This week has been another crazy one for the cryptocurrency market. Bitcoin (BTC), a popular digital currency, fell to a low of $37700, a long-term low. The stock market also experienced a significant sell-off, owing to investor concerns over the size of the Federal Reserve’s next rate hike.

The price of Bitcoin fell 41.72% from $69,000 at its high, but a deeper analysis of various derivatives and on-chain data shows that institutional investors have been shifting away from Bitcoin and that this is the main factor affecting the Bitcoin price.

Bitcoin Stumbles On $40K

Bitcoin has been holding steady below the 100-day moving median for several weeks and failing to move above that level. Bitcoin’s price support has come from the crucial $37K supply zone, and the decreasing mid-term trendline. This has helped to lessen the bearish momentum.

Bitcoin has reached $37,000, which is a critical support point. This makes it a formidable obstacle to bears who want to push the price down. It is almost certain that the price will fall below the $30K level if this fails. Also, the RSI indicator has reached 50%. There is a bullish divergence of the RSI with the price. This indicates a reversal in the trend and a new bullish leg ahead. Bitcoin will launch a bullish surge on the other side.

You might also like: Bitcoin 401k| Bitcoin 401k? Fidelity Investments Believes So

Bitcoin’s current value is $40,048, which intraday traders need to be well-versed in. Relative Strength Index indicates that bulls could be growing. If the Wycoff method is correct, bulls may experience an uptrend rally with a brief retracement into key points this month.

BTC/USD Trades Above $40k Source: TradingView

An intraday trading strategy combined with an average dollar cost technique can be a great way to maximize profit and minimize risk. Wave D is still possible for the macro Bitcoin triangle. The final goal for Bitcoin price should be around $51,000.

Now, the bullish thesis has been invalidated by the $37.650 swing low. If the Bitcoin price is unable to be subdued below this level, then $34,500 will become the next target for bears. This would result in a 15% decline from its current price.

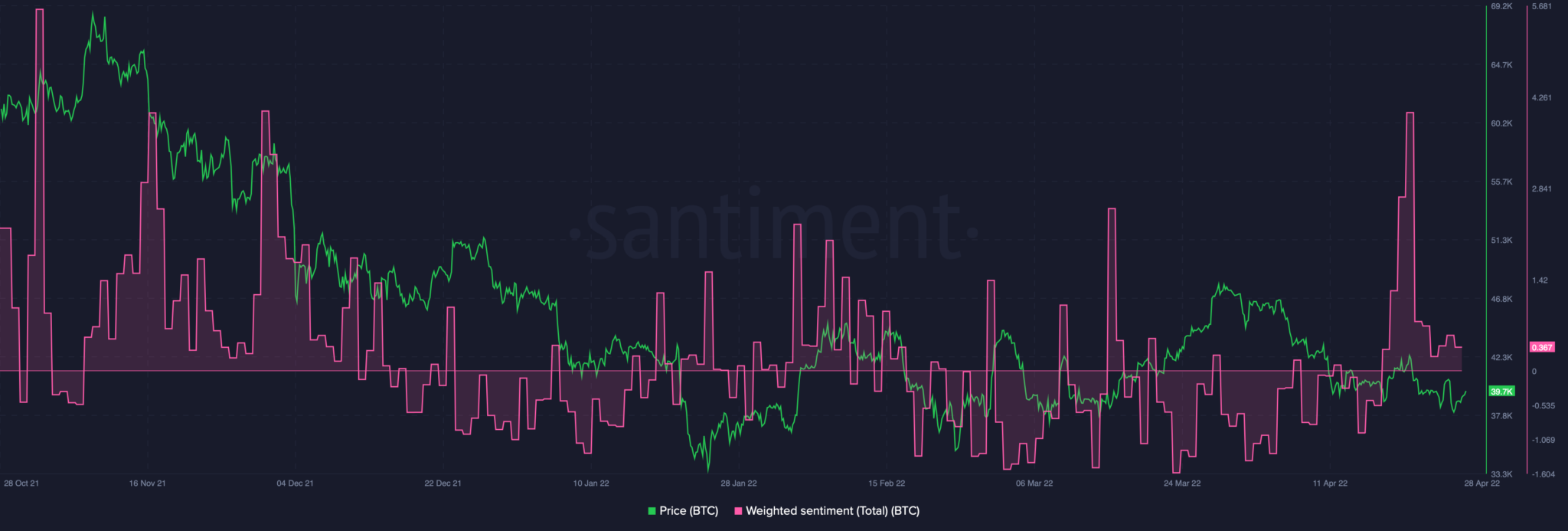

Source: Santiment

Furthermore, according to Arcane Research, the volume of the king cryptocurrency’s supply that has been unchanged for a year or more has reached a high of 64 percent. It was clear that investors were buying sats.

Dogecoin (DOGE) Struggles, Drops 9% After Elon Musk Twitter Buyout| Dogecoin (DOGE) Struggles, Drops 9% After Elon Musk Twitter Buyout

Featured Image from Pixabay. Charts from Santiment.