NFTs or non-fungible tokens have taken the cryptocurrency market by storm over the past 2 years. The general public is now welcome to the crypto market, thanks to these digital assets, which allow celebrities, billionaires, and athletes the opportunity of connecting with their followers.

While the “NFT” buzzword has been overused across mainstream media and social media platforms, many investors and holders of NFTs do not understand what NFTs are and why they were created. I could go as far as assuming that even the experts in the crypto space today don’t necessarily fully understand what NFTs are used for (minus digital art and collectible items) and what the future holds for this budding industry.

We will explain what is happening in the NFT area, how it works, and the outlook for the future.

Understanding Non-fungible Tokens (NFTS)

The non-fungible tokens (or NFTs) are digital tokens built on blockchain that can be used to identify ownership of specific assets. Users can use NFTs to show their immutable ownership over assets like music, video, art and collectibles. NFTs are different from traditional data records in that they can only be owned by one person at any given time. This is secured by blockchain and means no one can alter the ownership record or make a duplicate of the NFT.

NFTs can be called non-fungible as their name indicates. NFTs is an economic term that identifies uniqueness. Generally, NFTs are built using the same technology as cryptocurrencies and are based on the blockchain, but that’s where the similarities end. Fiat currencies and cryptocurrencies are “fungible” meaning they can be traded for one another without any implications. You can trade one US Dollar for another USdollar, one Bitcoin for another bitcoin, as long as they are equal.

NFTs can be used to create cryptocurrencies, but they are vastly different than cryptocurrencies. Every NFT has a digital signature which distinguishes it from the others. One Bored Ape Yacht Club NFT (BAYC), is different from a CryptoPunk and Azuki NFT. In fact, there are no two BATC NFTs that look the same.

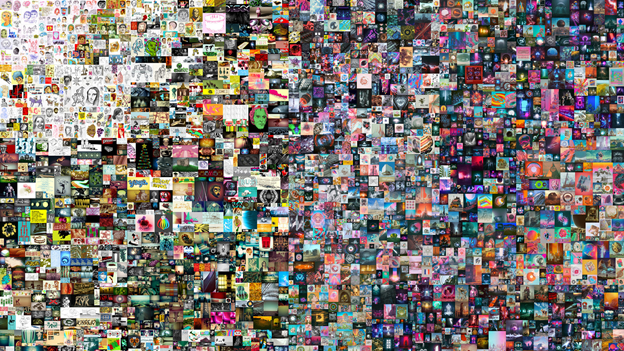

As the NFT market becomes more popular, these properties are now worth much more than they were in 2014. One of the most popular NFT artworks, Everyday’s: The First 5000 Days by Beeple, sold for a record $69 million at Christie’s, the 255-year old auction house, last year in March. Until October, the most Mike Winkelmann — the digital artist known as Beeple — had ever sold a print for was $100.

Beeple’s $69 million NFT: Everyday’s: The First 5,000 Days by Beeple (Image: Beeple)

Many NFT pieces sold for millions since then. Steph Curry (Snoop Dogg), Lionel Messi Jr., Neymar Jr., Justin Bieber and Paris Hilton are just a few of the celebrities that have bought into NFT and each own at least one NFT. DappRadar reports that the NFT space has surged to a market worth $50 billion. There is potential for further growth, as investors continue to buy digital assets.

Although digital files and digital art dominate the NFT space it is only one possible way to access these assets. As explained, NFTs can be used as unique ownership to any file or asset, including land title deeds and academic certificates. We will be looking at some potential uses of NFTs which could lead to an entirely new digital revolution.

More Use Cases For NFTs

It’s hard to think of NFTs in any other context than their wonderful digital artworks on OpenSea. Far from it, NFTs have widespread use cases that can be used to represent any kind of asset whether it’s your table, title deed, or even intangible assets such as royalties and intellectual property rights.

NFTs are widely used in gaming, but these digital assets also have more to offer global economic and financial ecosystems. We will discuss the many benefits of NFTs and how they can be utilized in the context of global economic systems.

1. Intellectual Property and royalties

Bitcoin, and other crypto- and blockchain companies have achieved great success by giving users control and autonomy over their data. This role is more important for musicians and artists than it is for digital creators.

NFTs provide creators with control over their creations. They also create a platform that allows them to track royalties on music and protect intellectual property (IP). Some of the platforms dealing with music-NFTs include Catalog, the primary marketplace for single-edition music NFTs; Sound.xyz, which runs almost daily drops where collectors or traders can mint editions of music NFTs; and Beats Foundry.

NFTs are able to provide details about ownership, including blockchain timestamps and all of the IP’s history. The artist creates an NFT and records the information on an immutable network. This allows the NFT owner to prove that they are the creator of any piece of work. The NFTs are also useful for tracking royalties that have been paid to creators. Opensea sells NFTs and resells them to creators for a 2% commission.

Many musicians and artists have chosen the NFT route in order to make their music more lucrative. Kings of Leon released their album When You See Yourself as NFT last March. They raised $2 million. Grimes and DJ 3LAU have released NFT albums, as has Steve Aoki and Haleek Maul, a Bajan rapper.

2. Identification Verification

The world is increasingly digital and connected. There’s a need to have trustless digital ownership. NFTs are the best solution, due to their unique features. The digital future has huge advantages if you have a stable, secure digital identity that can be used in the virtual and real worlds. It promises to give people the freedom to build genuine societies in the metaverse – with social, economic, even political interaction.

The value of NFTs resides in the ability to capture human’s uniqueness, in a similar way that each human is unique. This could be beneficial for governments as individuals’ data (such as the driving license, passport and ID numbers) can simply be coded into an NFT and this NFT can then be used to verify the individual’s information digitally.

Photochromic is one such project. It allows people to secure own their identities and verify them through an NFT. PhotoChromic is an NFT-based blockchain-based ID verification system that combines biometric evidence of life with unique attributes and government-backed verification to create a single asset. It can then be used by Web3 applications and for identity verification.

3. Educational Credentials

NFTs have moved from the arts world to academia, and theoretically into all other industries as shown in these examples. NFTs are not being accepted by all industries, except entertainment and arts. The NFT is a great way to show academic credentials. The provenance of each NFT can also be traced, as the data units are stored onto a blockchain. This could help to track academic credentials.

Blockchain is being welcomed by academia. NFTs may have a greater impact on the records-keeping of schools, universities, and other educational institutions. Blockademia (a Cardano-based DApp) is an example of how to reduce identity fraud. It focuses on government documents and certificates as well as IDs. Blockademia, which is simply a distributed information system, verifies the authenticity and legitimacy of government documents and certificates to ensure they are legitimate and legal.

Integrating NFTs will make it much simpler to verify academic credentials. These credentials today are often printed on physical paper. This makes it easy for fraudsters to create fakes. Blockademia is a solution that allows academic institutions to create NFTs linking diplomas and certificates. These NFTs are permanent. NFTs reduce the burden of students sending certificates, either digitally or physically to their employers.

4. Asset Protection/Crypto Inheritance

Over the past decade or so, digital assets have slowly crept into investors’ portfolios affording them immense opportunities. However, there are risks associated with these complex assets. Management and storage of cryptocurrency remains a major concern for new investors. Self-custody wallets provide greater security than having assets held by a third party.

Crypto-asset inheritance is a problem for self-custody. Security-minded users are often not prepared in case of sudden death. The grieving family members often have no way to access their relative’s inheritance, permanently locking the assets away. If this is not resolved, crypto assets worth billions of dollars could be locked away in cold wallet storage. This would prevent them from ever being released into circulation.

Serenity Shield is a cryptocurrency inheritance company that prepares its customers for this event. The tokens are kept accessible in the case of the owner’s death. NFTs allow users to save and store their individual credentials in the SerenityShield app.

The system divides a user’s wallet, called the StrongBox, into three non-transferable NFTs. The NFTs each contain a third of a secret (based on Shamir’s Secret Sharing) needed to access the wallet. The user holds one NFT, while the other is held in the name of the nominated heir. Serenity Wallet is the third and final holding. This smart contract delivers the key to the original user or to the heir depending on the Activation Conditions that were set up for the StrongBox. The conditions can be based on lack of activity, or active “pings” requiring action to ensure the original user still has access to the wallet.

5. Event Ticketing

NFTs also take over event ticketing. The existing ticketing systems are prone to fraud, fakery, and slow entry. NFTs improve the functionality, speed and cost of ticketing systems. There are problems with paper tickets. They can be lost, damaged or wet.

Organizers have turned to QR codes to achieve this goal. However, QR codes can also present challenges such as slow ticket verification and failures in entry systems. QR codes can also be ineffective when it comes to attendees buying them.

NFTs are a great option for event organizers as they have immutability properties which make it difficult to fake or forge tickets. Organizers can simply mint NFT tickets on their chosen blockchain platform. The NFTs can be customized to set the price or conduct an auction. These tickets can be purchased by customers and saved on blockchain wallets. They will then scan and verify their purchases upon arrival.

NFTs are used to confirm the authenticity and transfer tickets to secondary buyers. Secondary buyers can then verify that the ticket is genuine.

Conclusion

NFTs’ rise over the last half-decade has opened up the possibility for any single asset to be represented on the blockchain. While the industry has flourished in the art and entertainment sector, there’s still so much potential that NFT users can tap into to enhance systems across the global economy. This rapidly expanding industry is not limited to the use cases listed above.