Recently, cryptocurrency that burns tokens has become extremely popular. Many well-known blockchain projects have lost large amounts of digital assets. While there may be a variety of burn strategies for different crypto projects, the general effect is the same: the destruction tokens lowers the circulating supply.

Blockchain Projects Use Tokens to Get Specific Benefits and Objectives

The burning of tokens is a well-known trend. Articles often focus on specific projects such as Terra, Shiba Inu and Ethereum that have destroyed substantial amounts of native tokens.

$SHIBThe huge success of burn portal!👺🔥

— Shiba Inu to $1 (@ShibInform) April 28, 2022

Bitcoin.com News published six days ago a report on SHIB developers creating a burn portal that allows SHIB holders to dispose of their SHIB stash. SHIB burners receive rewards for dismantling their tokens in that case. SHIB has an average burn rate of 180.18% over the last 24 hours.

1 The Pre-Col-5 88.675 Million Pre-Col-5 On-Chain Votes for Proposals 133 and134 $LUNAIn the Community Pool ($4.5 Billion), you can swap for $USTThe on-chain swap is now available, and the distribution window for oracle_rewards_pool has been reduced from 3 years to 2!

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) November 10, 2021

The Terra (LUNA), Terra’s team of developers, met during the first week November 2021. burned 88.7 million LUNAProjects like Ethereum (ETH), for instance, burn native tokens almost every hour of the day. After the execution of EIP 1559, over 2.17 million Ethereum were destroyed.

76,100 #BNBSince the BEP95 real-time upgrading upgrade, $35,060,900 has been used.🔥

— BurnBNB (@BurnBNB) April 27, 2022

SHIB has a similar burn rate to Ethereum. The metrics indicate that over the last 60 mins, 135 ether was consumed and 4,477 ETH were destroyed. Binance’s digital asset BNB is scheduled to burn. The project has also destroyed coins in an effort to decrease the total supply.

Burning crypto simply means sending tokens to an address that is not null.

This process was embraced by many cryptocurrency network developers, and has gained popularity among the community. But, just because tokens are burned does not necessarily mean they will be engulfed with flames.

Many projects simply send digital currency to dead addresses in order to burn tokens. Because no one owns the keys to addresses that were used to desecrate the address, the address becomes a blackhole of funds.

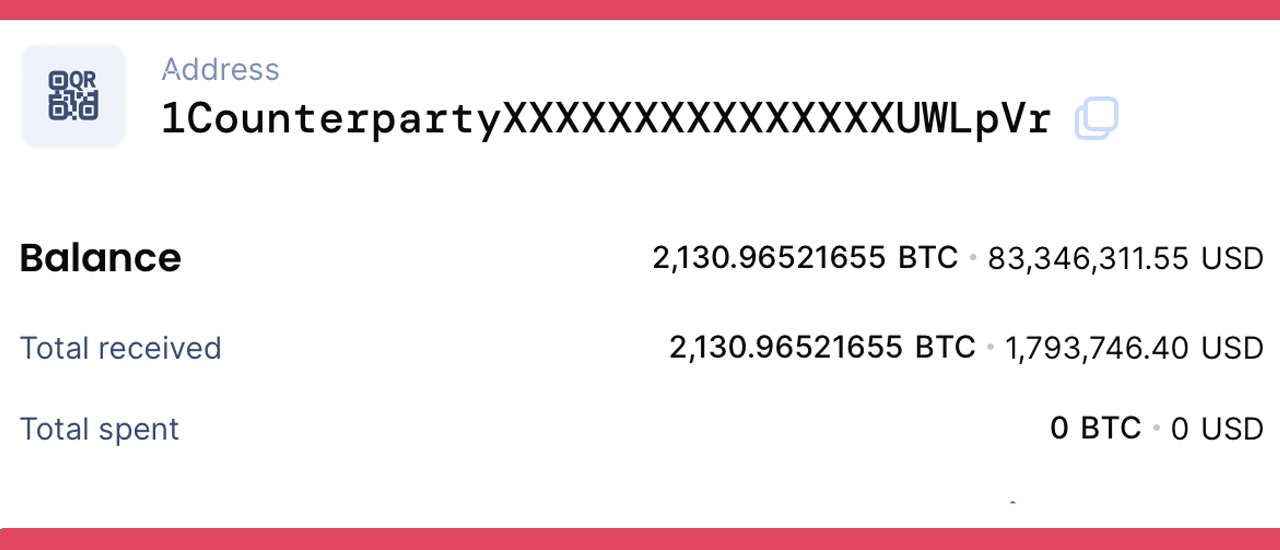

The tokens sent to the null email address are irretrievable once they are received. They will not be used again. The idea of digital currency burns has been in existence for many years. Counterparty is the oldest project to use the scheme.

Counterparty’s Proof-of-Burn

Counterparty actually burned Bitcoin (BTC), to help the project get off its feet. “All XCP that will ever exist were given out proportionally to those who recognized Counterparty’s value and were ready to “burn” their bitcoins to participate in Counterparty,” the project explains in a blog post about the proof-of-burn process.

Token burning has many advantages. Many algorithmic stablecoin protocol use the burn process to autonomously distribute stablecoin assets. While Counterparty used a proof-of-burn to bootstrap XCP, most blockchain projects burn coins to reduce the token’s overall supply.

Burning tokens can be compared to traditional share buybacks in equity markets. By removing coins, the cryptocurrency asset is less valuable and makes it more scarce.

What do you think about crypto asset projects that employ the proof-of-burn process or burn tokens to reduce the coin’s overall circulating supply? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.