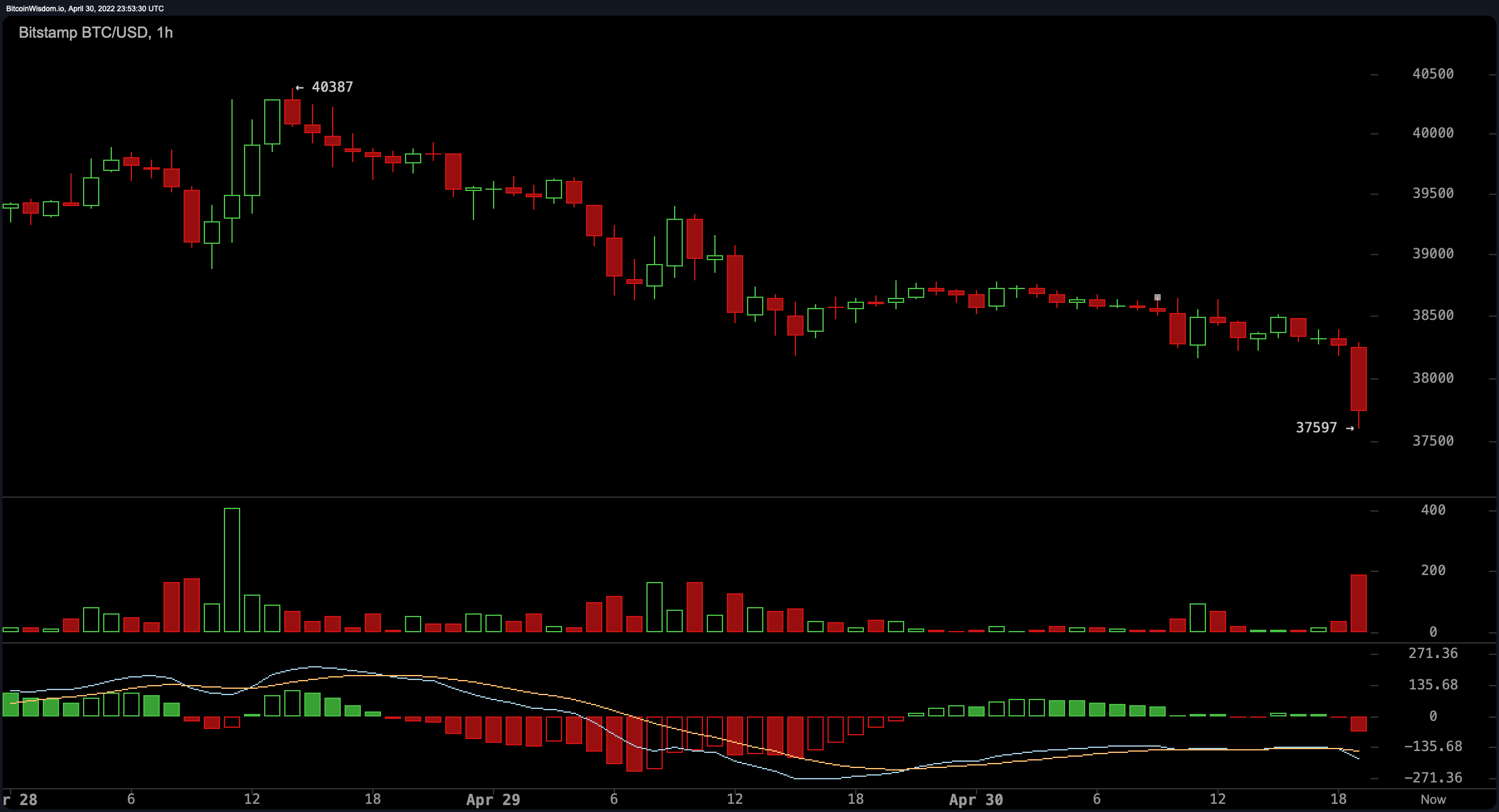

Fear Gives ‘Bear Market Vibes of 2018,’ Bitfinex Market Analysts Say Crypto Buyers Remain on the Sidelines

This week, the crypto market also suffered and was negatively correlated to equities markets. The CEO and founder of eightglobal.com Michaël van de Poppe tweeted about the fear in crypto markets on Saturday. “The amount of fear in the markets currently due to the upcoming FED meeting is comparable to the bear market vibes in 2018,” the Eightglobal founder said. “That tells a lot for the markets and Bitcoin.” On Saturday evening (ET) around 7:25 p.m., bitcoin (BTC) dropped below the $38K mark to $37,597 per unit.

Since April 25, 2022, the entire crypto economy’s net value slipped from $1.967 trillion to today’s $1.79 trillion. The crypto economy has experienced a loss of 8.99% over the past 24 hours. However, it lost 1.2% in the same time period. The Bitcoin (BTC), and the Ethereum (ETH) have lost 4.9% each to the U.S. Dollar over the last seven days. In a note sent to Bitcoin.com News on Friday, Bitfinex market analysts explained that “bitcoin is in range-bound trading as buyers remain on the sidelines.”

“The day trading fervour symptomatic of lockdown – which saw so-called meme stocks pump to unearthly valuations – already seems like a thing of the past,” the analysts added. “Robinhood has cut staff amid a drop in revenues as a bearish sentiment takes hold in the stock market. Still, it is interesting to note that the percentage of the bitcoin supply dormant for a year or more made new all-time highs this month, according to data from on-chain analytics firm Glassnode.”

Comment do you view the future of global markets, such as gold, stocks and crypto-currencies? Are you convinced that the Federal Reserve would raise its benchmark rate 50 bp? Please comment below on your views.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.