The global crypto market capization reached $3 trillion in 2021. There is still plenty of room for expansion. After the meteoric rise of the web 2.0, Web 3.0 became a buzzword in crypto. Although web 1.0 was a key factor in internet growth, web 2.0 had a more radical approach and is focused on data control. So what exactly is Web 3.0 and what are the top web 3.0 cryptocurrency coins you can buy in 2022?

Let’s jump right in!

Web 3.0: What is it?

Web 3.0 is one of the newest buzzwords for the internet’s next major evolution. Web 1.0 took place between 1990 – 2004, when the majority of websites were static and created by corporations. Many domain owners who saw an opportunity to sell their domains later on at a lower price for enterprises that needed them during this time period bought domain names.

Web 2.0 is the era that saw social media, user-generated content, and web design. It is encouraged that users communicate with each other using various social media platforms, such as blogs and vlogs. With the vast majority of data being controlled by smaller tech companies like Google, Microsoft, Facebook, this transition will result in greater content creation. This also led to the topic of whether or not the user’s privacy is secure?

Web 3.0 is focused on decentralization. This is achieved through the idea of peer-to–peer internet solutions. Users have control over what data they use. Web 3.0 will rely on blockchain technology to increase data accessibility and openness. Many applications and services are using blockchain technology and metaverse (an artificial intelligence) to enhance their functionality. This technology is widely adopted to reduce the need to have a central authority for data storage and to ensure security via widespread consensus. Essentially, Web 3.0 seeks to re-establish control in the hands of individuals – its users — rather than large corporations.

How Web 3.0 works with the Metaverse Interoperability

Web 3.0 states user interactivity is crucial for user operations. Web 3.0 needs to meet three essential features in order to be truly useful: security, decentralization and scalability. NFTs are a way for users to interact with each other using virtual reality technology. Web 3.0 allows for trade and communication, and Web 3.0 makes it possible.

Web 3.0 is a set of apps that are distributed on a central platform. Interoperability can also be achieved through the use of metaverse concepts to connect apps. Decentraland MANA is an example of an open network that allows a worldwide group to manage a virtual ecosystem by buying and selling digital property. In order to begin the process, you must purchase LAND. This identifies ownership and represents your digital real estate. On the other side, the MANA is used for the facilitation of the purchase and sale of LAND in Decentraland. This marketplace makes it easy to exchange LAND tokens as well as to make transactions in-game.

Top 10 Web 3.0 Bitcoins

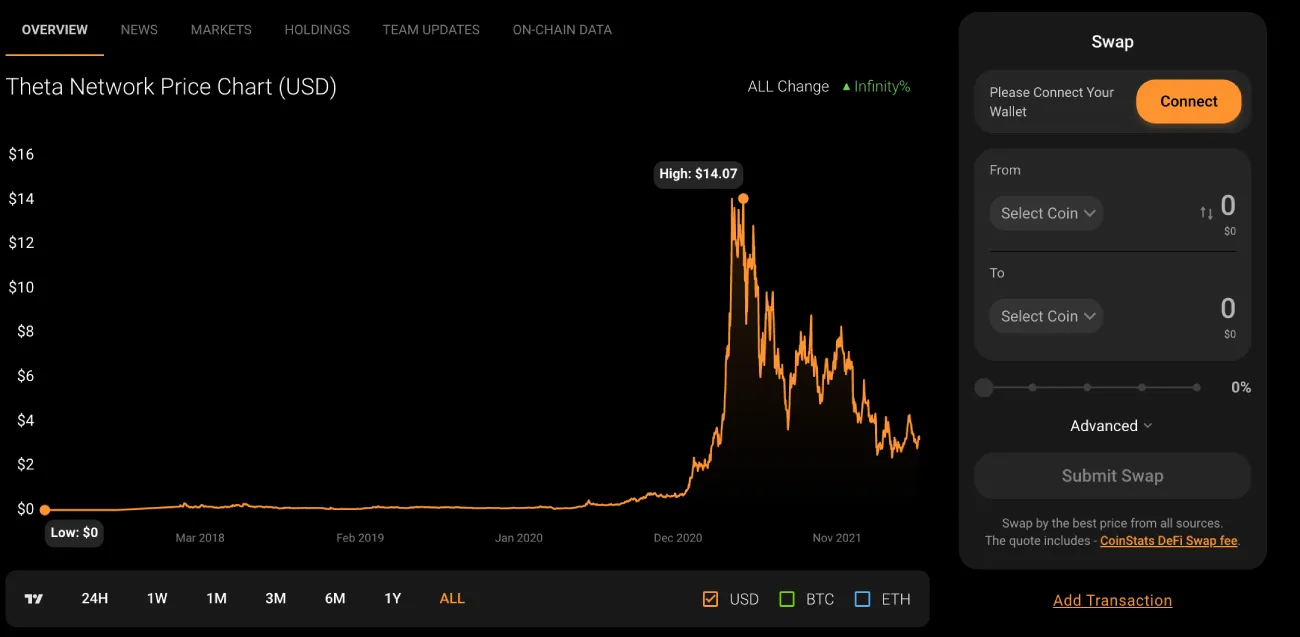

1. THETA (THETA).

Market Cap $3.2B

Theta works in a similar way to Airbnb when it comes to video streaming. Theta allows users to earn rewards by sharing additional bandwidth and computing resource. Steve Chen, the co-founder and CEO of YouTube says that Theta will be disrupting the online video market in a similar way as YouTube in 2005. But in a completely different manner. Theta is a solution to the problem of getting video to certain areas of the world. It lowers costs but maintains high quality. Theta believes it’s crucial to provide high-quality streaming services to everyone.

Theta Fuel token (TFUEL), which rewards users who contribute bandwidth and computing resources to the platform, is available for them. The normal Theta token (THETA) is tied to the platform’s governance. Theta also has the advantage of being an open-source platform that allows for community development. To protect the network, proof of stake (PoS), multi-level Byzantine fault tolerance (BFT), consensus mechanisms are employed.

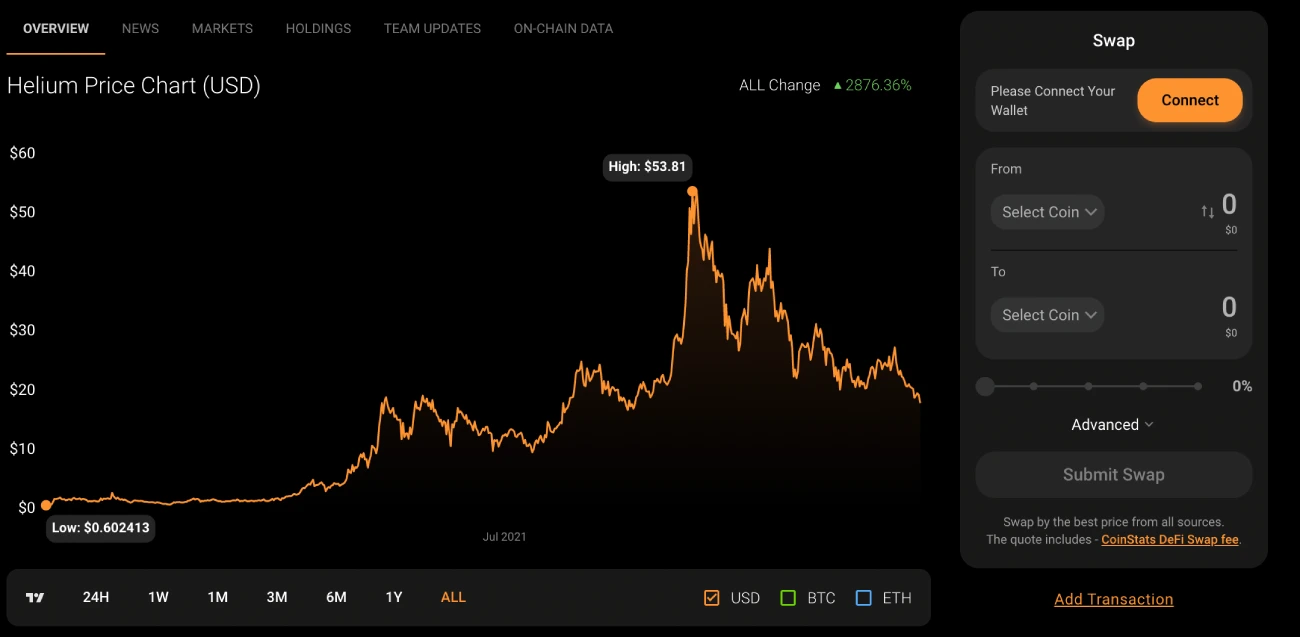

2. Helium (HNT)

Market Cap $2.0B

Helium is an open-source wireless network. It enables Internet of Things (IoT) devices to connect to the Internet wirelessly and geolocate themselves without the need for satellite positioning hardware or cellular plans.

The HNT native token is powered via a blockchain. This token facilitates the creation of a marketplace for service providers and customers.

Hotspots are a combination of a wireless gateway and a miner, providing network coverage in a certain radius. The hotspots can also extract HNT. Helium is mined using a consensus technique called proof-of-coverage.

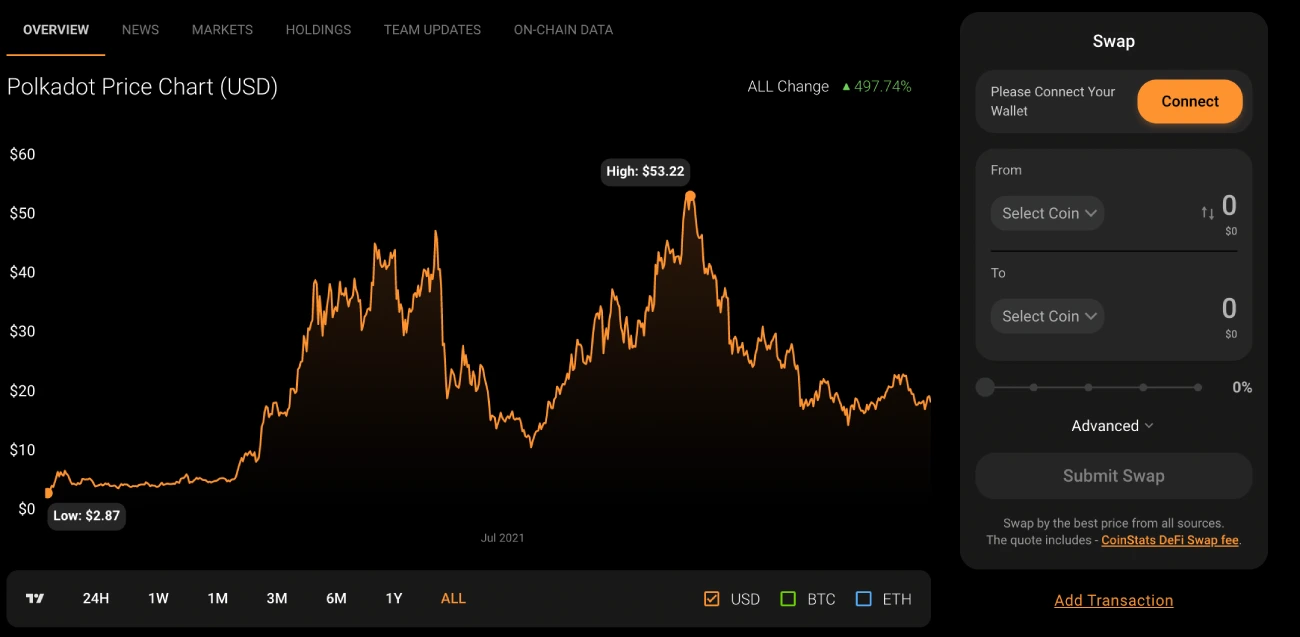

3. Polkadot (DOT)

Market Cap $21.3B

Polkadot is a decentralized project that provides a Layer 0 solution known as “Relay Chain,” which is known to boost scalability, as well as a Layer 1 solution known as “Parachain,” which functions as a bridge between chains.

Gavin Wood (the Co-founder of Ethereum) launched Polkadot. The native currency, DOT is used in governance as well as parachain auctions. Polkadot has only a limited number of parachain space. To be eligible to construct on Polkadot, developers must compete for DOT tokens by participating in auctions.

4. Filecoin, FIL

Market Cap $4.0B

Filecoin is a distributed marketplace for cloud storage. It is powered by many storage developers and providers. The network assists projects and organizations in finding affordable, secure, and cost-effective data storage solutions. Filecoin can be used to store large archives, NFTs and other frequently-accessed data.

The majority of storage providers on the Filecoin network have “committed” to providing data center resources by investing in hardware and depositing collateral to ensure service quality, data availability, and long-term data reliability. Its native token is FIL and it’s used to pay storage provider for data retrieval or storage.

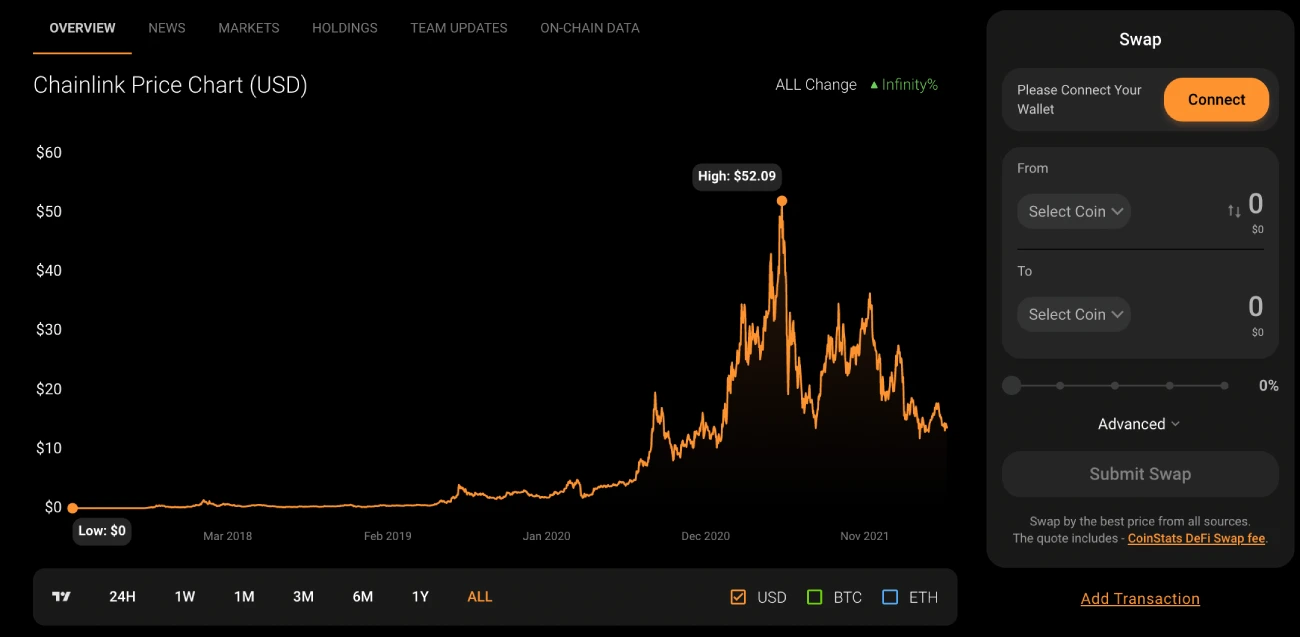

5. Chainlink (LINK)

Market Cap $6.7B

Chainlink is an open-source decentralized Oracle network. It relays data from smart contracts and allows for contracts to execute using real world inputs. The network was launched by Steve Ellis and Sergey Nazarov in 2017. The network quickly became the leader in blockchain and oracle market.

Web3, which relies on Oracle networks such as Chainlink for its functionality, is structured and managed by smart contracts and prewritten programs. Chainlink allows users to create decentralized Oracle networks (DONs), which can be used to transfer data between and within current blockchains. This will ensure data accuracy.

Chainlink’s native token, LINK can be used to reward node operators who fetch data from offchain data feeds. This data is then converted into off-chain computing forms and operators provide uptime guarantees. Chainlink has also developed a strong staking mechanism to support its network.

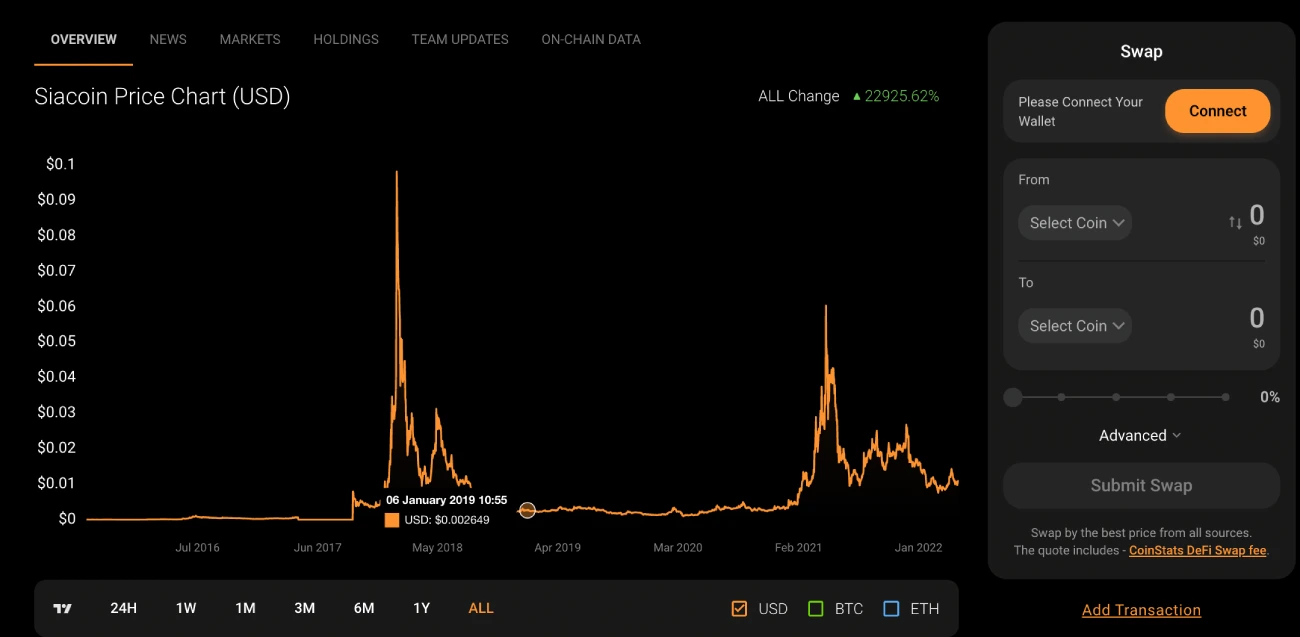

6. Siacoin (SC)

Market Cap $542.7M

Sia, a decentralized blockchain cloud storage platform, allows users to rent excess space over the network. Network transactions are made possible by smart contracts. It is used for payment of data storage and the native token SC (Siacoin), which is part of the blockchain.

Sia’s initial whitepaper said that the network’s purpose was to compete with established storage solutions such as Amazon, Google, and Microsoft. Sia is able to offer storage rates at a lower rate because it’s not centralized.

7. Audius (AUDIO).

Market Cap $808.4M

Audius is an online music streaming platform. It aims to give everyone the freedom to share, monetize, stream and distribute any audio content.

The native token, AUDIO enables network security, feature access and community-owned governance.

Audius can be used by musicians to release their music and build a following. Artists can stake AUDIO to gain badges and tokens. They also have the opportunity of voting from their following. Audius is supported by artists such as 3LAU,deadmau5, Rezz, and the Stafford Brothers. You can stream high-quality audio streaming at 320 kbps through this platform.

Audius has announced its partnership with TikTok streaming platform. The Audius project plans to include stablecoin in future networks to allow for sponsored content.

8. GRT stands for Graph

Market Cap $2.5B

The graph is a decentralized protocol. The DeFi community aims to bring a reliable, decentralized infrastructure to the mainstream. Network users can create and publish an Application Programming Interface (API) which allows them to hide complex code behind a simplified API.

APIs, which are subgraphs of graph protocols, use a particular query to retrieve data on a blockchain. The graph token (GRT) is used by graph network participants to secure the network’s economic security. GRT, a work token, enables stakeholders to provide network indexing or curation services.

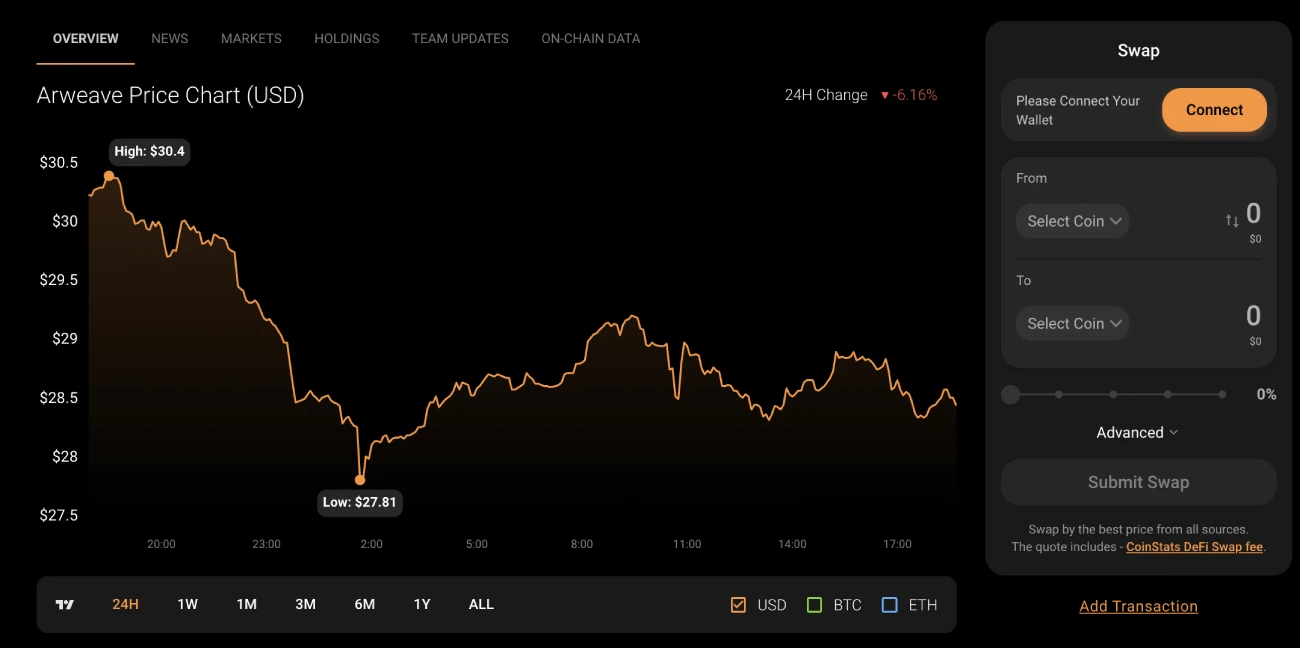

9. Arweave (AR),:

Market Cap $1.5B

Arweave is a joint-owned hard drive that doesn’t forget. You can store your data permanently for an additional fee.

Arweave is a distributed storage network which allows indefinite data storage. At its core is the ‘permaweb’ — a permanent, decentralized web with applications and platforms such as UI hosting, database writes and queries, and smart contracts.

Blockweave technology was used in the network. It is a variant of blockchain that allows blocks to be linked to each other and to random previous blocks. All three of the investors in the network are Coinbase Ventures (Andreessen Horowitz), Union Square Ventures (Union Square Ventures), and Union Square Ventures.

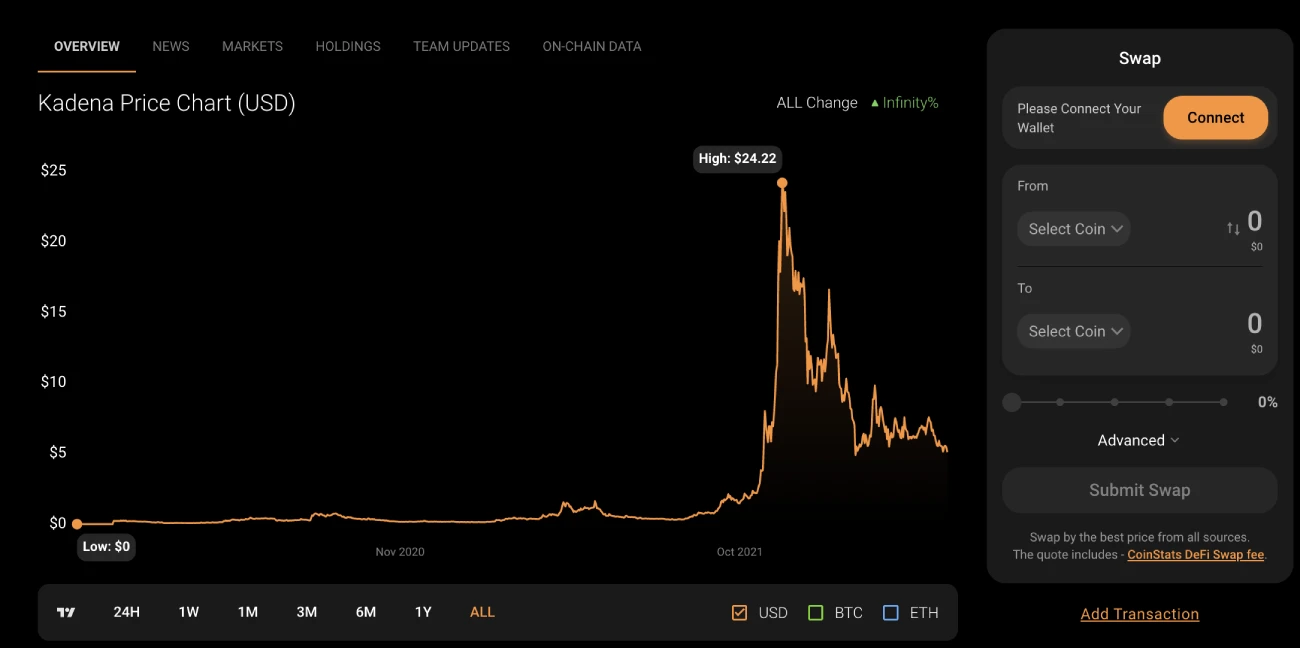

10. Kadena (KDA)

Market Cap $950.5M

This platform is designed to provide financial power for global financial markets. Kadena provides more secure smart contracts and unique energy efficiency. Kadena uses the same amount as other platforms even when network demand increases. Due to braided chain usage, it can process up to 480,000 transactions/second (TPS). With the addition of additional chains, processing power increases.

KDA tokens are used to make transactions on Kadena Blockchain. One billion KDA are total and will be mined over a period of 120 years.

CoinStats: How to buy Web 3.0 coins

Register for a CoinStats free trading account and invest in web 3.0 coin with your credit card or debit card. You can use the CoinStats App to purchase any of the web 3.0 coins mentioned above.

- Register for an account at CoinStatsYou can use your email address to check in with Coinbase.

- Verify the account. To authenticate your identity and comply with KYC (and improve account security), you will need to provide a valid national identification.

- Log in with your credentials. Next, search for the token to be purchased in the search box.

- This will show you the market price of your chosen web 3.0 cryptocurrency. Once you’ve done all your research, it is time to purchase that particular coin. CoinStats gives you two options to choose from: Sell or buy. Choose “Buy”Select the quantity that you want to buy of the coins from the menu. The coins will be delivered in just a few seconds.

- If your newly purchased coins will be kept for longer than one calendar month, you should move them quickly to a hardware wallet.

Closing Thoughts

Web 3.0 and metaverse crypto coins as well NFTs will be some of the most lucrative opportunities on the cryptocurrency market in 2022 and beyond. With artificial intelligence and virtual realities integrated in the internet experience, it is becoming more decentralized. People are adopting blockchain technology more frequently.

If you are looking to help promote Web 3.0 or the crypto market, we believe the top 10 tokens to invest in now is the right one.

Information about InvestmentsInformation on this site is for informational purposes only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products or instruments. This information does NOT constitute financial advice or investment advice.

The market for cryptocurrency can be volatile and subject to secondary activity. Do your research and get your own advice. Only invest the amount you are able to afford to lose. Trading stocks and CFDs can be risky. CFD trading can lead to losses between 74-89% for retail investors accounts. Before making an investment, you should carefully consider your situation and seek advice. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites

With plenty of potential for growth, the global cryptocurrency market capization exceeded $3 trillion by 2021. After the meteoric rise of the web 2.0, Web 3.0 became a buzzword in crypto. Although web 1.0 was a key factor in internet growth, web 2.0 had a more radical approach and is focused on decentralization. Users have the power to manage their own data. How do you define Web 3.0? And which crypto coins can be bought in web 3.0 by 2022?

Let’s jump right in!

Web 3.0: What does it mean?

Web 3.0 is one of the newest buzzwords for the internet’s next major evolution. Web 1.0 took place between 1990 – 2004, when the majority of websites were static and created by corporations. Many domain owners who saw an opportunity to sell their domain names later on at a lower price for enterprises that needed them during this time period bought domain names.

Web 2.0 is the era that saw social media, user-generated content, and web design. It is encouraged that users communicate using the social media platforms, such as blogs and vlogs. With the vast majority of data being controlled by smaller tech companies like Google, Microsoft, Facebook, this transition will result in greater content creation. This also led to the topic of whether or not the user’s privacy is secure?

Web 3.0 emphasizes decentralization. It is driven by peer-to-peer internet services, where users can choose how their data are used. Web 3.0 relies on blockchain technology. This is because many applications and services will use it, along with metaverse and artificial intelligence (AI). Web 3.0 should improve content accessibility and data transparency. This technology is widely adopted to reduce the need to have a central authority for data storage and to ensure security via widespread consensus. Essentially, Web 3.0 seeks to re-establish control in the hands of individuals – its users — rather than large corporations.

How Web 3.0 works with the Metaverse Interoperability

Web 3.0 states that user interaction and scaleability are crucial to user operations. Web 3.0 needs to meet three essential features in order to be truly useful: security, decentralization and scalability. NFTs are a way for users to interact with each other using virtual reality technology. Web 3.0 allows for trade and communication, and Web 3.0 makes it possible.

Web 3.0 is a set of apps that are distributed on a central platform. Interoperability can also be achieved through the use of metaverse concepts to connect apps. Decentraland MANA provides an open connection that allows users around the world to create and manage virtual environments. This includes digital real property sales or purchases. In order to begin the process, you must purchase LAND. This identifies ownership and represents your digital real estate. On the other side, the MANA is used for the facilitation of the purchase and sale of LAND in Decentraland. This marketplace makes it easy to exchange LAND tokens as well as to make transactions in-game.

Top 10 Web 3.0 Bitcoins

1. THETA (THETA).

Market Cap $3.2B

Theta works in a similar way to Airbnb when it comes to video streaming. Theta allows users to earn rewards by sharing additional bandwidth and computing resource. Steve Chen, the co-founder and CEO of YouTube says that Theta will be disrupting the online video market in a similar way as YouTube in 2005. But in a completely different manner. Theta is a solution to the problem of getting video to specific parts of the world. It lowers costs, but maintains high-quality. Theta believes it’s crucial to provide high-quality streaming services to everyone.

Theta Fuel token (TFUEL), which rewards users who contribute bandwidth and computing resources to the platform, is available for them. The normal Theta token (THETA) is tied to the platform’s governance. Theta also has the advantage of being an open-source platform that allows for community development. To protect the network, proof of stake (PoS), multi-level Byzantine fault tolerance (BFT), consensus mechanisms are employed.

2. Helium (HNT)

Market Cap $2.0B

Helium is an open-source wireless network. It enables Internet of Things (IoT) devices to connect to the Internet wirelessly and geolocate themselves without the need for satellite positioning hardware or cellular plans.

The native token for the network is HNT. It is powered by blockchain. This token facilitates the creation of a marketplace for service providers and customers.

Hotspots are a combination of a wireless gateway and a miner, providing network coverage in a certain radius. The hotspots can also extract HNT. Helium is mined using a consensus technique called proof-of-coverage.

3. Polkadot (DOT)

Market Cap $21.3B

Polkadot is a decentralized project that provides a Layer 0 solution known as “Relay Chain,” which is known to boost scalability, as well as a Layer 1 solution known as “Parachain,” which functions as a bridge between chains.

Gavin Wood (the Co-founder of Ethereum) launched Polkadot. The native cryptocurrency, DOT (pronounced “Dot”), is used to govern the company and for parachain slots auctions. Polkadot has only a limited number of parachain space. To be eligible to construct on Polkadot, developers must compete for DOT tokens by participating in auctions.

4. Filecoin, FIL

Market Cap $4.0B

Filecoin is a distributed marketplace for cloud storage. It is powered by many storage developers and providers. The network assists projects and organizations in finding affordable, secure, and cost-effective data storage solutions. Filecoin can be used to store large archives, NFTs and other frequently-accessed data.

The majority of storage providers on the Filecoin network have “committed” to providing data center resources by investing in hardware and depositing collateral to ensure service quality, data availability, and long-term data reliability. Its native token is FIL and it’s used to pay storage provider for data retrieval or storage.

5. Chainlink (LINK).

Market Cap $6.7B

Chainlink is an open-source decentralized Oracle network. It relays data from smart contracts and allows for contracts to execute using real world inputs. The network was launched by Steve Ellis and Sergey Nazarov in 2017. The network quickly became the leader in blockchain and oracle market.

Web3, which uses pre-written smart contracts and programs to structure and maintain its data, depends on Oracle networks such Chainlink. Chainlink allows users to create decentralized Oracle networks (DONs), which can be used to transfer data between and within current blockchains. This will ensure data accuracy.

Chainlink’s native token, LINK can be used to reward node operators who fetch data from offchain data feeds. This data is then converted into off-chain computing forms and operators provide uptime guarantees. Chainlink has also developed a strong staking mechanism to support its network.

6. Siacoin (SC)

Market Cap $542.7M

Sia, a decentralized blockchain cloud storage platform, allows users to rent excess space over the network. Network transactions are made possible by smart contracts. It is used for payment of data storage and the native token SC (Siacoin), which is part of the blockchain.

Sia’s initial whitepaper said that the network’s purpose was to compete with established storage solutions such as Amazon, Google, and Microsoft. Sia is able to offer storage rates at a lower rate because it’s not centralized.

7. Audius (AUDIO).

Market Cap $808.4M

Audius, a music streaming platform, provides everyone the opportunity to share, monetize, stream and listen to any audio content.

The native token, AUDIO allows network security and unique feature access. It also allows for community-owned governance.

Audius can be used by musicians to release their music and build a following. Artists can stake AUDIO to gain badges and artist tokens. They also have the opportunity of voting from their fans. Audius is supported by artists such as 3LAU,deadmau5, Rezz, and the Stafford Brothers. You can stream high-quality audio streaming at 320 kbps through this platform.

Audius has announced its partnership with TikTok streaming platform. The Audius project plans to include stablecoin in future networks to allow for sponsored content.

8. GRT stands for Graph

Market Cap $2.5B

The graph is a decentralized protocol. The DeFi community aims to bring a reliable, decentralized infrastructure to the mainstream. Network users can create and publish an Application Programming Interface (API) which allows them to hide complex code behind a simplified API.

APIs, which are subgraphs of graph protocols, use a particular query to retrieve data on a blockchain. The graph token (GRT) is used by graph network participants to secure the network’s economic security. GRT, a work token, enables stakeholders to provide network indexing or curation services.

9. Arweave (AR).

Market Cap $1.5B

Arweave is a joint-owned hard drive that doesn’t forget. You can store your data permanently for an additional fee.

Arweave is a distributed storage network which allows indefinite data storage. At its core is the ‘permaweb’ — a permanent, decentralized web with applications and platforms such as UI hosting, database writes and queries, and smart contracts.

Blockweave technology was used in the network. It is a variant of blockchain that allows blocks to be linked to each other and to random previous blocks. All three of the investors in the network are Coinbase Ventures (Andreessen Horowitz), Union Square Ventures (Union Square Ventures), and Union Square Ventures.

10. Kadena (KDA)

Market Cap $950.5M

This platform is designed to provide financial power for global financial markets. Kadena provides more secure smart contracts and unique energy efficiency. Kadena, unlike other platforms uses the same amount energy regardless of network demand. Due to braided chain usage, it can process up to 480,000 transactions per hour (TPS). With the addition of additional chains, processing power increases.

KDA tokens are used to make transactions on Kadena Blockchain. One billion KDA are total and will be mined over a period of 120 years.

CoinStats: How to buy Web 3.0 coins

Register for a CoinStats free trading account and invest in web 3.0 coin with your credit card or debit card. You can use the CoinStats App to purchase any of the web 3.0 coins mentioned above.

- Register for an account at CoinStats with your email address. You can also check in to Coinbase.

- Verify the account. To authenticate your identity and comply with KYC (and improve account security), you will need to provide a valid national identification.

- Log in with your credentials. Next, search for the token to be purchased in the search box.

- This will show you the market price of the web 3.0 coin. Once you’ve done all your research, it is time to purchase that particular coin. CoinStats offers two options for you to choose from: buy or sell. Choose “Buy” from the menu and input the desired quantity you wish to purchase of that coins and in a matter of few seconds the coins will arrive in your wallet.

- Do not keep your newly purchased coins in storage for longer than one month. You need to transfer them quickly to a hardware wallet.

Closing Thoughts

Web 3.0 and metaverse crypto coins as well NFTs will be some of the most lucrative opportunities on the cryptocurrency market in 2022 and beyond. With artificial intelligence and virtual realities integrated in the internet experience, it is becoming more decentralized. People are adopting blockchain technology more frequently.

If you are looking to help promote Web 3.0 or the crypto market, we believe the top 10 tokens to invest in now is the right one.

Information about InvestmentsInformation on this site is for informational purposes only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products or instruments. This information does NOT constitute financial advice or investment advice.

The market for cryptocurrency can be volatile and subject to secondary activity. Do your research and get your own advice. Only invest the amount you are able to afford to lose. Trading stocks and CFDs can be risky. CFD trading can lead to losses between 74-89% for retail investors accounts. Before making an investment, you should carefully consider your situation and seek advice. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.